Global Underwater Warfare Market Size, Share, and COVID-19 Impact Analysis, By System (Unmanned Systems, Sonar Systems, Electronic Warfare Systems, Weapons Systems, and Communications Systems), By Capability (Support, Protect, Attack, and Others), By Platform (Surface Ships, Naval Helicopters, and Submarines), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Underwater Warfare Market Insights Forecasts to 2033

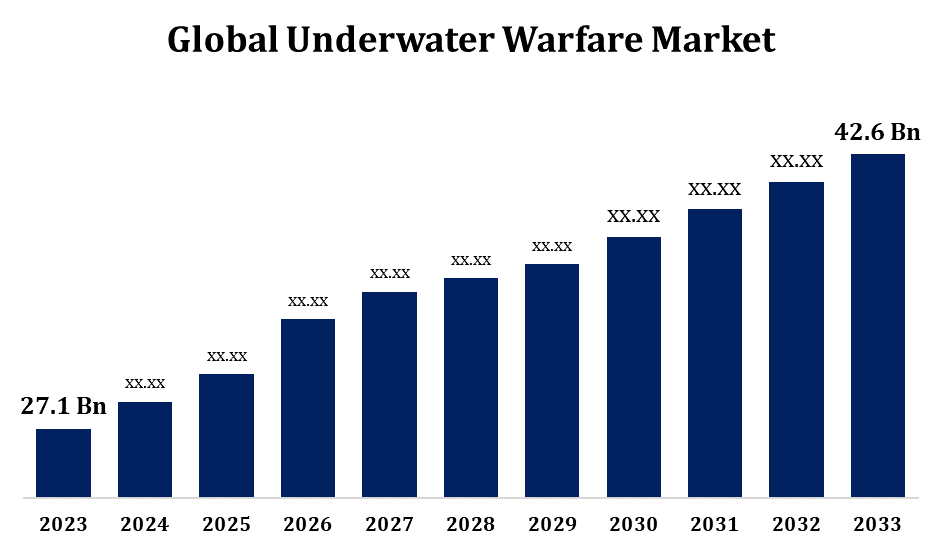

- The Underwater Warfare Market was valued at USD 27.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.63% from 2023 to 2033.

- The Worldwide Underwater Warfare Market Size is Expected to reach USD 42.6 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Underwater Warfare Market Size is Expected to reach USD 42.6 billion by 2033, at a CAGR of 4.63% during the forecast period 2023 to 2033.

The underwater warfare market is a critical sector within the global defense industry, focusing on technologies and systems designed for operations beneath the ocean's surface. This market encompasses submarine fleets, underwater drones, torpedoes, and sonar systems, catering to both military and defense organizations. Increased geopolitical tensions, advancements in naval defense technologies, and the need for underwater security in strategic regions are driving market growth. The integration of artificial intelligence, automation, and machine learning into underwater systems is enhancing operational efficiency and combat capabilities. Additionally, naval modernization programs and the rise of autonomous underwater vehicles (AUVs) further contribute to the sector's expansion. The market is expected to continue growing, with investments in advanced technologies, international collaborations, and a focus on enhancing maritime defense infrastructure.

Underwater Warfare Market Value Chain Analysis

The underwater warfare market value chain involves several key stages, from raw material sourcing to the end-user deployment. It begins with the research and development phase, where innovations in sonar systems, underwater drones, and torpedoes are conceptualized. Manufacturers produce components such as sensors, propulsion systems, and advanced materials, essential for creating reliable underwater defense solutions. These components are then assembled into complete systems like submarines and autonomous underwater vehicles (AUVs). Once manufactured, the systems undergo rigorous testing and certification for military use. Following this, distribution and integration into naval fleets are managed through defense contractors and government procurement programs. After deployment, maintenance and upgrades are crucial for ensuring long-term operational efficiency. The value chain thrives through collaborations between defense companies, technology firms, and governments.

Underwater Warfare Market Opportunity Analysis

The underwater warfare market presents significant opportunities driven by evolving defense needs and technological advancements. The growing demand for advanced naval defense systems, such as autonomous underwater vehicles (AUVs), unmanned underwater vehicles (UUVs), and next-generation sonar systems, creates a surge in opportunities for manufacturers and technology providers. Geopolitical tensions and the increasing need for maritime security encourage countries to invest in modernizing their naval fleets and enhancing underwater defense capabilities. Additionally, the integration of artificial intelligence (AI), machine learning, and automation into underwater warfare systems is expected to boost operational effectiveness, creating avenues for innovation. Expanding defense budgets, collaborations between nations, and the rise of public-private partnerships in defense contracts will drive market expansion. These factors position the underwater warfare market for sustained growth and technological breakthroughs.

Global Underwater Warfare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 27.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.63% |

| 2033 Value Projection: | USD 42.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By System, By Capability, By Platform, By Region |

| Companies covered:: | Aish Technologies, ATLAS ELEKTRONIK, General Dynamic Corporation, ASELSAN, BAE Systems plc, Elbit Systems Ltd, Saab AB, Naval Group, Huntington Ingalls Industries, Northrop Grumman Corporation, L3Harris Technologies, Raytheon Technologies, Thales, Thyssenkrupp AG, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Underwater Warfare Market Dynamics

Advancement and Implementation of Cutting-Edge Sonar Technologies in Underwater Warfare

The advancement and implementation of cutting-edge sonar technologies are crucial drivers of market growth in underwater warfare. These innovations enhance the detection, tracking, and targeting capabilities of naval forces, enabling more efficient operations in complex underwater environments. Modern sonar systems, incorporating artificial intelligence and machine learning, offer improved accuracy and real-time data processing, significantly boosting operational effectiveness. The development of advanced sonar for submarines, unmanned underwater vehicles (UUVs), and autonomous underwater vehicles (AUVs) has expanded the potential for both military and commercial applications. As nations invest in next-generation defense technologies and upgrade their naval capabilities, the demand for sophisticated sonar systems continues to rise. This progress fuels the overall growth of the underwater warfare market, with increased focus on stealth, precision, and enhanced survivability in maritime defense.

Restraints & Challenges

One of the primary challenges is the high cost of research, development, and deployment of advanced underwater systems, including submarines, sonar technologies, and unmanned underwater vehicles (UUVs). These sophisticated systems require significant investment and long development cycles, limiting accessibility for some nations. Additionally, the complex and hostile underwater environment presents technical difficulties in system reliability and performance. Interoperability between new technologies and legacy systems is another concern, as military forces look to integrate cutting-edge innovations with existing infrastructure. Security risks, such as cyberattacks on underwater defense systems, also pose threats to operational integrity. Lastly, the geopolitical tensions and regulatory hurdles in international defense agreements may hinder cross-border collaborations and market expansion.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Underwater Warfare Market from 2023 to 2033. The United States, with its extensive naval fleet and commitment to modernization, is the dominant player in the region. The U.S. Navy's investment in next-generation submarines, unmanned underwater vehicles (UUVs), and advanced sonar systems bolsters market growth. Additionally, increasing focus on anti-submarine warfare and securing critical underwater assets has fueled the demand for cutting-edge defense technologies. Canada, while smaller in scale, also contributes to regional growth with its strategic investments in maritime security. The market is further supported by collaborations between defense contractors, technology firms, and government agencies, fostering innovation in underwater warfare capabilities. With expanding defense initiatives and heightened geopolitical concerns, North America remains a key hub for underwater warfare market advancements.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, in particular, has significantly expanded its naval capabilities, investing heavily in submarine fleets and underwater defense technologies. India and Japan are similarly enhancing their underwater warfare capabilities to secure vital sea lanes and maintain a strategic presence in the Indo-Pacific region. The rise of advanced technologies, such as autonomous underwater vehicles (AUVs), AI-driven sonar systems, and advanced torpedoes, is further driving market demand. As regional security concerns grow, the Asia-Pacific market is expected to witness sustained growth, with governments prioritizing maritime defense.

Segmentation Analysis

Insights by System

The weapons systems segment accounted for the largest market share over the forecast period 2023 to 2033. As nations modernize their naval forces, there is an increasing demand for more precise, stealthy, and efficient underwater weapons to counter threats in the submerged domain. The integration of autonomous technologies, artificial intelligence, and advanced propulsion systems is enhancing the performance of underwater weaponry, enabling longer ranges, faster speeds, and improved accuracy. Modern torpedoes and anti-submarine missiles are increasingly designed to operate effectively in complex, congested underwater environments, offering superior targeting capabilities. Additionally, with rising security concerns and territorial disputes in strategic maritime regions, the weapons systems segment is growing as nations focus on strengthening their underwater combat capabilities. This trend is expected to continue as technological innovations redefine naval defense strategies.

Insights by Capability

The protect segment accounted for the largest market share over the forecast period 2023 to 2033. Advances in submarine hull protection, countermeasures, and anti-torpedo defense systems are key factors fueling this growth. As underwater threats, including mines, torpedoes, and hostile submarines, evolve, nations are investing in sophisticated protection technologies to ensure the survivability of their fleets and offshore installations. The development of advanced sonar systems, electromagnetic countermeasures, and decoy systems, along with the integration of artificial intelligence for threat detection and mitigation, enhances defense capabilities. Additionally, the rise of autonomous underwater vehicles (AUVs) and unmanned underwater vehicles (UUVs) for reconnaissance and protection operations further supports market expansion. As geopolitical tensions intensify, the demand for advanced protection systems will continue to grow, strengthening naval defense strategies.

Insights by Platform

The submarines segment accounted for the largest market share over the forecast period 2023 to 2033. Submarines remain a crucial element of naval forces, providing strategic deterrence, intelligence gathering, and strike capabilities. Modernization programs are upgrading existing fleets with enhanced technologies, including improved sonar systems, stealth features, and long-range cruise missiles. Additionally, the development of autonomous and nuclear-powered submarines is further accelerating growth, offering greater operational efficiency and longer deployment times. Nations, especially in the Asia-Pacific, North America, and Europe, are investing heavily in advanced submarines to strengthen their maritime security and maintain a tactical edge. The need to counter emerging underwater threats and secure critical maritime routes ensures continued growth in the submarines segment of the underwater warfare market.

Recent Market Developments

- In January 2023, Raytheon Technologies began developing prototypes for miniature torpedoes designed to target and divert enemy submarines, as well as protect U.S. Navy submarines from incoming torpedoes.

Competitive Landscape

Major players in the market

- Aish Technologies

- ATLAS ELEKTRONIK

- General Dynamic Corporation

- ASELSAN

- BAE Systems plc

- Elbit Systems Ltd

- Saab AB

- Naval Group

- Huntington Ingalls Industries

- Northrop Grumman Corporation

- L3Harris Technologies

- Raytheon Technologies

- Thales

- Thyssenkrupp AG

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Underwater Warfare Market, System Analysis

- Unmanned Systems

- Sonar Systems

- Electronic Warfare Systems

- Weapons Systems

- Communications Systems

Underwater Warfare Market, Capability Analysis

- Support

- Protect

- Attack

- Others

Underwater Warfare Market, Platform Analysis

- Surface Ships

- Naval Helicopters

- Submarines

Underwater Warfare Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Underwater Warfare Market?The global Underwater Warfare Market is expected to grow from USD 27.1 billion in 2023 to USD 42.6 billion by 2033, at a CAGR of 4.63% during the forecast period 2023-2033.

-

2. Who are the key market players of the Underwater Warfare Market?Some of the key market players of the market are Aish Technologies, ATLAS ELEKTRONIK, General Dynamic Corporation, ASELSAN, BAE Systems plc, Elbit Systems Ltd, Saab AB, Naval Group, Huntington Ingalls Industries, Northrop Grumman Corporation, L3Harris Technologies, Raytheon Technologies, Thales, and Thyssenkrupp AG.

-

3. Which segment holds the largest market share?The submarines segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Underwater Warfare Market?North America dominates the Underwater Warfare Market and has the highest market share.

Need help to buy this report?