United Kingdom Casein and Caseinates Market Size, Share, and COVID-19 Impact Analysis, By Product (Edible Casein, Industrial Casein, and Caseinates), By End-User (Food & Beverage, Pharmaceutical & Clinical Nutrition, Agriculture/Animal Feed, Infant Nutrition, Sports Nutrition, Personal Care, and Others), and United Kingdom Casein and Caseinates Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Casein and Caseinates Market Insights Forecasts to 2033

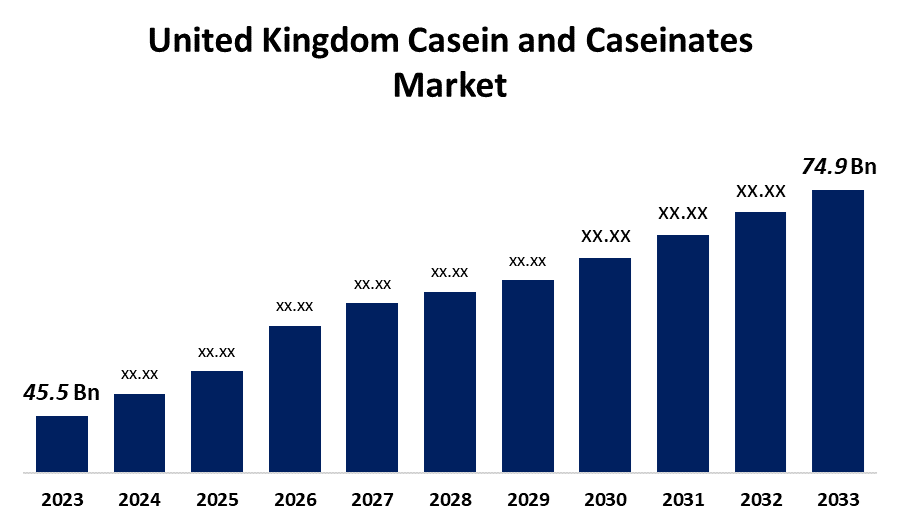

- The U.K. Casein and Caseinates Market Size was valued at USD 45.5 Million in 2023.

- The Market is growing at a CAGR of 5.11% from 2023 to 2033

- The U.K. Casein and Caseinates Market Size is expected to reach USD 74.9 Million by 2033

Get more details on this report -

The United Kingdom Casein and Caseinates Market is anticipated to exceed USD 74.9 Million by 2033, growing at a CAGR of 5.11% from 2023 to 2033. The growing application in protein-rich food products and rising demand for infant formula are driving the growth of the casein and caseinates market in the UK.

Market Overview

Casein and caseinates are products made from milk. Casein is the skim milk precipitation produced by milk acidification while caseinates are water-soluble derivatives of acid caseins. Caseinates are obtained by reaction with alkalis. Casein has high protein and low fat content and thus can be used in dietary supplement products, which are in high demand among professional athletes. The di- and tripeptides present in hydrolyzed casein and caseinates are responsible for protein absorption in the human body. Thus, there is a high demand for casein and caseinates products among professional athletes. Further, a vital component of baby formula is milk protein which offers vital nutrients for a baby's healthy growth and development. Directive 2006/141/EC of the European Union regulates the composition of baby and follow-on formulae sold in the United Kingdom. Dairy protein concentrate is becoming popular in high-protein meal replacements and ready-to-drink protein smoothies. Ingredients for caseinate can be found in baked goods such as puddings, cheesecakes, frostings, and whipped tops. Customers now find it easier to include protein in their regular diets as a result. There are growing uses of casein in the personal care and cosmetics sectors, particularly as conditioning and emulsifying agents for hair and skin, leveraging new market opportunities.

Report Coverage

This research report categorizes the market for the UK casein and caseinates market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom casein and caseinates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK casein and caseinates market.

United Kingdom Casein and Caseinates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 45.5 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.11% |

| 2033 Value Projection: | USD 74.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Arla Foods amba, Lactoprot Deutscland GmbH, Royal FrieslandCampina N.V., LAITA, Prinova Group LLC, Erie Foods International, Inc., and others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The accessibility of casein protein and the growing demand for foods high in protein because of consumers’ health consciousness is driving up the UK casein and caseinates market. Further, the increased demand for casein and caseinate products among professional athletes is driving market growth in the region. In 2022, about 353,000 adults in England played cricket each month, according to Sport England. Due to increasing urbanization and changing lifestyles, there is surging demand for infant formula among the number of working mothers as it is convenient and reliable to feed their infants. The approved use of hydrolyzed milk protein in baby formulae is anticipated to drive market expansion. For example, a recent update on the European Union rule in February 2022 said that all protein hydrolyzates used in babies and follow-on formulae within the EU will require evaluation.

Restraining Factors

The growing market penetration of milk protein alternatives is restraining the market for casein and caseinates in United Kingdom.

Market Segmentation

The United Kingdom Casein and Caseinates Market share are classified into product and end-user.

- The edible casein segment dominated the market with the largest market share in 2023.

Based on the product, the U.K. casein and caseinates market is divided into edible casein, industrial casein, and caseinates. Among these, the edible casein segment dominated the market with the largest market share in 2023. As this product has a low fat and cholesterol level, it is utilized in processed cheese, baby formula, and coffee whiteners. Byproducts for medicine and nutrition are common uses for edible casein. Casein and caseinates product capability to deliver consistent, highly customizable nourishment to athletes and foster market growth.

- The food & beverage segment dominates the market with the largest market share during the forecast period.

The United Kingdom casein and caseinates market is segmented by end-user into food & beverage, pharmaceutical & clinical nutrition, agriculture/animal feed, infant nutrition, sports nutrition, personal care, and others. Among these, the food & beverage segment dominates the market with the largest market share during the forecast period. The growing health concerns as well as the availability of casein and caseinates containing foods and drinks are driving the market. Due to nutritional value, manufacturers are preferably incorporating casein and caseinates as additives for packaged and ready-to-eat food.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. casein and caseinates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods amba

- Lactoprot Deutscland GmbH

- Royal FrieslandCampina N.V.

- LAITA

- Prinova Group LLC

- Erie Foods International, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2021, Arla Foods Ingredients (AFI) is targeting infant formula, sports nutrition, and medical nutrition with its new patented milk fractionation technology that separates milk proteins from whey, bypassing the need to make cheese.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Casein and Caseinates Market based on the below-mentioned segments:

UK Casein and Caseinates Market, By Product

- Edible Casein

- Industrial Casein

- Caseinates

UK Casein and Caseinates Market, By End-User

- Food & Beverage

- Pharmaceutical & Clinical Nutrition

- Agriculture/Animal Feed

- Infant Nutrition

- Sports Nutrition

- Personal Care

- Others

Need help to buy this report?