United Kingdom Chemical Logistics Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transportation (Roadways, Railways, Airways, Waterways, and Pipelines), By Service (Transportation & Distribution, Storage & Warehousing, Customs & Security, Green Logistics, Consulting & Management Services, and Others), By End-Use (Chemical Industry, Pharmaceutical Industry, Cosmetic Industry, Oil & Gas Industry, Specialty Chemicals Industry, Food, and Others), and United Kingdom Chemical Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited Kingdom Chemical Logistics Market Insights Forecasts to 2033

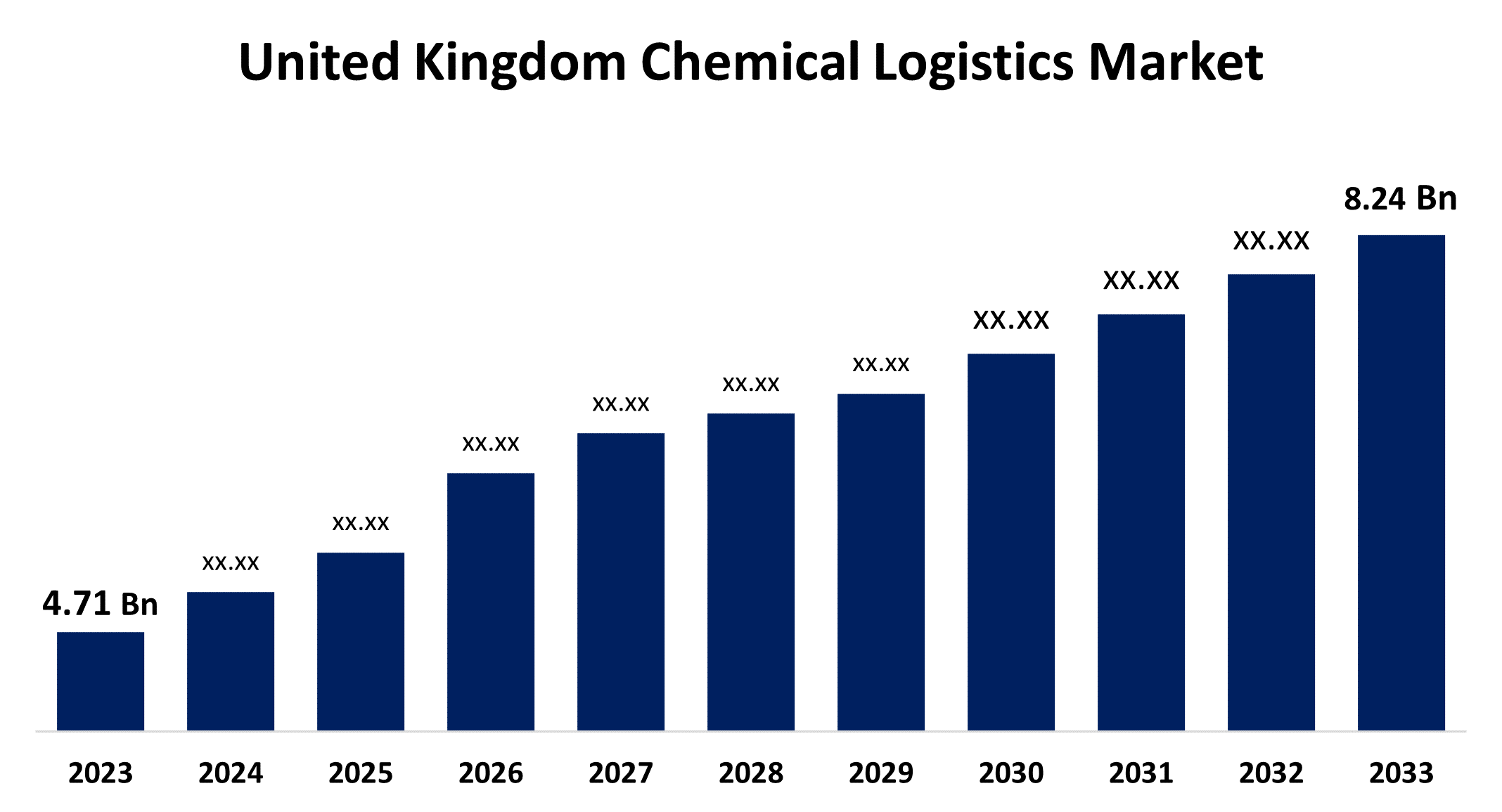

- The U.K. Chemical Logistics Market Size was valued at USD 4.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.75% from 2023 to 2033

- The U.K. Chemical Logistics Market Size is Expected to reach USD 8.24 Billion by 2033

Get more details on this report -

The United Kingdom Chemical Logistics Market is anticipated to exceed USD 8.24 Billion by 2033, growing at a CAGR of 5.75% from 2023 to 2033. The growing adherence to stringent regulations for chemicals and globalization of the supply chain are driving the growth of the chemical logistics market in the UK.

Market Overview

Chemical logistics is the process of organization and management of the supply of chemicals and related materials from suppliers to manufacturers and consumers. It comprises transportation, storage, and distribution services of chemicals. In the UK, chemical logistics operations must adhere to stringent legal regulations. The value of fertilizer imports into the United Kingdom has been growing, a sign of the nation's chemical consumption, ultimately surging the demand for logistics. For instance, in 2022, fertilizer imports into the United Kingdom totaled USD 2.62 billion, according to Statista. Further, there is an increasing adoption of green logistics that involves sustainable practices, optimizing transportation routes, and using eco-friendly packaging materials to reduce the carbon footprint. The emphasis on a sustainable supply chain that involves the implementation of green warehouses and energy-efficient transportation modes is enhancing the market opportunity for chemical logistics.

Report Coverage

This research report categorizes the market for the UK chemical logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom chemical logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK chemical logistics market.

United Kingdom Chemical Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.71 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.75% |

| 2033 Value Projection: | USD 8.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mode of Transportation, By Service, By End-Use |

| Companies covered:: | DHL, Rhenus Logistics, CEVA Logistics, DACHSER, Den Hartogh, C.H. Robinson, Suttons Group, BDP International, Streamline Shipping, Hoyer Group, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The distribution of chemicals is subject to a strict regulatory system in the United Kingdom, mainly managed by the Chemicals Regulation Division (CRD) and Health & Safety Executive (HSE). The increasing adherence to stringent regulations in order to protect the environment and public health from any potential risks related to chemicals is driving the market demand for chemical logistics. European Union (EU) which is the international supply chain market comprises 70% of the UK’s chemical imports (and the destination for 60% of the UK’s chemical exports). The globalization of the supply chain is responsible for driving the market growth for chemical logistics.

Restraining Factors

Transportation and management of chemicals are associated with carbon emissions and potential environmental hazards. These environmental concerns are challenging the market for chemical logistics.

Market Segmentation

The United Kingdom Chemical Logistics Market share is classified into mode of transportation, service, and end-use.

- he roadways segment dominates the UK chemical logistics market with the largest market share during the forecast period.

The United Kingdom chemical logistics market is segmented by mode of transportation into roadways, railways, airways, waterways, and pipelines. Among these, the roadways segment dominates the UK chemical logistics market with the largest market share during the forecast period. Roadways are the most common and economical way of transporting chemicals. The tried-and-true HAZMAT trucking approach is more cost-effective and enables carriers to move chemicals on a highly efficient timetable. Further, the safe transportation of cargo with tight deadlines without having concerns about the scheduling of ports, stations, and airports is driving the market demand.

- The transportation & distribution segment dominates the market with the largest market share during the forecast period.

The United Kingdom chemical logistics market is segmented by service into transportation & distribution, storage & warehousing, customs & security, green logistics, consulting & management services, and others. Among these, the transportation & distribution segment dominates the market with the largest market share during the forecast period. Transportation & distribution service involves moving chemical products across national borders by various modes of transportation. The expansion of distribution hubs by the chemical industries through collaborative efforts for faster access to the products is anticipated to drive the market. Further, the utilization of green hydrogen in the transportation sector is driving the market.

- The chemical industry segment dominates the UK chemical logistics market during the forecast period.

Based on the end-use, the U.K. chemical logistics market is divided into chemical industry, pharmaceutical industry, cosmetic industry, oil & gas industry, specialty chemicals industry, food, and others. Among these, the chemical industry segment dominates the UK chemical logistics market during the forecast period. The chemical industry makes use of a network of raw material suppliers to obtain ingredients for its products which surges the demand for logistics for transporting chemicals with essential statutory regulations for product transportation and storage. The increasing emphasis on local chemical manufacturing by businesses and rising demand for raw chemicals are driving the market demand in the chemical industry segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. chemical logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DHL

- Rhenus Logistics

- CEVA Logistics

- DACHSER

- Den Hartogh

- C.H. Robinson

- Suttons Group

- BDP International

- Streamline Shipping

- Hoyer Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Brenntag acquired Solventis Group. The acquisition is intended to improve Brenntag Essentials’ sustainability profile in the future, as procurement would increasingly be carried out via ships and barges. In addition, delivery options via rail transport would be expanded.

- In November 2023, LyondellBasell, a global leader in the chemical industry, announced the establishment of a new distribution hub in the United Kingdom for its Polyolefins grades.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Chemical Logistics Market based on the below-mentioned segments:

UK Chemical Logistics Market, By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

UK Chemical Logistics Market, By Service

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

UK Chemical Logistics Market, By End-Use

- Chemical Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food

- Others

Need help to buy this report?