UK Health Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Private, Public), By Demographics (Minor, Adult, Senior), and UK Health Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUK Health Insurance Market Insights Forecasts to 2033

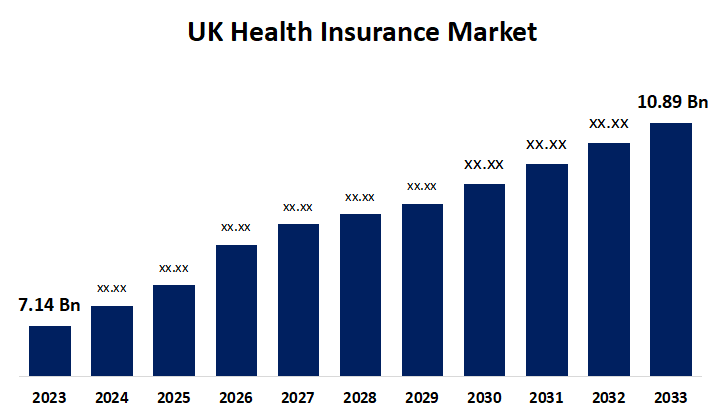

- The UK Health Insurance Market Size was valued at USD 7.14 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.31% from 2023 to 2033

- The UK Health Insurance Market Size is expected to reach USD 10.89 Billion by 2033

Get more details on this report -

The UK Health Insurance Market is anticipated to exceed USD 10.89 Billion by 2033, growing at a CAGR of 4.31% from 2023 to 2033.

Market Overview

Health insurance is a type of policy that covers healthcare, surgical, prescription drug, and occasionally dental charges incurred by the insured. Health insurance can either repay the insured for charges incurred as a result of illness or accident, or pay the medical professional directly. It's a way to manage the risk of incurring medical expenses among individuals by pooling the risk of many people. Health insurance can be provided by private companies, government-sponsored programs, or obtained through employers as part of an employee benefit package. The rising number of chronic and lifestyle-related ailments, such as diabetes, cancer, neurological disorders, cancer, CVD, and others, contributes to the demand for health insurance. With an increased emphasis on healthcare and rising healthcare expenditures, there is a growing need for health insurance coverage in the UK. The market is moving towards individualized and customized health insurance policies that provide full coverage and incentives. The market is also being shaped by technological breakthroughs and digital innovations, such as the rise of digital health insurance platforms and telehealth services.

Report Coverage

This research report categorizes the market for the UK health insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the health insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the health insurance market.

UK Health Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.31% |

| 2033 Value Projection: | 10.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Demographics |

| Companies covered:: | Aviva plc, Vitality Health, Freedom Health Insurance, Western Provident Association, Cigna, Bupa, AXA Health, Simply Health, Prudential, VitalityHealth, Simplyhealth, Nuffield Health, Expat Insurance, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising healthcare expenses are one of the factors driving the UK health insurance industry. As medical costs climb, individuals and organizations seek health insurance coverage to alleviate the financial burden related to healthcare services. Health insurance allows people to receive great treatment without paying high out-of-pocket costs, making it an important part of financial planning and minimizing risk. Advancements in medical technology and healthcare services can impact the cost and coverage of health insurance plans. Innovative treatments and procedures may lead to higher premiums but also attract individuals seeking comprehensive coverage. The performance and capacity of the National Health Service (NHS) in the UK can affect the demand for private health insurance. Long waiting times or limited access to certain treatments within the NHS may prompt individuals to seek private insurance for faster or more comprehensive care. Such factors propel market growth in the UK for health insurance.

Restraining Factors

Health insurance is extensively supervised to provide consumer protection and fair dealings. While regulations are required to ensure market integrity, they might additionally raise compliance expenses and limit industry innovation. Compliance with regulatory requirements and adjusting to shifting rules can be difficult for health insurance companies, which could hinder their capacity to offer innovative goods and services or enter new markets.

Market Segmentation

The UK health insurance market share is classified into material and end-use.

- The public segment is expected to hold the largest share of the UK health insurance market during the forecast period.

The UK health insurance market is segmented by type into private, and public. Among these, the public segment is expected to hold the largest share of the UK health insurance market during the forecast period. The UK government may introduce policies and initiatives aimed at expanding public health insurance coverage, thereby driving growth in the public segment. As healthcare costs continue to rise, individuals may increasingly turn to public health insurance options for more affordable coverage.

- The adult segment is expected to hold the largest share of the UK health insurance market during the forecast period.

Based on the demographics, the UK health insurance market is divided into minor, adult, and senior. Among these, the adult segment is expected to hold the largest share of the UK health insurance market during the forecast period. A great deal of adults are insured by public or private health insurance, usually through private policies provided by their job. Furthermore, this age group is especially vulnerable to a variety of lifestyle-related disorders that necessitate rapid medical attention, such as diabetes, cancer, hypertension, and many others. Thus, the previously mentioned reasons are boosting market expansion in this area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK health insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aviva plc

- Vitality Health

- Freedom Health Insurance

- Western Provident Association

- Cigna

- Bupa

- AXA Health

- Simply Health

- Prudential

- VitalityHealth

- Simplyhealth

- Nuffield Health

- Expat Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, HealthCare Plus, a top health insurance provider in the UK, collaborated with MedTech Solutions, a digital health company, to incorporate advanced telehealth and remote monitoring solutions into their insurance plans. This partnership strives to improve the accessibility and quality of healthcare services for HealthCare Plus members.

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UK health insurance market based on the below-mentioned segments:

UK Health Insurance Market, By Type

- Private

- Public

UK Health Insurance Market, By Demographics

- Minor

- Adult

- Senior

Need help to buy this report?