UK Electronic Gadgets Insurance Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Laptops, Computers, Cameras, Mobile Devices, and Drones), By Coverage Type (Accidental Damage, Theft, and Loss), and UK Electronic Gadgets Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUK Electronic Gadgets Insurance Market Insights Forecasts to 2033

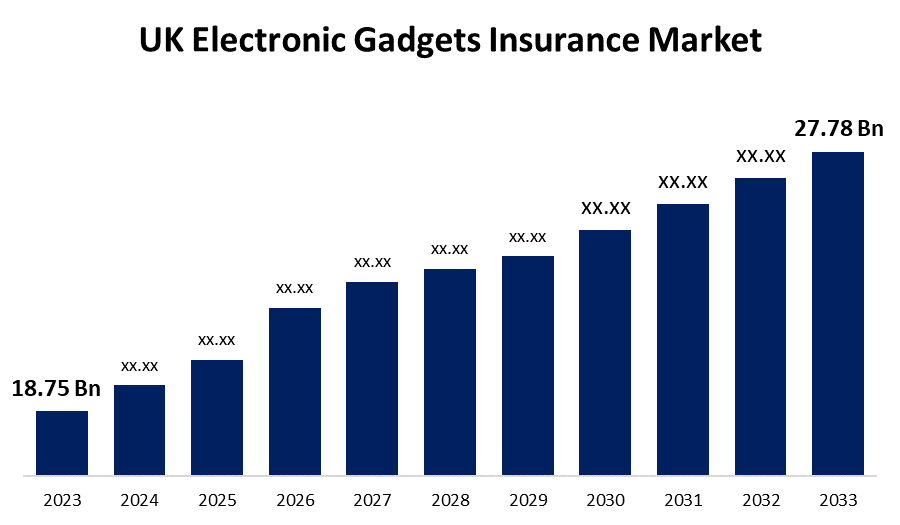

- The UK Electronic Gadgets Insurance Market Size was valued at USD 18.75 Billion in 2023.

- The Market is Growing at a CAGR of 4.01% from 2023 to 2033

- The UK Electronic Gadgets Insurance Market Size is Expected to Reach USD 27.78 Billion by 2033

Get more details on this report -

The UK Electronic Gadgets Insurance Market is Anticipated to exceed USD 27.78 Billion by 2033, growing at a CAGR of 4.01% from 2023 to 2033. The need to digitize every industry is becoming more and more necessary, which will increase demand for gadgets and improve the UK's electronic gadgets insurance market.

Market Overview

Coverage against a range of risks, such as unintentional harm, theft, loss, and even technical failures, is offered by electronic gadget insurance. All types of gadgets, including phones, tablets, laptops, digital cameras, gaming consoles, MP3 players, e-readers, digital recorders, smartwatches, and other handheld devices, are covered by gadget insurance. This insurance covers any technical failure as well as loss, theft, and accidental damage. The market for device insurance is expanding as more people use gadgets globally; both individuals and corporations can use them. To meet their unique needs, customers can select from a variety of plans and coverage options. This market serves both individuals and companies whose activities significantly depend on technological gadgets. The scope of insurance varies depending on the policy, including the degree of coverage and the sorts of incidents covered. Electronic Gadget Insurance attempts to provide financial protection for customers by helping to pay the expenses of repairing or replacing their devices under the limits set in the insurance policy.

Report Coverage

This research report categorizes the market for the UK electronic gadgets insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK electronic gadgets insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK electronic gadgets insurance market.

UK Electronic Gadgets Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.01% |

| 2033 Value Projection: | USD 27.78 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Coverage Type |

| Companies covered:: | Axa (Inter Partner Assistance SA), Aviva Insurance Ltd, Assurant General Insurance Limited, AmTrust Europe Limited, American International Group UK Limited, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

For the past two decades, technology has driven industry-wide developments, allowing enterprises across industries in the UK to reach unprecedented sizes and growth. Almost all industries have gone digital, with barely a few left. Since the present epidemic has confined people to their homes, there has been an increased demand to digitalize almost every industry. The need to digitalize sectors will increase demand for a wide range of devices, as will the requirement to insure them, thus fueling market expansion. As a result, the growing need to digitize all industries will increase demand for gadgets, propelling the UK electronic devices insurance market forward. Furthermore, the quick pace of technical breakthroughs, as well as the introduction of high-value gadgets with advanced capabilities, have increased the demand for insurance coverage to limit risks and provide peace of mind to gadget owners. Insurance companies are responding to these market dynamics by providing novel insurance products and services targeted to the individual demands of gadget owners, resulting in market growth.

Restraining Factors

The UK insurance industry for electronic devices confronts obstacles including pricing competitiveness, customer perception, and complicated claims processing even with its consistent growth potential. Price rivalry among insurance companies and mobile network operators who supply device insurance goods and services has resulted in market margin pressures and lowered profitability.

Market Segmentation

The UK electronic gadgets insurance market share is classified into device type and coverage type.

- The mobile devices segment is expected to hold a significant market share through the forecast period.

The UK electronic gadgets insurance market is segmented by device type into laptops, computers, cameras, mobile devices, and drones. Among these, the mobile devices segment is expected to hold a significant market share through the forecast period. The growth of premium flagship smartphones and the growing popularity of 5G technology have attributed to the higher price tags connected with mobile phones, significantly encouraging consumers to choose insurance coverage.

- The accidental damage segment is expected to dominate the UK electronic gadgets insurance market during the forecast period.

Based on the coverage type, the UK electronic gadgets insurance market is divided into accidental damage, theft, and loss. Among these, the accidental damage segment is expected to dominate the UK electronic gadgets insurance market during the forecast period. It provides protection from unintentional falls, spills, broken screens, and other physical disasters, guaranteeing that users' gadgets can be fixed or replaced in the event of such accidents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK electronic gadgets insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Axa (Inter Partner Assistance SA)

- Aviva Insurance Ltd

- Assurant General Insurance Limited

- AmTrust Europe Limited

- American International Group UK Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, the mobile operator, owned by BT, has stated it will provide an expanded range of services and products, that involve gadget insurance, to all UK users through a new consolidated platform, powered by an EE ID.

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UK Electronic Gadgets Insurance Market based on the below-mentioned segments:

UK Electronic Gadgets Insurance Market, By Device Type

- Laptops

- Computers

- Cameras

- Mobile Devices

- Drones

UK Electronic Gadgets Insurance Market, By Coverage Type

- Accidental Damage

- Theft

- Loss

Need help to buy this report?