U.S. Residential Water Treatment System Market Size, Share, and COVID-19 Impact Analysis, By Type (Filtration Systems, Disinfection Systems, Water Softening Systems, Reverse Osmosis (RO) Systems, Distillation Systems, Carbon Filters), By End-Use Applications (Drinking Water, Whole-House Systems, Point-of-Use (POU) Systems, Appliances Protection, and Gardening and Outdoor Us), By Distribution Channel (Direct Sales, Retail Sales, Online Retail, Third-Party Distributors) Analysis and Forecast 2023 - 2033

Industry: Machinery & EquipmentU.S. Residential Water Treatment System Market Insights Forecasts to 2033

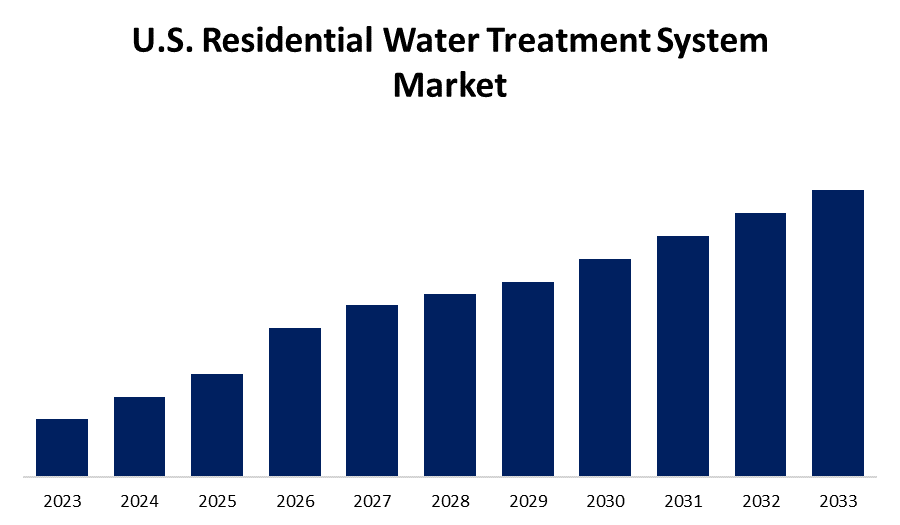

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033.

- The U.S. Residential Water Treatment System Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The U.S. Residential Water Treatment System Market Size is Expected to hold a significant share by 2033, at a CAGR of during the Forecast period 2023 to 2033.

Market Overview

Residential water treatment refers to any procedure that improves the quality of water to make it suitable for drinking or other household uses. It is done in the domain of gathering or using water. This reduces diarrheal sickness & improves the quality of the water. In addition, there has been a global trend toward healthier living and a growing consumer awareness of the need for residential water treatment facilities. A water treatment plant is a large facility for purifying water that uses a variety of processes such as filtration, sedimentation, and distillation, depending on the primary process used. A lot of customers have installed secondary filtration systems in their homes. Furthermore, the U.S. residential water treatment system market is anticipated to expand due to the growing need for premium water and stringent environmental protection laws. Water security concerns and growing surface and groundwater pollution will be the main drivers of the market growth. The demand for water treatment due to the depletion of water resources is expected to drive growth in the U.S. residential water treatment systems market.

Report Coverage

This research report categorizes the market for U.S. residential water treatment system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. residential water treatment system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the U.S. residential water treatment system market.

U.S. Residential Water Treatment System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-Use, By Distribution Channel, and COVID-19 Impact Analysis |

| Companies covered:: | Pentair plc, A. O. Smith Corporation, 3M Company, Ecolab Inc., Culligan International Company, Aquasana Inc., Whirlpool Corporation, Kinetico Incorporated, Evoqua Water Technologies LLC, Pelican Water Systems, Others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Residential Water Treatment market has seen an increase in demand for smartphone-connected residential water treatment systems in recent years. Smart water treatment systems—which make use of sensors, smart meters, and other technologies were made possible by technological developments in water treatment systems. The popularity of these systems is rising as a result of the widespread integration of new software products from manufacturers like Siemens & Bentley Systems into water treatment systems. These products provide useful information about leaks and water pressure well in advance. These systems are built on a combination of big data, artificial intelligence (AI), and the Internet of Things (IoT), which can help provide critical information ahead of time and provide preventative measures.

Restraining Factors

In addition, there are high running and maintenance costs associated with certain residential water treatment systems, such as distillation systems. Therefore, during the forecast period, the Global Residential Water Treatment market will be hindered by the high operating costs of water treatment systems.

Market Segment

- In 2023, the reverse osmosis (RO) systems segment accounted for the largest revenue share over the forecast period.

Based on the type, the U.S. residential water treatment system market is segmented into filtration systems, disinfection systems, water softening systems, reverse osmosis (RO) systems, distillation systems, and carbon filters. Among these, the reverse osmosis (RO) systems segment has the largest revenue share over the forecast period. Reverse osmosis can be used to remove a variety of dissolved or suspended bacterial and amoebic particles from water. Carbon and silt are two types of filters used in reverse osmosis systems. Sediment filters remove dirt and debris from the RO system, while carbon filters remove chlorine, bad tastes, and odors.

- In 2023, the point-of-use (POU) systems segment accounted for the largest revenue share over the forecast period.

On the basis of end use application, the U.S. residential water treatment system market is segmented into drinking water, whole-house systems, point-of-use (POU) systems, appliances protection, and gardening & outdoor us. Among these, the point-of-use (POU) systems segment has the largest revenue share over the forecast period. Point-of-use water treatment is important in reducing water pollution because it provides individuals and communities with a decentralized method of purifying contaminated water sources, ensuring access to safe and clean drinking water. Rising water pollution is expected to drive growth in the point-of-use water treatment market in the coming years. When dangerous materials, such as pollutants, chemicals, and waste, are introduced into water bodies, such as lakes, rivers, oceans, groundwater, and sources of drinking water, the quality of the water is degraded and risks to the environment and public health are raised.

- In 2023, the direct sales segment is expected to hold the largest share of the U.S. residential water treatment system market during the forecast period.

Based on the distribution channel, the U.S. residential water treatment system market is classified into direct sales, retail sales, online retail, and third-party distributors. Among these, the direct sales segment is expected to hold the largest share of the U.S. residential water treatment system market during the forecast period. Traditional retail partnerships lack complete control over the customer journey, whereas direct to consumers. Doing sale seller can offer better customers service and more flexibility in targeted customers. Also, seller can enhance the customer experience by getting more direct feedback from customers such factors are booth the market growth in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. residential water treatment system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pentair plc

- O. Smith Corporation

- 3M Company

- Ecolab Inc.

- Culligan International Company

- Aquasana Inc.

- Whirlpool Corporation

- Kinetico Incorporated

- Evoqua Water Technologies LLC

- Pelican Water Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, Waterfresh Inc. was purchased by Quench, a US-based supplier of filtered water solutions, for an undisclosed sum. By way of this acquisition, Quench would provide its dealers with enticing prospects for support. An American business called Waterfresh Inc. provides a wide range of point-of-use drinking water systems. It offers filtered water services and drinking water systems designed to be environmentally friendly.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the U.S. Residential Water Treatment System Market based on the below-mentioned segments:

U.S. Residential Water Treatment System Market, By Type

- Filtration Systems

- Disinfection Systems

- Water Softening Systems

- Reverse Osmosis (RO) Systems

- Distillation Systems

- Carbon Filters

U.S. Residential Water Treatment System Market, By End Use Application

- Drinking Water

- Whole-House Systems

- Point-of-Use (POU) Systems

- Appliances Protection

- Gardening & Outdoor Us

U.S. Residential Water Treatment System Market, By Distribution Channel

- Direct Sales

- Retail Sales

- Online Retail

- Third-Party Distributors

Need help to buy this report?