Global Ultrasonic Testing Market Size, Share, and COVID-19 Impact Analysis, By Type (Immersion Testing, Guided Wave, Acoustography, Phased Array, Time-of-Flight Diffraction, Others), By Equipment (Bond Testers, Imaging Systems, Industrial Scanners, Flaw Detectors, Thickness Gauges, Transducers & Probes, Tube Inspection Systems, Others), By Services (Inspection, Training, Equipment Rental, Calibration, Others), By End-Users (Oil & Gas, Aerospace, Automotive, Manufacturing, Marine, Power Generation, Government Infrastructure, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Ultrasonic Testing Market Insights Forecasts to 2032

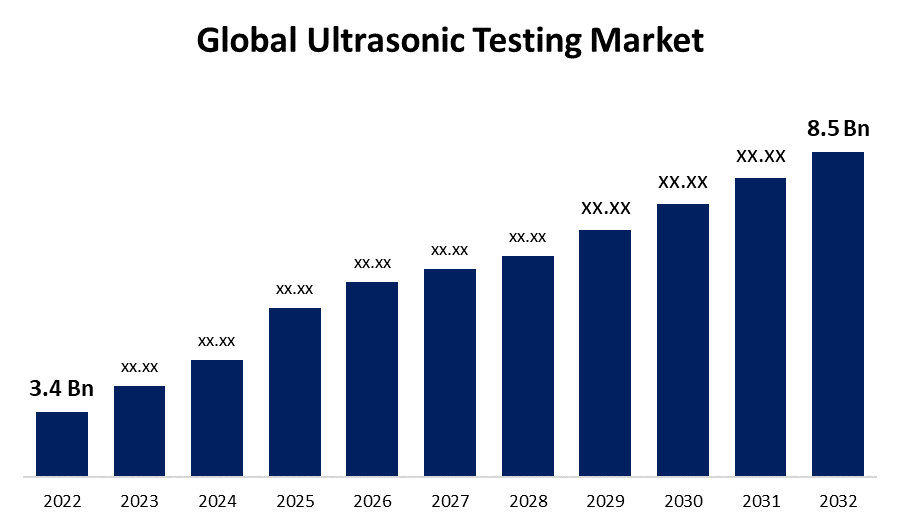

- The Global Ultrasonic Testing Market Size was valued at USD 3.4 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.6% from 2022 to 2032

- The Worldwide Ultrasonic Testing Market Size is expected to reach USD 8.5 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Ultrasonic Testing Market Size is expected to reach USD 8.5 Billion by 2032, at a CAGR of 9.6% during the forecast period 2022 to 2032.

Ultrasonic testing (UT) refers to a type of non-destructive testing (NDT) technique that transmits ultrasonic waves through a surface or object. These high-frequency sound waves are delivered into materials in order to characterize their properties or determine shortcomings. Although ultrasonic testing is commonly used on steel and other metals and alloys, it is additionally utilized on concrete, wood, and composites, however with less successful precision. It is utilized in a variety of applications such as aluminum and steel construction, metallurgy, manufacturing, aerospace, automotive, and other transportation applications. Since it lacks ionizing radiation, ultrasonic technology has been used consistently in medical applications for a long time and continues to be the most common option for both regular diagnostic imaging and clinical study. Ultrasonic testing provides several advantages, including the ability to pinpoint internal damage and the lack of radiation. Ultrasonic testing of this sort can also be used for inspection or flaw detection, high-speed rotating engine parts, material thickness, and dimensional measurement. Ultrasonic testing has certain benefits, which include high penetration power, increased sensitivity, heightened precision, fully automated and flexible processes, and being non-hazardous to adjacent workers, equipment, or materials. The demand for quality control tools in the manufacturing industry to detect substance faults at an early stage to produce a finished product with better output is surging the demand for ultrasonic testing.

Global Ultrasonic Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.6% |

| 2032 Value Projection: | USD 8.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Equipment, By Services, By End-Users, By Region |

| Companies covered:: | T.D. Williamson Inc., Bosello High Technology srl, Eddyfi, Magnaflux, Fischer Technology Inc., Cygnus Instruments Ltd., NDT Global GmbH, Acuren, LynX Inspection, Baker Hughes, Olympus Corporation, MISTRAS Group, Intertek, Sonatest, Zetec, Inc., Nikon Metrology, Ashtead Technology, General Electric And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Ultrasonic testing technology is the most widely used NDT technology because it is easy, compact, lightweight, and immune to variations in humidity, temperature, vibration, and dust. It is also very cost-effective. Ultrasonic testing has emerged as a popular method for identifying problems among end users because it is non-hazardous to operators or adjacent people and has no effect on the objects that are being tested. All of these variables continue to propel the ultrasonic testing market forward. In addition, an increasing range of applications of ultrasonic testing in the defense and aerospace sectors for identifying internal defects with greater accuracy, as well as the fast-rising dependence on automation in industries such as manufacturing, are further propelling the market. Along with the escalating aging infrastructure and the rapid development of new infrastructure, there is an increasing requirement for competent NDT practitioners.

The growing number of industries worldwide, driven by high consumer demand, is fueling market expansion. likewise, the increasing importance of the military, aerospace, and marine industries are expected to boost the construction industry, hence propelling market growth. Furthermore, increasing investment in residential, commercial, and public buildings is expected to fuel market demand. Ultrasonic testing is employed for identifying vulnerabilities and structural integrity in industrial and public infrastructure assets, which include manufacturing facilities, platforms, bridges, railroad tracks, pipe networks, and machinery used in industries. Stringent legislation governing public safety and product quality, as well as continuing advancements in technological devices, digitization, and automation, are expected to dominate the ultrasonic testing market over the forecast period.

Market Segmentation

By Type Insights

The time-of-flight diffraction segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global ultrasonic testing market is segmented into the immersion testing, guided wave, acoustography, phased array, time-of-flight diffraction, and others. Among these, the time-of-flight diffraction segment is dominating the market with the largest revenue share of 38.6% over the forecast period. Time of flight diffraction (TOFD) has become one of the most dependable non-destructive testing procedures for pre-service and in-service evaluation of welding operations. This ultrasonic technology is employed in a variety of industries such as petrochemicals, chemicals, oil and gas, power generation, and fabrication. TOFD is frequently used in tandem with additional non-destructive testing technologies such as a phased array. Time of flight diffraction is regarded as one of the fastest non-destructive testing procedures as, in contrast to other types of UT, just one scan is usually required to identify any flaw information within the weld. It has exceptional precision in locating and measuring the size of many different sorts of errors.

By Equipment Insights

The flaw detectors segment is expected to hold the largest share of the Global Ultrasonic Testing Market during the forecast period.

Based on the equipment, the global ultrasonic testing market is classified into bond testers, imaging systems, industrial scanners, flaw detectors, thickness gauges, transducers & probes, tube inspection systems, and others. Among these, the flaw detectors segment is expected to hold the largest share of the Ultrasonic Testing market during the forecast period. The adaptability and fundamental dependence on flaw detection in a wide range of industries, from aviation to infrastructure, contribute to it being a vital component of ultrasonic testing. Flaw detectors are devices that detect and characterize flaws, ruptures, and abnormalities in materials. Furthermore, these instruments are critical for detecting internal faults and inconsistencies in materials, thus being widely employed in industries such as manufacturing, building, construction, and the aerospace industry.

By Services Insights

The training segment is witnessing significant CAGR growth over the forecast period.

On the basis of service, the global ultrasonic testing market is segmented into inspection, training, equipment rental, calibration, and others. Among these, the training segment is witnessing significant CAGR growth over the forecast period, due to the challenge of having a low number of skilled and trained technicians for conducting ultrasonic testing inspections. This sub-segment typically includes educational offerings, certificates, and training programs that provide professionals with the expertise and knowledge needed to perform ultrasonic testing effectively and precisely. With the rapid development of new infrastructure, the demand for skilled NDT professionals is expected to increase in the coming years. Proper training allows the UT supervisor to find defects with high precision and reliability while inflicting no damage to the components or structures.

By End-Users Insights

The oil & gas segment accounted for the largest revenue share of more than 34.6% over the forecast period.

On the basis of end-uses, the global ultrasonic testing market is segmented into oil & gas, aerospace, automotive, manufacturing, marine, power generation, government infrastructure, and others. Among these, the oil & gas segment is dominating the market with the largest revenue share of 34.6% over the forecast period. Ultrasonic testing has become essential in the oil and gas industry. Given the extensive network of pipelines, storage facilities, and other essential facilities, as well as the industry's inherent dangers and high stakes, it places an increased focus on frequent and comprehensive inspections. UT is critical in offshore operations to maintain the reliable functioning of platforms and submerged equipment. Regular inspections play a part in spotting potential faults and ensuring safe hydrocarbon transportation and storage. It also aids in the detection of corrosion, cracks, and faults, assuring infrastructure safety and mitigating potentially major breakdowns.

Regional Insights

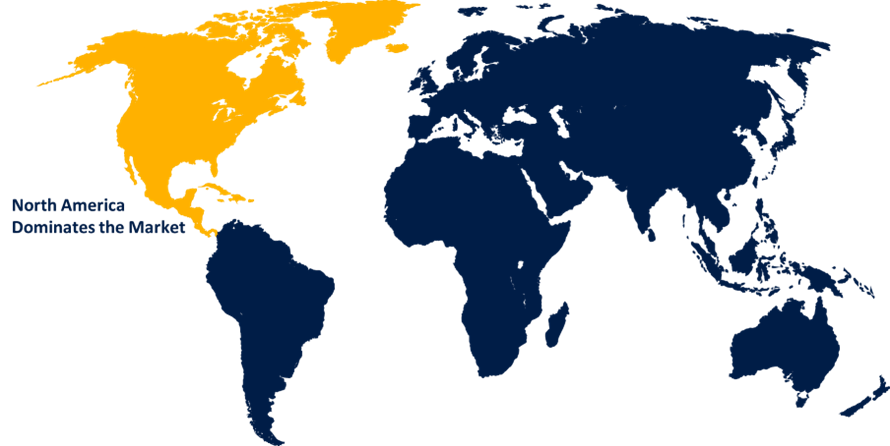

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. North America's dominance in the ultrasonic testing market has been strengthened by aspects such as the rapid adoption of emerging technologies, the substantial oil and gas infrastructure, and the expansion of sectors that demand stringent testing processes. The region has significant roots in manufacturing sectors such as aerospace, automotive, and oil and gas, all of which depend upon ultrasonic testing services extensively. Furthermore, businesses and organizations in North America have stood at the epicenter of technological breakthroughs in ultrasonic testing, boosting creativity and offering novel strategies. Moreover, the region's ongoing focus on infrastructure construction and maintenance drives the popularity of ultrasonic testing for structural evaluations, pipeline inspections, and other associated obligations.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. This is due to China's booming manufacturing sector and India's rapid development in its public infrastructure industry. In addition, Japan's indigenous automobile industry continues to encourage market expansion. Furthermore, increased railway infrastructure construction as the railway industry expands is expected to boost the ultrasonic testing market growth in the region over the period of forecasting. The growing demand for detecting flaws and unequal structures to prevent collisions between trains in the region is propelling market expansion. Furthermore, the increasing use of ultrasonic testing for manufacturing equipment and public infrastructure is likely to drive market demand.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. The strong manufacturing industry in Europe, particularly in fields such as automobile manufacture, aerospace, and energy, needs stringent inspection and quality assurance procedures, which drives demand for ultrasonic test equipment. Furthermore, numerous European countries have significant nuclear energy programs. In this industry, ultrasonic testing is critical to ensuring the solidity of reactor components along with related infrastructure.

List of Key Market Players

- T.D. Williamson Inc.

- Bosello High Technology srl

- Eddyfi

- Magnaflux

- Fischer Technology Inc.

- Cygnus Instruments Ltd.

- NDT Global GmbH

- Acuren

- LynX Inspection

- Baker Hughes

- Olympus Corporation

- MISTRAS Group

- Intertek

- Sonatest

- Zetec, Inc.

- Nikon Metrology

- Ashtead Technology

- General Electric

Key Market Developments

- On August 2023, Waygate Technologies, a global leader in non-destructive testing (NDT) solutions for industrial and energy inspection, has introduced Krautkrämer RotoArray comPAct, a portable roller probe for manual Phased Array (PA) ultrasonic inspection of large-scale composite materials. The Krautkrämer RotoArray comPAct features new Baker Hughes proprietary comPAct technology, allowing for lighter, simpler, and more cost-effective ultrasonic (UT) phased array applications.

- On March 2023, NSK has developed the world's first extremely accurate bearing life prediction technology based on ultrasonic testing, which increases the basic dynamic load rating of NSK rolling bearings. This technology has allowed NSK to modify the basic dynamic load rating of its bearings, allowing customers to design equipment and vehicles that take full advantage of the long-life performance of high-quality NSK bearings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Ultrasonic Testing Market based on the below-mentioned segments:

Ultrasonic Testing Market, Type Analysis

- Immersion Testing

- Guided Wave

- Acoustography

- Phased Array

- Time-of-Flight Diffraction

- Others

Ultrasonic Testing Market, Equipment Analysis

- Bond Testers

- Imaging Systems

- Industrial Scanners

- Flaw Detectors

- Thickness Gauges

- Transducers & Probes

- Tube Inspection Systems

- Others

Ultrasonic Testing Market, Services Analysis

- Inspection

- Training

- Equipment Rental

- Calibration

- Others

Ultrasonic Testing Market, End-Users Analysis

- Oil & Gas

- Aerospace

- Automotive

- Manufacturing

- Marine

- Power Generation

- Government Infrastructure

- Others

Ultrasonic Testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the ultrasonic testing market?The Global Ultrasonic Testing Market is expected to grow from USD 3.4 billion in 2022 to USD 8.5 billion by 2032, at a CAGR of 9.6% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?T.D. Williamson Inc., Bosello High Technology srl, Eddyfi, Magnaflux, Fischer Technology Inc., Cygnus Instruments Ltd., NDT Global GmbH, Acuren, LynX Inspection, Baker Hughes, Olympus Corporation, MISTRAS Group, Intertek, Sonatest, Zetec, Inc., Nikon Metrology, Ashtead Technology, General Electric

-

3. Which segment dominated the ultrasonic testing market share?The oil & gas segment in end-users type dominated the ultrasonic testing market in 2022 and accounted for a revenue share of over 34.6%.

-

4. Which region is dominating the ultrasonic testing market?North America is dominating the ultrasonic testing market with more than 38.7% market share.

-

5. Which segment holds the largest market share of the ultrasonic testing market?The time-of-flight diffraction segment based on type holds the maximum market share of the ultrasonic testing market.

Need help to buy this report?