United Kingdom Cattle Feed Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Corn, Soybean Meal, Wheat, Oilseeds, Additives, and Others), By Distribution Channel (Offline and Online), and United Kingdom Cattle Feed Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited Kingdom Cattle Feed Market Insights Forecasts to 2033

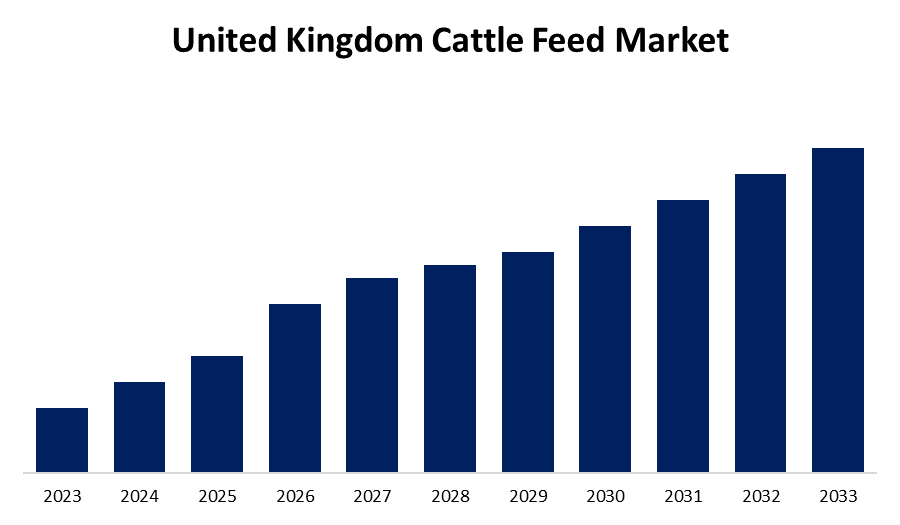

- The Market Size is Growing at a CAGR of 2.31% from 2023 to 2033

- The UK Cattle Feed Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Cattle Feed Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 2.31% from 2023 to 2033.

Market Overview

The food provided to cows and other bovine animals to suit their nutritional demands is known as cattle feed. In order to supply vital nutrients including carbs, protein, lipids, vitamins, minerals, phosphorus, magnesium, omega-3, fibers, and other nutrients, it can include a variety of molasses, mixers, cereals, feed crops, oil seeds, protein cakes, and agro-industrial by-products. It helps keep the body in optimal shape, avoid muscle problems like azoturia and laminitis, and shield pellets from insect or mold infestations. Additionally, it maintains a nutritious diet, increases milk production with a higher fat content, and promotes reproductive efficiency. Additionally, meat consumption is growing at one of the fastest rates in the United Kingdom due to changing dietary habits, urbanization, population growth, and economic expansion. The health advantages of eating protein have come to the attention of the general public in recent years. The growing demand for a variety of animal products is propelling the UK's cattle feed market.

Report Coverage

This research report categorizes the market for the UK cattle feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cattle feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. cattle feed market.

United Kingdom Cattle Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.31% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Ingredient, By Distribution |

| Companies covered:: | Cargill Inc., Archer Daniels Midland Company (ADM), ForFarmers Inc., Land O’Lakes, Inc., De Heus, Biomin, New Hope Lihue Wen’s Food Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The public's understanding of the health advantages of eating protein has grown in recent years. A shift toward consuming more meat and dairy products was one of the many dietary and consumption patterns that arose from this. Customers are increasingly focused on nutrient-dense items made from calves given enriched feed because they are more worried about their health. The market for ruminant feed in this area is expanding as a result of the growing demand for different animal products. Additionally, the UK exports the majority of the beef consumed in the EU. The UK's national farmers organization claims that 82% of the country's beef exports go to the EU. 30% of the lamb produced in the UK is exported, with the majority going to the EU. Additionally, in the United Kingdom, there were over 9.42 million cattle and calves in 2022. Due to the growing number of cattle in the UK, there is a significant demand for cattle feed for animal consumption, which fuels the market's expansion.

Additionally, in the UK, beef consumption has increased by 9% in the past ten years due to population growth. The requirement for wholesome cow feed has increased due to the rising demand for premium beef and dairy products, which has helped the UK cattle feed market.

Restraining Factors

Unsafe and contaminated feed materials weaken farm animals' immunity, which reduces farmers' production. Livestock farmers have started investing in premium feed premixes as disease outbreaks have become increasingly frequent. Quality control and product safety are highly valued by consumers.

Market Segmentation

The UK cattle feed market share is classified into ingredient and distribution channel.

- The corn segment is expected to hold the greatest market share through the forecast period.

The U.K. cattle feed market is segmented by ingredient into corn, soybean meal, wheat, oilseeds, additives, and others. Among these, the corn segment is expected to hold the greatest market share through the forecast period. Corn's significant amount of carbohydrates makes it a major source of energy in cattle feed. It supplies the calories required for growth, everyday tasks, and milk production. It is frequently provided in its entirety as grain, smashed corn, or cornmeal and usually easy to metabolize.

- The offline segment is anticipated to hold a significant share of the United Kingdom cattle feed market during the forecast period.

Based on the distribution channel, the UK cattle feed market is divided into offline and online. Among these, the offline segment is anticipated to hold a significant share of the United Kingdom cattle feed market during the forecast period. Many people still primarily use offline methods, especially in rural areas where internet penetration is lower. Farmers can physically inspect items, get professional advice, and make quick purchases at these local feed stores, cooperatives, and agricultural supply businesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cattle feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- Archer Daniels Midland Company (ADM)

- ForFarmers Inc.

- Land O'Lakes, Inc.

- De Heus

- Biomin

- New Hope Lihue Wen's Food Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, the decision to form a joint venture between 2Agriculture and ForFarmers United Kingdom (ForFarmers UK) was made in an effort to expand their customer base.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cattle Feed Market based on the below-mentioned segments:

United Kingdom Cattle Feed Market, By Ingredient

- Corn

- Soybean Meal

- Wheat

- Oilseeds

- Additives

- Others

United Kingdom Cattle Feed Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?