United Kingdom Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Product (Bioherbicides, Bio-insecticides, Bio-fungicides, and Others), By Mode of Application (Seed Treatment, Soil Treatment, Foliar Spray, and Others), and United Kingdom Biopesticides Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureUnited Kingdom Biopesticides Market Insights Forecasts to 2033

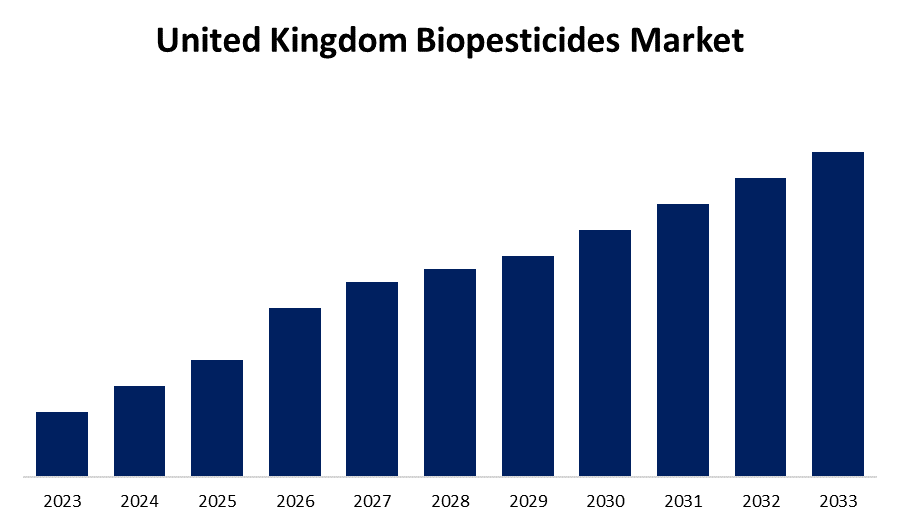

- The Market is Growing at a CAGR of 5.9% from 2023 to 2033

- The UK Biopesticides Market Size is expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Biopesticides Market is anticipated to hold a significant share by 2033, growing at a CAGR of 5.9% from 2023 to 2033. The growing demand for organic products, the promotion of biocontrol products by the government, and rising consumer demand for food safety and quality are driving the growth of the biopesticides market in the United Kingdom.

Market Overview

Biopesticides are naturally derived agents that are obtained from living organisms, suppressing the growth and proliferation of pests' populations by diverse mechanisms of action. Crop protection is heavily relied on synthetic chemical pesticides over the past 50 years, but their availability is now declining. The associated harmful side effects, new legislation, and the evolution of resistance in pest populations of synthetic pesticides surge the requirement for biological or natural-based pesticides in the agricultural field. Therefore, alternative pest management tactics are needed. The greater emphasis on Integrated Pest Management (IPM) as part of agricultural policy in the European Union promotes new opportunities for developing biopesticides by combining ecological science with post-genomics technologies. Consumer demand, government support, and scientific advancements, biopesticides are the factors that play crucial roles in shaping the future of sustainable agriculture in the country. Further, the increased focus on innovation and sustainability significantly contributed to the growth of biopesticides in the agricultural sector.

Report Coverage

This research report categorizes the market for the UK biopesticides market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biopesticides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK biopesticides market.

United Kingdom Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Mode of Application and COVID-19 Impact Analysis. |

| Companies covered:: | Bionema Ltd., Bayer UK Ltd., Syngenta UK Ltd., Koppert Biological Systems, Novozymes UK Ltd., BASF UK Ltd., UPL Europe Ltd., Real IPM UK and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing concern regarding the associated harmful side effects of synthetic pesticides surges the demand for eco-friendly and organic-based alternative products. Thus, growing awareness about the environmental and health impacts of synthetic pesticides, increasing market demand for biopesticides. Further, the support by the UK government for sustainable farming practices plays a crucial role in driving the market. The increasing health consciousness by consumers and the increasing popularity of organic products that are grown without the use of synthetic pesticides and fertilizers fueling the biopesticides market. The remarkable advancement in biotechnology surging the development of biopesticides is further propelling the market growth.

Restraining Factors

The navigation and adherence to the environmental regulations by the biopesticides industry challenging the market. The fulfillment of these regulatory compliances of biopesticides ensures product safety, environmental sustainability, and public health.

Market Segmentation

The United Kingdom Biopesticides Market share is classified into product and mode of application.

- The bio-insecticides segment dominates the UK biopesticides market.

The United Kingdom biopesticides market is segmented by product into bioherbicides, bio-insecticides, bio-fungicides, and others. Among these, the bio-insecticides segment dominates the UK biopesticides market. The rising concerns about the protection of crops among farmers and increasing awareness about the negative impact of chemical pesticides on the environment and human health led to a surge in the demand for sustainable and eco-friendly alternatives. The growing popularity of naturally derived biopesticides is due to safe and effective solutions than pest control as these are pesticide residue-free products.

- The foliar spray segment is expected to grow at the fastest CAGR during the forecast period.

The United Kingdom biopesticides market is segmented by mode of application into seed treatment, soil treatment, foliar spray, and others. Among these, the foliar spray segment is expected to grow at the fastest CAGR during the forecast period. The foliar spraying of biopesticides on the surface of plant areas where pests, diseases, and deficiencies are more prevalent. It boosts healthier growth and enhances resistance to various threats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK biopesticides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bionema Ltd.

- Bayer UK Ltd.

- Syngenta UK Ltd.

- Koppert Biological Systems

- Novozymes UK Ltd.

- BASF UK Ltd.

- UPL Europe Ltd.

- Real IPM UK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, UK’s Moa Technology & Croda partner to develop next gen bioherbicides. Moa Technology, the leading agricultural biotech company, and Croda International plc, the global life sciences and consumer care company, have formed a strategic partnership to tackle the global problem of declining food crop yields by using marine science.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Biopesticides Market based on the below-mentioned segments:

United Kingdom Biopesticides Market, By Product

- Bioherbicides

- Bio-insecticides

- Bio fungicides

- Others

United Kingdom Biopesticides Market, By Mode of Application

- Seed Treatment

- Soil Treatment

- Foliar Spray

- Others

Need help to buy this report?