UK Islamic Finance Market Size, Share, and COVID-19 Impact Analysis, By Financial Sector (Islamic Banking, Islamic Insurance-Takaful, Islamic Bonds ‘Sukuk’, Other Islamic Financial Institutions (OIFI’s) and Islamic Funds), and UK Islamic Finance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUK Islamic Finance Market Insights Forecasts to 2033

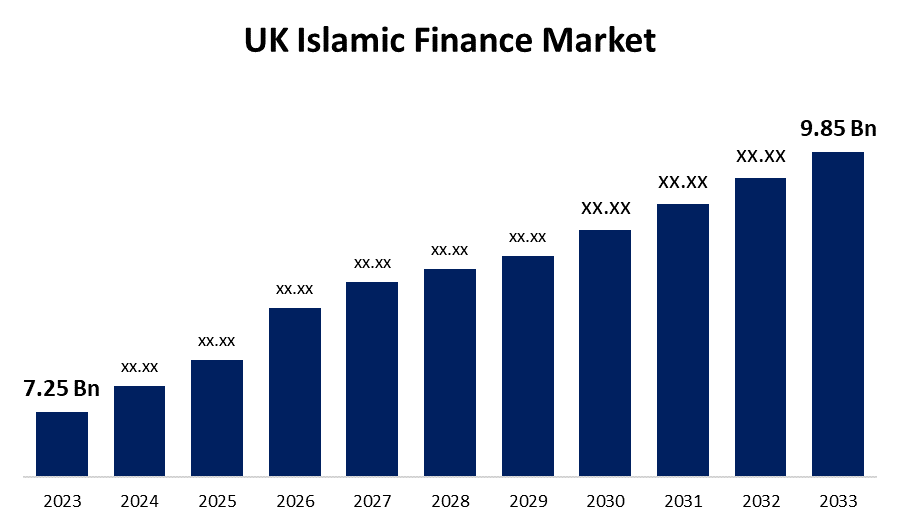

- The UK Islamic Finance Market Size was valued at USD 7.25 Billion in 2023.

- The Market is Growing at a CAGR of 3.11% from 2023 to 2033

- The UK Islamic Finance Market Size is Expected to Reach USD 9.85 Billion by 2033

Get more details on this report -

The UK Islamic Finance Market is Anticipated to exceed USD 9.85 Billion by 2033, growing at a CAGR of 3.11% from 2023 to 2033. The UK Islamic finance market has grown steadily in recent years, owing to rising demand for Sharia-compliant financial goods and services, positive legislative actions, and an expanding muslim population.

Market Overview

The Islamic financial sector is a specific branch of the global financial industry that serves Muslims all over the world. The core principles are founded on Islamic law, also known as the Shariah. Islamic law classifies the methods by which enterprises and lending institutions raise capital as lawful (halal) or prohibited (haram). It views itself to be a socially and ethically responsible investment type that avoids benefitting from riba, which the majority of Islamic scholars translate as interest, although some consider it to be usury. Islamic financial institutions prohibit gharar, which involves investing in high-risk or speculative businesses. In principle, risk should be spread equally among all engaged partners in a corporate enterprise. Furthermore, investment in fields that violate Islamic morality is prohibited. This could apply to firms that handle alcohol, gambling (casinos), or pork. The fundamentals of Islamic Shariah are not a fixed set of laws that can be applied with absolute certainty in all situations. There is no single 'rule book' for Islamic finance that an authority or judge can turn to. The Auditing and Accounting Organization for Islamic Financial Institutions (AAOIFI) establishes standards for Islamic finance. Finance institutions and the wider industry commonly embrace these standards, but they are not legally binding in the United Kingdom.

Report Coverage

This research report categorizes the market for the UK Islamic finance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK Islamic finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK Islamic finance market.

UK Islamic Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.11% |

| 2033 Value Projection: | USD 9.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Financial Sector |

| Companies covered:: | GateHouse Bank, Al Rayan Bank, QIB UK (Qatar Islamic Bank UK), Bank of London and The Middle East (BLME), ABC International Bank, Bank of Ireland, Barclays, Bristol & West, Citigroup (Citi), J Aron & Co (part of Goldman Sachs), and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing demand for morally and socially conscious financial services and products is one of the main factors propelling the UK Islamic finance market. Islamic finance principles, which emphasize fairness, openness, and risk-sharing, appeal to consumers looking for alternatives to traditional banking and finance. Muslim consumers, in particular, are drawn to Islamic banking solutions that reflect their religious beliefs and values, such as prohibitions on interest-based trades and investments in illegal businesses including gambling and alcohol. The UK Islamic finance sector has grown steadily, due to increased understanding and acceptance of Islamic finance concepts among muslim and non-muslim consumers.

Restraining Factors

Despite the potential, hurdles to the expansion of the UK Islamic banking market include legislative restraints, misunderstandings, and a lack of awareness. There may be misconceptions and mistrust regarding the viability and appropriateness of Islamic finance among many consumers, especially non-Muslims, due to their lack of familiarity with the concepts and offerings of the industry.

Market Segmentation

The UK Islamic finance market share is classified into financial sector.

- The islamic banking segment is expected to hold the largest market share through the forecast period.

The UK Islamic finance market is segmented by financial sector into islamic banking, islamic insurance-takaful, islamic bonds ‘sukuk’, other islamic financial institutions (oifi’s) and islamic funds. Among these, the islamic banking segment is expected to hold the largest market share through the forecast period. Islamic banking offers two advantages over ordinary banking. The first is the assumption that Islamic banks must uphold a higher moral standard. They will not give their best bankers huge bonuses or accept excessively high levels of risk. The second point is that earnings are produced from identifiable assets, not a jumble of derivatives and securities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK Islamic finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GateHouse Bank

- Al Rayan Bank

- QIB UK (Qatar Islamic Bank UK)

- Bank of London and The Middle East (BLME)

- ABC International Bank

- Bank of Ireland

- Barclays

- Bristol & West

- Citigroup (Citi)

- J Aron & Co (part of Goldman Sachs)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, to provide digital UK banking to UAE citizens and nationals, London-based Nomo Bank has launched an inventive new cooperation with Abu Dhabi-based institutions ADCB and Al Hilal Bank.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UK Islamic Finance Market based on the below-mentioned segments:

UK Islamic Finance Market, By Financial Sector

- Islamic Banking

- Islamic Insurance-Takaful

- Islamic Bonds ‘Sukuk’

- Other Islamic Financial Institutions

- Islamic Funds

Need help to buy this report?