United Kingdom Cardiovascular Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Diagnostic & Monitoring Devices and Therapeutic & Surgical Devices), By Application (Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, and Others), By End User (Hospitals, Specialty Clinics, and Others), and United Kingdom Cardiovascular Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Cardiovascular Devices Market Insights Forecasts to 2033

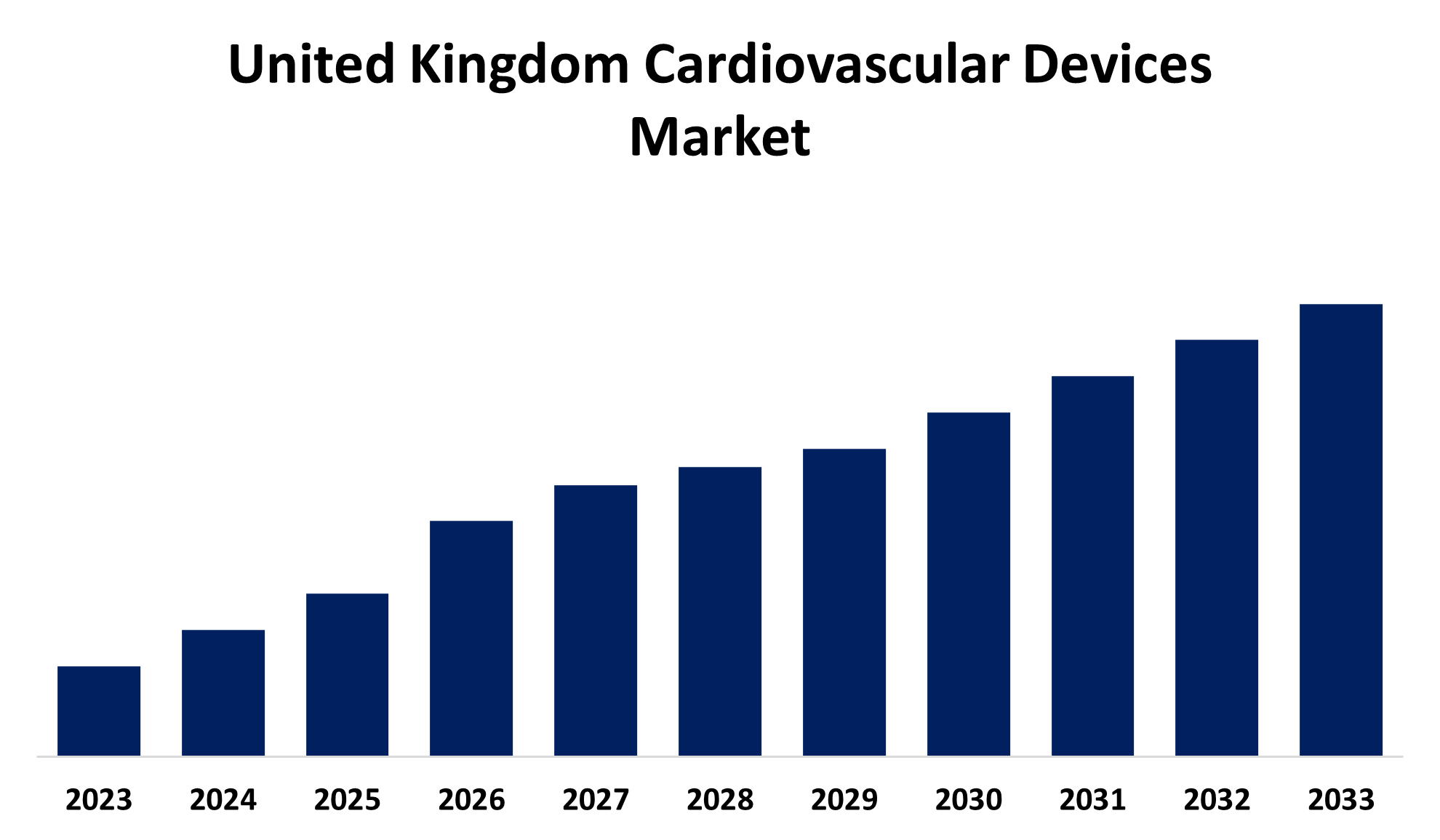

- The U.K. Cardiovascular Devices Market Size is Growing at a CAGR of 7.15% from 2023 to 2033

- The U.K. Cardiovascular Devices Market Size is expected to hold a significant share by 2033

Get more details on this report -

The United Kingdom Cardiovascular Devices Market is anticipated to hold a significant share by 2033, growing at a CAGR of 7.15% from 2023 to 2033. The growing burden of cardiovascular diseases and technological advancement in the devices are driving the growth of the cardiovascular devices market in the UK.

Market Overview

Cardiovascular devices market is the market including medical devices for imaging, monitoring, rhythm management, and surgical procedures. Cardiovascular devices are a category of medical devices used for the diagnosis, treatment, and management of heart and blood vessel conditions. The devices can be implanted in the body or used externally. Pacemakers, implantable cardioverter defibrillator (ICD), biventricular pacemakers, and cardiac loop recorders, are some of the cardiac implantable electronic devices that help to control or monitor irregular heartbeats in people with certain heart rhythm disorders and heart failure. The rapid technical development, an increase in affordable and effective devices, and demand for minimally invasive procedures are propelling the market for cardiovascular devices. The increased incidence of CVDs with the growing old age population in the country as well as the adoption of minimally invasive technologies are offering lucrative market growth opportunities for cardiovascular devices.

Report Coverage

This research report categorizes the market for the UK cardiovascular devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cardiovascular devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK cardiovascular devices market.

United Kingdom Cardiovascular Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.15% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Application, By End User |

| Companies covered:: | Livanova, B. Braun SE, Abbott Laboratories, Boston Scientific Corporation, Biotronik, Cardinal Health, GE Healthcare, Medtronic Plc, Siemens Healthineers AG, W. L. Gore & Associates, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing burden of cardiovascular diseases is driving the market for cardiovascular devices. CVD remains a significant burden in the UK, accounting for at least 1.18 million hospital admissions. The advancements in cardiovascular wearable devices such as photoplethysmography (PPG), radio frequency (RF), and wearables using galvanic contact are propelling the market growth. In addition, the increasing prevalence of risk factors such as diabetes, hypertension, obesity, and sedentary lifestyle are significantly contributing to cardiovascular devices market growth.

Restraining Factors

The adverse effects associated with the use of cardiovascular devices challenge the cardiovascular devices market. Further, the complications with the use of implantable cardiovascular devices are hampering the market growth.

Market Segmentation

The United Kingdom cardiovascular devices market share is classified into device type, application, and end user.

- The therapeutic & surgical devices segment dominates the market with the largest market share and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cardiovascular devices market is segmented by device type into diagnostic & monitoring devices and therapeutic & surgical devices. Among these, the therapeutic & surgical devices segment dominates the market with the largest market share and is expected to grow at a significant CAGR during the projected period. Pacemakers, implantable cardioverter defibrillators (ICDs), heart valves, balloons, catheters, and stents are some of the examples of therapeutic and surgical devices. The increasing number of key market players and surging advancements in devices are driving the market growth.

- The coronary artery disease (CAD) segment held the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom cardiovascular devices market is segmented by application into coronary artery disease (CAD), cardiac arrhythmia, heart failure, and others. Among these, the coronary artery disease (CAD) segment held the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period. Devices like coronary stents help to treat life-threatening cardiac conditions like heart attack, coronary heart diseases, and opening of narrowed arteries. The use of devices such as pacemakers, implantable cardioverter defibrillators (ICDs), and stents for coronary artery disease is driving the market growth.

- The hospitals segment dominated the UK cardiovascular devices in 2023 and is anticipated to grow at a significant CAGR growth through the forecast period.

The United Kingdom cardiovascular devices market is segmented by end user into hospitals, specialty clinics, and others. Among these, the hospitals segment dominated the UK cardiovascular devices in 2023 and is anticipated to grow at a significant CAGR growth through the forecast period. Cardiovascular devices are used in hospitals for diagnosing, monitoring, and treating heart conditions such as arrhythmias, heart failure, and coronary artery disease. The requirement of trained medical professionals to insert critical cardiovascular devices like stents is propelling the market in the hospitals segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cardiovascular devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Livanova

- B. Braun SE

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik

- Cardinal Health

- GE Healthcare

- Medtronic Plc

- Siemens Healthineers AG

- W. L. Gore & Associates, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Novartis Pharmaceuticals UK announced the launch of the Novartis Biome UK Heart Health Catalyst 2022, in a world-first investor partnership with Medtronic ltd, RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity CW+.

- In February 2022, Ceryx Medical launched Cysoni bionic device for respiratory sinus arrhythmia. A collaboration between Ceryx Medical Limited and the scientists at the Auckland Bioengineering Institute (ABI) and the Universities of Bath and Bristol, have developed technology that they claim, could improve the outlook for patients with serious heart conditions.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cardiovascular Devices Market based on the below-mentioned segments:

UK Cardiovascular Devices Market, By Device Type

- Diagnostic & Monitoring Devices

- Therapeutic & Surgical Devices

UK Cardiovascular Devices Market, By Application

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

UK Cardiovascular Devices Market, By End User

- Hospitals

- Specialty Clinics

- Others

Need help to buy this report?