UK Mutual Funds Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Equity Funds, Bond Funds, Money Market Funds, Hybrid, and Other Funds), By Investor Type (Institutional and Individual), and UK Mutual Funds Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUK Mutual Funds Market Insights Forecasts to 2033

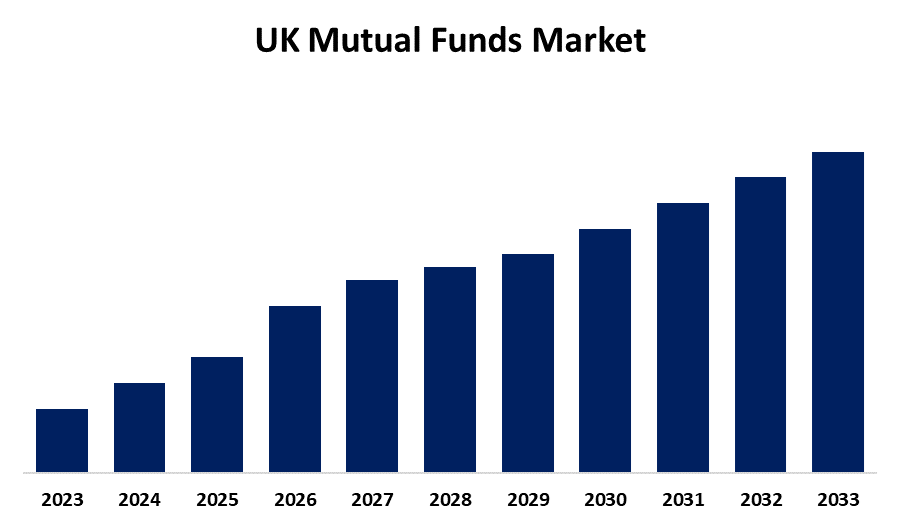

- The Market is Growing at a CAGR of 3.80% from 2023 to 2033

- The UK Mutual Funds Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The UK Mutual Funds Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 3.80% from 2023 to 2033. Individuals in the United Kingdom are becoming increasingly aware of the need to invest and save for their future financial stability.

Market Overview

Mutual funds are frequently referred to as variable share investment businesses. An investment trust fund organization that invests in small property owners and issues stocks that can be converted into cash at any moment. People in Western countries are unable to pick which stocks to buy or when to acquire and sell them due to established securities markets and intense speculation. Some people with experience in the securities business begin by pursuing income, capital appreciation, or even speculation, then form "mutual funds," raise funds on their own, and pool investors' funds to purchase a variety of securities while offering investors a substitute purchase plans from which fees are collected. Investors can also trade investment kinds for fees as needed. The market has no direct influence on the price at which it sells shares; instead, the price of the securities owned by mutual funds determines this price. The rise of the market in the United Kingdom is attributed to various factors, including but not limited to market liquidity, the rising proportion of financial savings in total household savings, and increased investor knowledge. The market is driven by an expanding trend in UK mutual fund assets.

Report Coverage

This research report categorizes the market for the UK mutual funds market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK mutual funds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK mutual funds market.

UK Mutual Funds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.80% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fund Type and By Investor Type |

| Companies covered:: | BlackRock Funds, JP Morgan, BNP Paribas Asset Management, Natixis Investment Managers, Amundi Asset Management, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK's increasing personal finance industry fuels the mutual fund market. Personal finance includes a variety of financial services geared toward individuals, such as banking, insurance, investments, and retirement planning. People in the UK are getting more conscious of the necessity of saving and investing for their future financial security, which has driven up demand for investment opportunities such as mutual funds. Retirement planning has become a big issue for many people in the UK as the population ages and pension restrictions change. People choose customized retirement plans that go beyond typical pensions. This has led to the expansion of services such as self-invested personal pensions (SIPPs) and individual savings accounts (ISAs), which offer tax breaks and more control over retirement savings. In response to the low-interest-rate situation and unpredictability in other asset classes, investors have resorted to alternative investment options, such as stocks, bonds, mutual funds, and exchange-traded funds, to enhance their wealth.

Restraining Factors

Transaction risks develop when a corporation conducts financial transactions or maintains accounts in a currency other than its own. Transaction risks refer to the hazards that a corporation confronts when undertaking international financial transactions. The potential risk is that the exchange rate will fluctuate before the transaction is finalized. The time between transaction and settlement is primarily a source of transaction risk. In general, selling mutual funds when the foreign currency has strengthened compared to the dollar yields a profit. However, if the fund's currency or target index falls compared to the dollar, it will incur a loss. Such transaction risks may slow market growth during the probable term.

Market Segmentation

The UK mutual funds Market share is classified into fund type and investor type.

- The equity funds segment is expected to hold the largest market share through the forecast period.

The UK mutual funds market is segmented by fund type into equity funds, bond funds, money market funds, hybrid, and other funds. Among these, the equity funds segment is expected to hold the largest market share through the forecast period. Individual investors can access equity markets more easily than fixed-income sectors, and they offer more opportunities for profits. Stock investors emphasize financial gains through aggressive techniques, compared to the cautious strategy seen in bond markets.

- The institutional segment is expected to dominate the UK mutual funds market during the forecast period.

Based on the investor type, the UK mutual funds market is divided into institutional and individual. Among these, the institutional segment is expected to dominate the UK mutual funds market during the forecast period. Institutional investors dominate the industry due to their huge cash reserves and long investment timelines. Entities such as pension funds, insurance companies, and awards wield significant financial blows, lured to mutual funds for diversification benefits, competent management, and customizable investment strategies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK mutual funds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BlackRock Funds

- JP Morgan

- BNP Paribas Asset Management

- Natixis Investment Managers

- Amundi Asset Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, BlackRock launched a UK version of its LifePath Target Date fund line to rival Vanguard and Legal & General Investment Management's comparable products.

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UK Mutual Funds Market based on the below-mentioned segments:

UK Mutual Funds Market, By Fund Type

- Equity Funds

- Bond Funds

- Money Market Funds

- Hybrid

- Other Funds

UK Mutual Funds Market, By Investor Type

- Institutional

- Individual

Need help to buy this report?