United Kingdom Automotive Carbon Fiber Composites Market Size, Share, and COVID-19 Impact Analysis, By Production Type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, and Compression Molding), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Application (Powertrain Component, Interior, Exterior, and Others), and United Kingdom Automotive Carbon Fiber Composites Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited Kingdom Automotive Carbon Fiber Composites Market Insights Forecasts to 2033

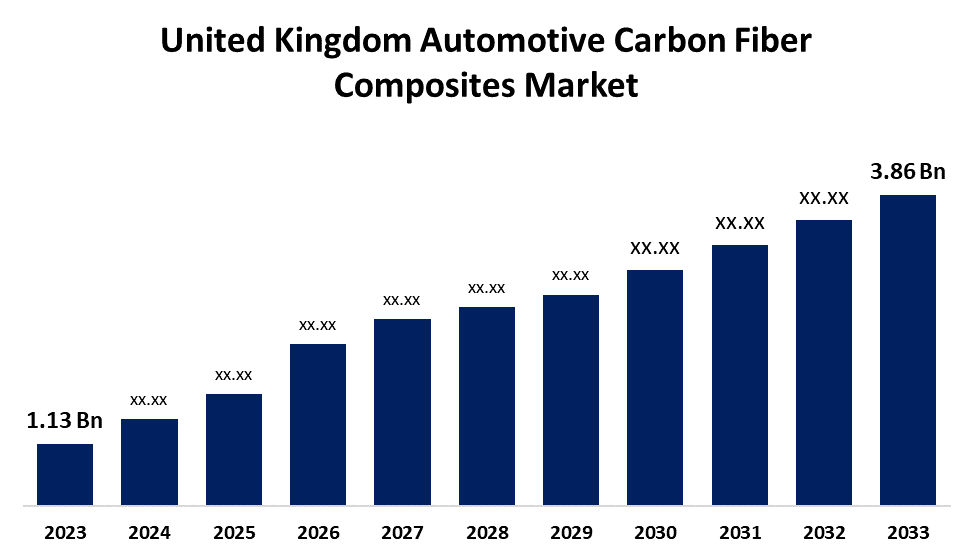

- The U.K. Automotive Carbon Fiber Composites Market Size was valued at USD 1.13 Billion in 2023

- The Market Size is growing at a CAGR of 13.07% from 2023 to 2033

- The U.K. Automotive Carbon Fiber Composites Market Size is Expected to Reach USD 3.86 Billion by 2033

Get more details on this report -

The United Kingdom Automotive Carbon Fiber Composites Market is anticipated to exceed USD 3.86 Billion by 2033, growing at a CAGR of 13.07% from 2023 to 2033. The growing demand for lightweight materials from the automotive industry is driving the growth of the automotive carbon fiber composites market in the UK.

Market Overview

Automotive carbon fiber composites are ideally used for automotive design where reducing weight is essential. These composite materials are made of carbon fibers embedded in a polymer matrix, usually epoxy resin. They are remarkably strong and lightweight due to the firmly bound carbon atoms grouped in a crystalline structure, which also contributes to their stiffness. In addition, carbon fiber composites have superior strength-to-weight ratios than conventional materials like steel or aluminum, offering improved crash protection and structural integrity. Manufacturers are innovating and developing carbon fiber production processes leading to advancements in lightweight materials and adoption across the automotive industry. 3-D printing technology in the production process offers market opportunity as it enables the streamline and cuts the cost of traditional composite manufacturing as software controls each stage of the process, requiring human input only during the post-processing phase. Numerous automakers, including GM, Honda, BMW, Audi, and Polestar, have mass production agreements with suppliers of carbon fiber materials, and they are investing in their processes to enable low-cost carbon fiber manufacture.

Report Coverage

This research report categorizes the market for the UK automotive carbon fiber composites market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom automotive carbon fiber composites market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK automotive carbon fiber composites market.

United Kingdom Automotive Carbon Fiber Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.13 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.07% |

| 2033 Value Projection: | USD 3.86 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Production Type, By Vehicle Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Hexcel Corporation, General Motor Company, SGL Carbon, MouldCam Pty Ltd, Toray Industries, Toho Tenex, Sigmatex, BASF, Nippon Sheet Glass Company Limited, Mitsubishi Chemical Carbon Fiber and Composites Inc., Solvay, Others and other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Carbon fiber is an excellent substitute for traditional metals in vehicles since it may lower the weight of the vehicle in the face of tightening emission regulations and growing fuel costs. The increased emphasis on fuel economy and the automotive industry's increasing need for lightweight materials are expected to propel the market growth. The increased demand for electric vehicles is likely to boost carbon fiber's penetration to increase the range of electric vehicles, which ultimately lead to significant market expansion.

Restraining Factors

The high costs of carbon fiber are hindering the market since their use in low-cost vehicles could significantly raise such vehicles' prices.

Market Segmentation

The United Kingdom Automotive Carbon Fiber Composites Market share is classified into production type, vehicle type, and application.

- The injection molding segment accounted for the largest market share in 2023.

The United Kingdom automotive carbon fiber composites market is segmented by production type into hand layup, resin transfer molding, vacuum infusion processing, injection molding, and compression molding. Among these, the injection molding segment accounted for the largest market share in 2023. In the injection molding, the raw material, a pellet of thermoplastic resin reinforced with carbon fiber (such as nylon or polycarbonate), is heated until it melts and then injected into a mold's cavity. The increasing adoption in the automotive industry as well as the growing operating temperature are propelling the market.

- The passenger cars segment is expected to hold the largest market share during the forecast period.

The United Kingdom automotive carbon fiber composites market is segmented by vehicle type into passenger cars and commercial vehicles. Among these, the passenger cars segment is expected to hold the largest market share during the forecast period. Carbon fiber composites are being used in the production of automobiles by automakers in the UK, including BMW, Volkswagen, Audi, and others, due to the implementation of strict emission regulations and fuel economy standards throughout the region.

- The exterior segment dominated the UK automotive carbon fiber composites market with the largest market share in 2023.

The United Kingdom automotive carbon fiber composites market is segmented by application into powertrain component, interior, exterior, and others. Among these, the exterior segment dominated the UK automotive carbon fiber composites market with the largest market share in 2023. The exterior segment provides high rigidity, which reduces occupant injury in the event of an accident. The increasing need from manufacturers to make various exterior elements, like fenders, hoods, bumper beams, and deck lids of automobiles as well as the nation’s expanding automobile manufacturing and export sector is accelerating the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. automotive carbon fiber composites market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hexcel Corporation

- General Motor Company

- SGL Carbon

- MouldCam Pty Ltd

- Toray Industries

- Toho Tenex

- Sigmatex

- BASF

- Nippon Sheet Glass Company Limited

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Solvay

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Huntsman, V-carbon came together to take apart carbon-fiber composites for recycling. The two companies plan to recycle the entire carbon-fiber composite, including the fiber and resin or its chemical components.

- In September 2022, the National Composites Centre (NCC, Bristol, U.K.) launched an initiative to industrialize continuous carbon fiber reclamation in the U.K.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Automotive Carbon Fiber Composites Market based on the below-mentioned segments:

UK Automotive Carbon Fiber Composites Market, By Production Type

- Hand Layup

- Resin Transfer Molding

- Vacuum Infusion Processing

- Injection Molding

- Compression Molding

UK Automotive Carbon Fiber Composites Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

UK Automotive Carbon Fiber Composites Market, By Application

- Powertrain Component

- Interior

- Exterior

- Others

Need help to buy this report?