United Kingdom Car Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Third-Party Liability Coverage, Collision, Comprehensive, and Others), By Distribution Channel (Insurance Agents & Brokers, Direct Sales, Banks, and Others), and United Kingdom Car Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Car Insurance Market Insights Forecasts to 2033

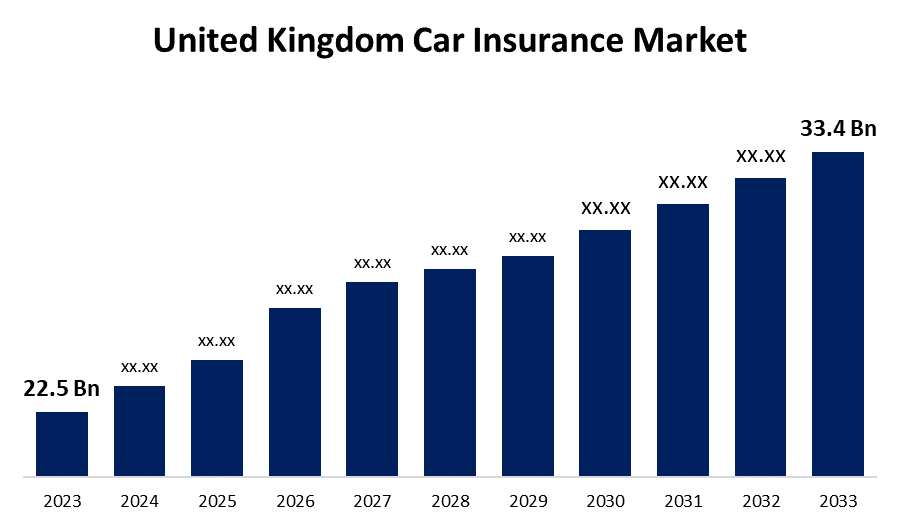

- The United Kingdom Car Insurance Market Size was valued at USD 22.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.03% from 2023 to 2033

- The U.K. Car Insurance Market Size is expected to reach USD 33.4 Billion by 2033

Get more details on this report -

The United Kingdom Car Insurance Market is anticipated to exceed USD 33.4 billion by 2033, growing at a CAGR of 4.03% from 2023 to 2033. The growing vehicle ownership, mandatory auto insurance requirements, and increasing adoption of innovative tracking technologies are driving the growth of the car insurance market in the United Kingdom.

Market Overview

Car Insurance is a kind of insurance that protects against loss or harm to the vehicle, reducing financial loss from collisions that result in damage to the vehicle. It is an agreement whereby the owner of the vehicle agrees to pay a set premium amount over time to the insurance provider to get financial protection if the vehicle is damaged or lost. Its main purpose is to offer financial protection against bodily harm or physical damage sustained in auto accidents, as well as against any responsibility resulting from such situations. It also provides financial security against car theft, damage to the vehicle resulting from non-collision occurrences like weather-related catastrophes or natural disasters, and damage resulting from collisions with stationary objects. The UK vehicle insurance industry is growing due to an increase in accidents, strict government regulations requiring auto insurance, and an upsurge in car sales. Furthermore, the emerging market of electric vehicles is expanding the UK car insurance market.

Report Coverage

This research report categorizes the market for the UK car insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the car insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the car insurance market.

United Kingdom Car Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 22.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.03% |

| 023 – 2033 Value Projection: | USD 33.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage, By Distribution Channel |

| Companies covered:: | AVIVA, ZURICH ASSURANCE LTD, THE PRUDENTIAL ASSURANCE COMPANY LIMITED, AXA INSURANCE UK PLC, DL INSURANCE SERVICES LIMITED, GENERAL REINSURANCE PLC, ALLIANZ INSURANCE, AGEAS INSURANCE LIMITED, ROYAL & SUN ALLIANCE INSURANCE PLC, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

According to the data by the Society of Motor Manufacturers and Traders (SMMT), the number of vehicles rising by 1.7% with a high record in 2023, showing the biggest growth in car ownership. There is a legal and mandatory car insurance requirement by the UK government to provide financial protection if an accident happens. Thus, the increasing vehicle ownership is driving the UK car insurance market. Further, the increasing adoption of innovative tracking technologies is significantly contributing to driving the market.

Restraining Factors

The growing competition of banks with fintech and financial services is restraining the UK car insurance market.

Market Segmentation

The United Kingdom Car Insurance Market share is classified into coverage and distribution channel.

- The third-party liability coverage segment dominates the market with the largest market share during the forecast period.

The United Kingdom car insurance market is segmented by coverage into third-party liability coverage, collision, comprehensive, and others. Among these, the third-party liability coverage segment dominates the market with the largest market share during the forecast period. Liability coverage for third-party involved in accidents caused by the insured vehicle is offered by the car insurance policy. Third-party liability coverage car insurance is less expensive than comprehensive insurance, which appeals to customers on a tight budget. The legal and mandatory car insurance requirements are driving the market demand.

- The direct sales segment accounted for the largest share of the United Kingdom car insurance market during the forecast period.

Based on the distribution channel, the United Kingdom car insurance market is divided into insurance agents & brokers, direct sales, banks, and others. Among these, the direct sales segment accounted for the largest share of the United Kingdom car insurance market during the forecast period. Insurance companies sell policies to customers directly through their channels, which mediate easy communication of clients with the insurance company directly. This promotes brand loyalty and trust. Due to the benefit of cost effectiveness of direct sales for the consumer and the insurance is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK car insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AVIVA

- ZURICH ASSURANCE LTD

- THE PRUDENTIAL ASSURANCE COMPANY LIMITED

- AXA INSURANCE UK PLC

- DL INSURANCE SERVICES LIMITED

- GENERAL REINSURANCE PLC

- ALLIANZ INSURANCE

- AGEAS INSURANCE LIMITED

- ROYAL & SUN ALLIANCE INSURANCE PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, AXA UK&I announced the acquisition of the renewal rights to Ageas UK’s commercial business, for the initial consideration of £47.5 million. This acquisition further strengthens AXA’s growth strategy and commitment to its commercial business customers and broker partnerships, particularly in the SME and Schemes market segments.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Car Insurance Market based on the below-mentioned segments:

United Kingdom Car Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision

- Comprehensive

- Others

United Kingdom Car Insurance Market, By Distribution Channel

- Insurance Agents & Brokers

- Direct Sales

- Banks

- Other

Need help to buy this report?