United Kingdom Banking-as-a-Service Market Size, Share, and COVID-19 Impact Analysis, By Solution (Banking as a Service Platform, Banking as a Service APIs, and Services), By Enterprise Size (Small & Mid-Sized Organizations and Large Organizations), By Industry (Banks, FinTech Corporations, Investment Firms, Luxury Fashion & Jewelry, Home Improvement, Grocery, Mid Fashion & Jewelry, Electronics, E-Commerce Retailors, Travel Portals, Automotive, Airlines, and Others), and United Kingdom Banking-as-a-Service Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Banking-as-a-Service Market Insights Forecasts to 2033

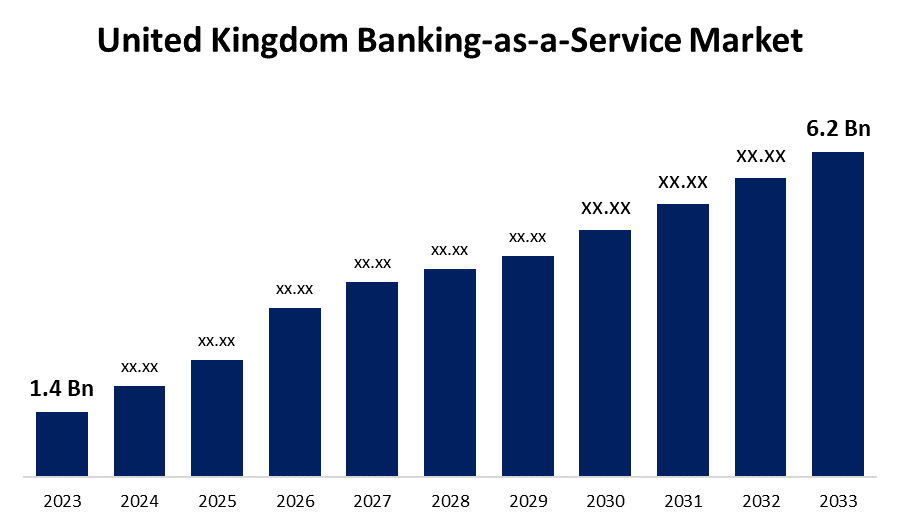

- The United Kingdom Banking-as-a-Service Market Size was valued at USD 1.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 16.04% from 2023 to 2033

- The U.K. Banking-as-a-Service Market Size is expected to reach USD 6.2 Billion by 2033

Get more details on this report -

The United Kingdom Banking-as-a-Service Market is anticipated to exceed USD 6.2 billion by 2033, growing at a CAGR of 16.04% from 2023 to 2033. The growing adoption of digital banking solutions, increased competition & improved customer experiences, and the presence of several retail banks and financial service providers in the UK are driving the growth of the banking-as-a-service market in the United Kingdom.

Market Overview

Banking-as-a-service market is an end-to-end model that enables digital banks and other third parties to establish direct connections with banks' systems through APIs, enabling them to develop banking services on top of the providers' regulated infrastructure. This model also unlocks the potential for open banking, thereby revolutionizing the financial services industry. End consumers are adopting cutting-edge digital banking solutions that provide convenience and efficiency while reducing costs for banks and other service providers, which is driving market expansion, as a result of the shifting dynamics in the banking and financial services industry. Newer technologies including blockchain, robotic process automation, and artificial intelligence are driving the current wave of digital transformation. The rise in demand for omni-channel payments and real-time processing, and the usage of smarter technologies for applications targeted at certain industries, indicate the UK’s quick transition to embedded finance. The emergence of open banking is creating ample opportunities. Further, the increasing collaboration between financial institutions (FIs) and Fintech will likely create growth avenues.

Report Coverage

This research report categorizes the market for the UK banking-as-a-service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the banking-as-a-service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the banking-as-a-service market.

United Kingdom Banking-as-a-Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.4 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 16.04% |

| 023 – 2033 Value Projection: | USD 6.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solution, By Enterprise Size, By Industry |

| Companies covered:: | Thought Machine, Bankable, ClearBank, Solarisbank, Starling Bank, Treezor, Unnax, 11:FS Foundry, Cambr, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The buy now pay later model is becoming more and more popular, customers are becoming more interested in embedded finance. The United Kingdom has the highest prevalence of embedded lending when compared to other European countries. In addition, rapid evolution of BaaS and BaaS-powered business models to drive demand. Large enterprises are using BaaS systems more frequently due to their growing need for dependable service platforms and automation capabilities, as well as their expanding client base from investing in digital transformation to providing tech-savvy banking operations. Furthermore, the growing adoption of digital banking solutions, increased competition & improved customer experiences, and the presence of several retail banks and financial service providers in the UK are significantly driving the UK banking-as-a-service market.

Restraining Factors

The difficult and time-consuming process of integrating with the current infrastructure is restraining the market. The internal resistance in the financial sector, especially in conventional institutions hamper the adoption of new technologies which resulted in restraining the UK banking-as-a-services market.

Market Segmentation

The United Kingdom Banking-as-a-Service Market share is classified into solution, enterprise size, and industry.

- The banking as a service platform segment is anticipated to witness the fastest CAGR growth during the forecast period.

The United Kingdom banking-as-a-service market is segmented by solution into banking as a service platform, banking as a service APIs, and services. Among these, the banking as a service platform segment is anticipated to witness the fastest CAGR growth during the forecast period. BaaS platforms have revolutionized the traditional banking industry by providing financial institutions a flexible and adaptable infrastructure to create and deploy digital banking solutions. This has improved customer experiences, accelerated innovation, and boosted operational efficiency. The introduction of new products and services as well as collaborations between established banks and emerging fintech startups has driven the market growth.

- The small & mid-sized organizations segment is expected to grow at the fastest CAGR during the forecast period.

The United Kingdom banking-as-a-service market is segmented by enterprise size into small & mid-sized organizations, and large organizations. Among these, the small & mid-sized organizations segment is expected to grow at the fastest CAGR during the forecast period. BaaS platforms are used to access advanced technology, streamline operations, and provide innovative financial services without the substantial upfront investment for traditional banking infrastructure. BaaS systems enable smaller firms to meet the ever-changing demands of tech-savvy consumers and become more competitive in the ever-changing financial technology market. Thus, there is high demand in small and mid-sized organizations.

- The banks segment is anticipated to hold the largest share of the United Kingdom banking-as-a-service market during the forecast period.

Based on the industry, the United Kingdom banking-as-a-service market is divided into banks, fintech corporations, investment firms, luxury fashion & jewelry, home improvement, grocery, mid fashion & jewelry, electronics, e-commerce retailors, travel portals, automotive, airlines, and others. Among these, the banks segment is anticipated to hold the largest share of the United Kingdom banking-as-a-service market during the forecast period. Banks can gain a competitive edge by adopting BaaS and easily integrating digital services into the business, thereby increasing digital capabilities, improving consumer experiences, and providing a wider range of services by utilizing BaaS platforms. The rising demand for robust compliance solutions in banks surges the market demand for BaaS in the banks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK banking-as-a-service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thought Machine

- Bankable

- ClearBank

- Solarisbank

- Starling Bank

- Treezor

- Unnax

- 11:FS Foundry

- Cambr

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2022, PEXA, the Australian-founded fintech that enabled the world’s first fully digitised property settlement process, announced the successful development of a brand new payment scheme – PEXA Pay. At the same time, PEXA has partnered with ClearBank, clearing and embedded banking platform in the UK, to broaden access to its forthcoming remortgage platform.

- In July 2021, Paysafe, a leading specialised payments platform, announced a new partnership with Bankable, a global architect of ‘banking-as-a-service’ solutions. Through the global agreement, the two companies would collaborate to launch a broad range of integrated, omnichannel banking services from Paysafe.

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Banking-as-a-Service Market based on the below-mentioned segments:

United Kingdom Banking-as-a-Service Market, By Solution

- Banking as a Service Platform

- Banking as a Service APIs

- Services

United Kingdom Banking-as-a-Service Market, By Enterprise Size

- Small & Mid-Sized Organizations

- Large Organizations

United Kingdom Banking-as-a-Service Market, By Industry

- Banks

- FineTech Corporations

- Investment Firms

- Luxury Fashion & Jewelry

- Home Improvement

- Grocery

- Mid Fashion & Jewelry

- Electronics

- E-Commerce Retailors

- Travel Portals

- Automotive

- Airlines

- Others

Need help to buy this report?