United Kingdom Animal Protein Market Size, Share, and COVID-19 Impact Analysis, By Type (Whey, Egg Protein, Gelatin, and Caseinate), By End-Use (Pharmaceutical, Food & Beverages, Cosmetics, and Animal Feed), and United Kingdom Animal Protein Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Animal Protein Market Insights Forecasts to 2033

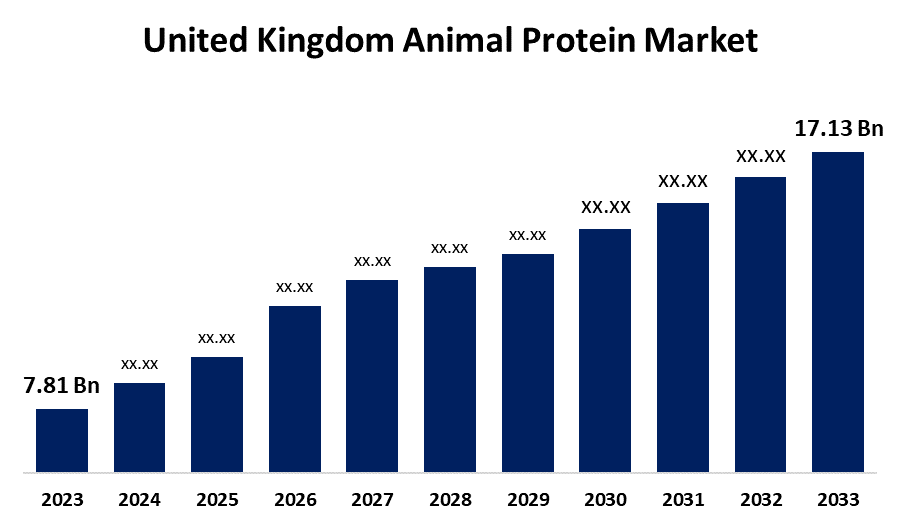

- The U.K. Animal Protein Market Size was valued at USD 7.81 Billion in 2023.

- The U.K. Animal Protein Market Size is Growing at a CAGR of 8.17% from 2023 to 2033

- The U.K. Animal Protein Market Size is Expected to reach USD 17.13 Billion by 2033

Get more details on this report -

The United Kingdom Animal Protein Market Size is anticipated to exceed USD 17.13 Billion by 2033, Growing at a CAGR of 8.17% from 2023 to 2033. The growing consumer need for protein rich diets, rise in meat substitution trends & premium products, meat processing & export sector, and technological advancements in animal feeding are driving the growth of the animal protein market in the UK.

Market Overview

The animal protein market refers to the industry encompassing trade and consumption of proteins derived from animals, including meat, poultry, fish, eggs, and dairy, that are used across diverse applications, including food & beverages, nutritional supplements, animal feed, pet food, and pharmaceuticals. Animal protein is considered a complete protein source, containing all nine essential amino acids. They are widely used in food products, e.g., casein, whey protein, gelatin, egg protein, and fibroin, as they provide a superior functionality and balance of essential amino acids. The awareness about the benefits of these dietary supplements, including the management of health conditions like diabetes, obesity, cardiovascular diseases, and others, is significantly driving the animal protein market in the nutraceutical industry. Furthermore, technological development in the dairy industry and the adoption of innovative products by the manufacturers are creating market growth opportunities for animal protein.

Report Coverage

This research report categorizes the market for the UK animal protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom animal protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK animal protein market.

United Kingdom Animal Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.81 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.17% |

| 2033 Value Projection: | USD 17.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End-Use |

| Companies covered:: | Agrial Enterprise, Arla Foods AmbA, Carbery Food Ingredients Limited, Darling Ingredients Inc., Glanbia PLC, Insect Technology Group Holdings UK Limited, Jellice Pioneer Private Limited, Kerry Group PLC, Koninklijke FrieslandCampina NV, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing consumer need for protein-rich diets, owing to the increased health and fitness consciousness among consumers, especially athletes and health-conscious individuals, is propelling the market. The country’s growing meat processing industry and export sector are also responsible for the animal protein market. The export of red meat from the UK amounts to over half a million tonnes each year, worth about £1.7 billion according to the report of AHDB. In addition, the technological advancements in animal feeding are driving the market for animal protein due to its significant role in the growth, development, and overall health of the animal and serves as the building blocks for muscles, tissues, and supporting reproductive functions of these animals.

Restraining Factors

The changing consumer preferences for plant-based diets are restraining the market for animal protein. The rising concerns regarding animal welfare and environmental sustainability are challenging market growth.

Market Segmentation

The United Kingdom animal protein market share is classified into type and end-use.

- The whey segment dominates the United Kingdom animal protein market and is expected to grow at the fastest CAGR growth during the projected period.

The United Kingdom animal protein market is segmented by type into whey, egg protein, gelatin, and caseinate. Among these, the whey segment dominates the United Kingdom animal protein market and is expected to grow at the fastest CAGR growth during the projected period. Whey protein is a protein mixture isolated from whey, a liquid material created as a by-product of cheese production. The participation in sports, athletics, and fitness regimes is fueling the market demand in the whey segment.

- The food & beverages segment accounted for the largest market share and is expected to grow at the fastest CAGR during the projected period.

The United Kingdom animal protein market is segmented by end-use into pharmaceutical, food & beverages, cosmetics, and animal feed. Among these, the food & beverages segment accounted for the largest market share and is expected to grow at the fastest CAGR during the projected period. Due to their nutritional value and functional properties, animal proteins are widely used in food and beverage processing. The surging preference for protein-rich diets and the need for infant formula are driving the market in the food & beverages segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. animal protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agrial Enterprise

- Arla Foods AmbA

- Carbery Food Ingredients Limited

- Darling Ingredients Inc.

- Glanbia PLC

- Insect Technology Group Holdings UK Limited

- Jellice Pioneer Private Limited

- Kerry Group PLC

- Koninklijke FrieslandCampina NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2021, Rousselot, a darling Ingredients brand producing collagen-based solutions, launched MSC-certified marine collagen peptide, known as Peptan, at the virtual Beauty & Skincare Formulation Conference in 2021.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Animal Protein Market based on the below-mentioned segments:

UK Animal Protein Market, By Type

- Whey

- Egg Protein

- Gelatin

- Caseinate

UK Animal Protein Market, By End-Use

- Pharmaceutical

- Food & Beverages

- Cosmetics

- Animal Feed

Need help to buy this report?