United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Consulting, Auditing & Assessment, Regulatory Affairs, Product Maintenance, Product Design & Development, Product Testing & Validation, Training & Education, and Others), By End-use (Pharmaceutical and Biotech), and United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market Insights Forecasts to 2033

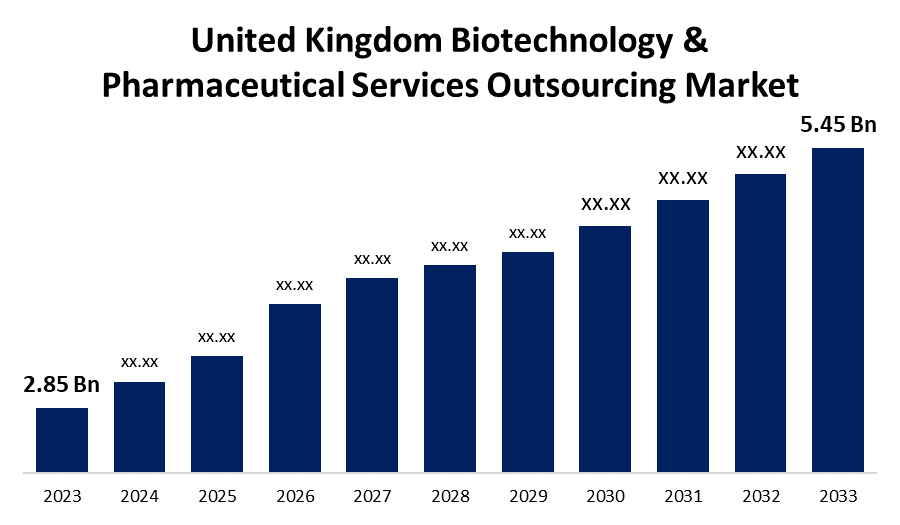

- The U.K. Biotechnology & Pharmaceutical Services Outsourcing Market Size was valued at USD 2.85 Billion in 2023.

- The Market is growing at a CAGR of 6.70% from 2023 to 2033

- The U.K. Biotechnology & Pharmaceutical Services Outsourcing Market Size is expected to reach USD 5.45 Billion by 2033

Get more details on this report -

The United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market is anticipated to exceed USD 5.45 Billion by 2033, growing at a CAGR of 6.70% from 2023 to 2033. The growing cost of drug development, the increased number of clinical development failures, and the launch of generics are driving the growth of the biotechnology & pharmaceutical services outsourcing market in the UK.

Market Overview

Biotechnology & pharmaceutical services outsourcing are a crucial part of the healthcare landscape, enabling faster medication discovery and improved research capacities. Pharmaceutical and biotech companies can concentrate on their core capabilities and optimize their operations by outsourcing different elements of drug discovery, development, and manufacturing to specialist third-party suppliers in this competitive industry. There is a growing need for contract biotechnology and pharmaceutical services due to the rise in R&D efforts for new medication development, combination products, and other advanced treatments. The surge in research and development (R&D) for novel medicine creation, combination products, and other cutting-edge treatments has resulted in an increasing need for contract biotechnology and pharmaceutical services. Many biotechnology and pharmaceutical companies from developed economies are choosing to contract out various business functions to organizations operating in the region, including drug development, manufacturing, distribution, research & development, and clinical trials.

Report Coverage

This research report categorizes the market for the UK biotechnology & pharmaceutical services outsourcing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biotechnology & pharmaceutical services outsourcing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK biotechnology & pharmaceutical services outsourcing market.

United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.70% |

| 2033 Value Projection: | USD 5.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service, By End-use |

| Companies covered:: | Parexel International Corporation, IQVIA, The Quantic Group, Lachman Consultant Services, Inc., ICON plc., Charles River Laboratories, Concept Heidelberg GmbH, GMP Pharmaceuticals Pty Ltd., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing concerns regarding the cost of drug development and the need for advanced technology to increase the quality of final formulations are driving the market demand for biotechnology & pharmaceutical services outsourcing. Further, the increased number of clinical development failures and the launch of generics are promoting market growth.

Restraining Factors

The stringent regulations and management of costs during fluctuations in currency exchange and unexpected project scope changes are negatively influencing market growth.

Market Segmentation

The United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market share is classified into service and end-use.

- The consulting segment dominates the market with the largest market share during the forecast period.

The United Kingdom biotechnology & pharmaceutical services outsourcing market is segmented by service into consulting, auditing & assessment, regulatory affairs, product maintenance, product design & development, product testing & validation, training & education, and others. Among these, the consulting segment dominates the market with the largest market share during the forecast period. Consulting firms provide a range of services to address the needs of strategic consulting as well as regulatory compliance, quality assurance, and remedial difficulties. The growing need for CRO consultants is contributing to driving the market.

- The pharmaceutical segment dominates the UK biotechnology & pharmaceutical services outsourcing market with the largest revenue share in 2023.

Based on the end-use, the U.K. biotechnology & pharmaceutical services outsourcing market is divided into pharmaceutical and biotech. Among these, the pharmaceutical segment dominates the UK biotechnology & pharmaceutical services outsourcing market with the largest revenue share in 2023. The pharmaceutical segment increasingly spends on the R&D sector for the development of large molecules. The growing investments by CROs and the development of potential drug molecules are anticipated to drive market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. biotechnology & pharmaceutical services outsourcing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Parexel International Corporation

- IQVIA

- The Quantic Group

- Lachman Consultant Services, Inc.

- ICON plc.

- Charles River Laboratories

- Concept Heidelberg GmbH

- GMP Pharmaceuticals Pty Ltd.

- Others

- Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2021, Parexel and Veeva Systems announced a strategic collaboration to accelerate clinical trials through technology and process innovation. This collaboration - Parexel as a leading clinical research organization (CRO) and Veeva as the technology innovator powering trials to improve study efficiency and get new therapies to patients faster.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Biotechnology & Pharmaceutical Services Outsourcing Market based on the below-mentioned segments:

UK Biotechnology & Pharmaceutical Services Outsourcing Market, By Service

- Consulting

- Auditing & Assessment

- Regulatory Affairs

- Product Maintenance

- Product Design & Development

- Product Testing & Validation

- Training & Education

- Others

UK Biotechnology & Pharmaceutical Services Outsourcing Market, By End-use

- Pharmaceutical

- Biotech

Need help to buy this report?