United Kingdom Ceramic Tiles Market Size, Share, and COVID-19 Impact Analysis, By Type (Glazed Ceramic Tiles, Porcelain Tiles, Scratch-Free Ceramic Tiles, and Others), By Application (Wall Tiles and Floor Tiles), and United Kingdom Ceramic Tiles Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Ceramic Tiles Market Insights Forecasts to 2033

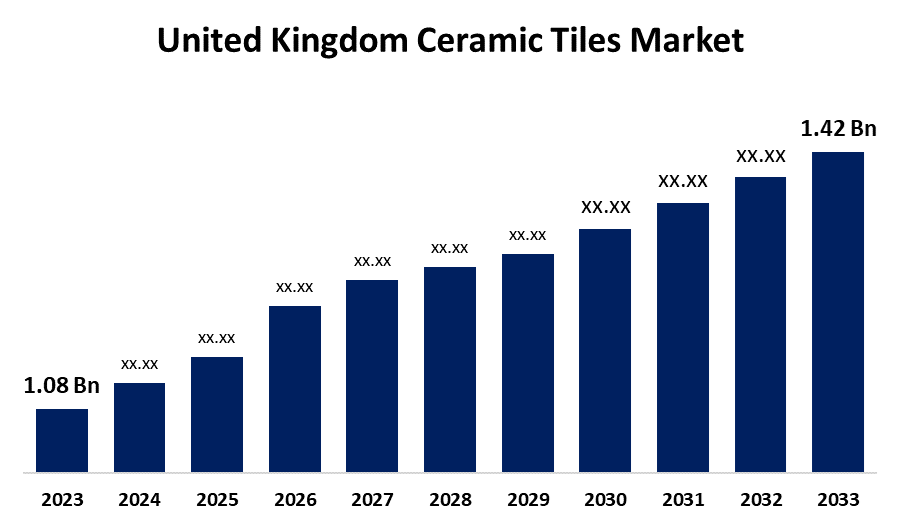

- The U.K. Ceramic Tiles Market Size was valued at USD 1.08 Billion in 2023.

- The Market is growing at a CAGR of 2.77% from 2023 to 2033

- The U.K. Ceramic Tiles Market Size is expected to reach USD 1.42 Billion by 2033

Get more details on this report -

The United Kingdom Ceramic Tiles Market is anticipated to exceed USD 1.42 Billion by 2033, growing at a CAGR of 2.77% from 2023 to 2033. The growing urbanization, increasing population density, rise in construction activities, and increasing investment in residential projects are driving the growth of the ceramic tiles market in the UK.

Market Overview

Ceramic tiles are produced using basic elements including clay, sand, feldspar, and talc. These are versatile and decorative tiles popularly used for flooring and wall covering. To remove moisture and create a hard, durable surface, they are moulded and burned in a kiln. Since the majority of the materials used to make ceramic tiles are naturally occurring, the method of making them is environmentally benign. Through a variety of processes, such as spray-dying clay, pressing, and fire of tiles, ceramic tiles can be produced in a wide range of designs, textures, colours, forms, and sizes. Consumers in the region are anticipating a more modern touch to ceramic tiles because of the increased modernisation and urbanisation, which can be achieved by frying, spray drying, etc. There is an increased demand for ceramic tiles in the construction of several structures which is attributed to their superior dependability, sustainability, and aesthetic appeal.

Report Coverage

This research report categorizes the market for the UK ceramic tiles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom ceramic tiles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK ceramic tiles market.

United Kingdom Ceramic Tiles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.77% |

| 2033 Value Projection: | USD 1.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Johnson Tiles, Ceramica Impex Ltd, Porcelanosa Group, Saint-Gobain, Saloni Ceramic SA, Ecotile Flooring Ltd, Original Style Ltd, H&E Smith Ltd, Unique Tiles, Dune Ceramica, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The availability of ceramic tiles in many designs is the primary reason for their preference in construction and building operations in the United Kingdom. The increasing growth in population density and residential project investment in urbanized areas are responsible for driving the ceramic tiles market. The increase in remodelling and renovation activities brought on by fast industrialisation and urbanisation is anticipated to drive the market. Further, the rising investments in the building sector and industrialization lead to increasing construction activity resulting in propelling the market growth.

Restraining Factors

The fluctuation in raw material prices due to constraints in the supply chain may result in increased production costs which is responsible for hampering the market for ceramic tiles. Further, the increased natural gas prices negatively affect the market as it constitutes 30-40% price of ceramic tiles manufacturing.

Market Segmentation

The United Kingdom Ceramic Tiles Market share is classified into type and application.

- The porcelain tiles segment holds the largest market share during the forecast period.

The United Kingdom ceramic tiles market is segmented by product type into glazed ceramic tiles, porcelain tiles, scratch-free ceramic tiles, and others. Among these, the porcelain tiles segment holds the largest market share during the forecast period. Porcelain tiles can provide a multitude of design possibilities, such as accurate duplication of natural stone and wood textures. Additionally, they offer adaptability in design and installation due to their range of sizes, shapes, and finishes. The advancement in manufacturing techniques for large-format porcelain tiles drives market growth.

- The floor tiles segment dominated the US ceramic tiles market with the largest market share in 2023.

The United Kingdom ceramic tiles market is segmented by application into wall tiles and floor tiles. Among these, the floor tiles segment dominated the US ceramic tiles market with the largest market share in 2023. Ceramic floor tiles are perfect for high-traffic areas because of their strength and resilience, guaranteeing endurance and wear and tear resistance. Further, a multitude of design alternatives are provided by floor tiles along with the availability of a wide range of sizes, forms, colours, and patterns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. ceramic tiles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson Tiles

- Ceramica Impex Ltd

- Porcelanosa Group

- Saint-Gobain

- Saloni Ceramic SA

- Ecotile Flooring Ltd

- Original Style Ltd

- H&E Smith Ltd

- Unique Tiles

- Dune Ceramica

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Norcros plc ("Norcros" or the "Group"), a market-leading designer and supplier of high quality bathroom and kitchen products in UK, announced that a strategic review, it has entered into an agreement to sell Johnson Tiles UK to its existing management team.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Ceramic Tiles Market based on the below-mentioned segments:

UK Ceramic Tiles Market, By Type

- Glazed Ceramic Tiles

- Porcelain Tiles

- Scratch-Free Ceramic Tiles

- Others

UK Ceramic Tiles Market, By Application

- Wall Tiles

- Floor Tiles

Need help to buy this report?