United Kingdom Co-Working Office Spaces Market Size, Share, and COVID-19 Impact Analysis, By Type (Corporate & Professional and Open & Conventional), By Application (SMEs and Large Size Enterprise), and By UK Co-Working Office Spaces Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingU.K. Co-Working Office Spaces Market Insights Forecasts to 2033

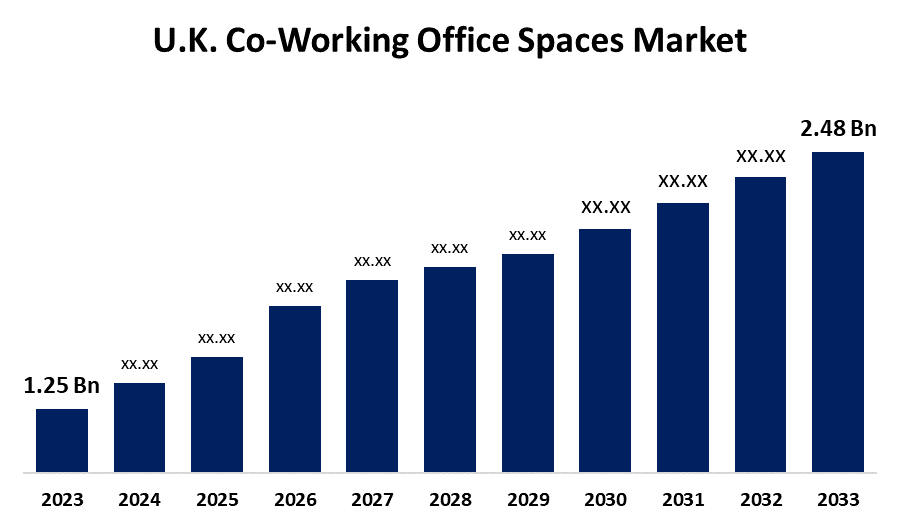

- The UK Co-Working Office Spaces Market Size was valued at USD 1.25 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.09% from 2023 to 2033

- The U.K. Co-Working Office Spaces Market Size is Expected to reach USD 2.48 Billion by 2033

Get more details on this report -

The UK Co-Working Office Spaces Market Size is anticipated to exceed USD 2.48 Billion by 2033, Growing at a CAGR of 7.09% from 2023 to 2033.

Market Overview

Co-working office space refers to a shared work environment where individuals and organizations can rent desks, private offices or meeting rooms on a flexible basis. These spaces are typically managed by cooperative operators that provide various amenities such as high-speed internet, communal areas, conference facilities and networking events. The core concept behind the collaboration is to create a vibrant and inclusive ecosystem that promotes collaboration, innovation and work-life balance. Businesses in the UK will also look for smaller, more flexible leases and co-working spaces like WeWork. Coworking spaces offer a flexible and adaptable solution to meet the evolving needs of companies. Such co-working spaces offer startups and small businesses the flexibility to choose lease terms and space to suit their needs, helping them avoid the upfront costs of traditional offices. The shared setting encourages professionals from different backgrounds to connect and work together, leading to new ideas and creative solutions. With contemporary amenities and convenient locations, coworking spaces provide an affordable, flexible and convenient option for businesses looking for a central location without having to commit to long rental contracts. The field has expanded greatly as companies have recognized the benefits of this approach, welcoming opportunities to work together and utilizing the common resources provided by colleagues.

Report Coverage

This research report categorizes the market for the UK co-working office spaces market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.K. co-working office spaces market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK co-working office spaces market.

United Kingdom Co-Working Office Spaces Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.09% |

| 2033 Value Projection: | USD 2.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Regus Group, Spaces, Servcorp Limited, NeueHouse LLC, The Office Group (TOG), Work Well Offices, Labs, The Brew, Huckle Tree, Jactin House, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The primary drivers of the growth of the co-working space industry are the rise in remote workers and the creation of environmentally-friendly co-working areas. Numerous businesses and professionals seek options to traditional work environments, with co-working spaces providing a versatile remedy. Furthermore, the rise in startups and freelancers is seen as a key element in driving growth in the co-working industry. CBRE, a leading company in commercial real estate services, has capitalized on this trend by introducing Hana. Hana team initiative provides customized private office suites for big corporate tenants at Hana. These flexible spaces offer up-to-date amenities, advanced technology, and personalized layouts, allowing companies to retain their branding and culture while embracing the versatile nature of coworking spaces. Additionally, the coworking industry in the United Kingdom is advancing due to ongoing changes such as the rise of niche businesses and the increase in rural coworking locations.

Restraining Factors

Nevertheless, market growth is anticipated to be hindered by restricted space and limited availability of equipment. The constrained area in coworking spaces poses challenges for needs like privacy, creativity, innovative ideas, and one-on-one conversations.

Market Segmentation

The United Kingdom co-working office spaces market share is classified into type and application.

- The corporate & professional segment is expected to hold the largest market share through the forecast period.

The U.K. co-working office spaces market is segmented by type into corporate & professional and open & conventional. Among these, the corporate & professional segment is expected to hold the largest market share through the forecast period. Companies and professional environments provide exclusive workstations, personal offices, conference rooms, high-quality furnishings, state-of-the-art technology, and additional services for professionals and established firms that desire a formal work setting. These kinds of environments provide a structured setting for companies requiring privacy and confidentiality, ideal for specific needs of legal firms or financial consultants that require a focus-driven atmosphere.

- The large size enterprise segment dominates the market with the largest market share over the predicted period.

The United Kingdom co-working office spaces market is segmented by application into SMEs and large size enterprise. Among these, the large size enterprise segment dominates the market with the largest market share over the predicted period. Many big companies are opting for coworking spaces due to their cost-effectiveness and various benefits. These locations provide an opportunity to reduce fixed costs and avoid extended commitments. Major companies utilize coworking spaces' flexibility and scalability rather than investing in their own dedicated office spaces. Businesses are choosing decentralized workplace plans to make commuting easier for employees, rather than having one large central headquarters. Individuals are able to select workplace choices that can easily adjust to changing business requirements, enabling them to swiftly respond to shifts in market conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom co-working office spaces market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Regus Group

- Spaces

- Servcorp Limited

- NeueHouse LLC

- The Office Group (TOG)

- Work Well Offices

- Labs

- The Brew

- Huckle Tree

- Jactin House

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In May 2023, Amazon acquired WeWork Cos.' 70,000 sq. ft office space in London. The technology company will acquire WeWork's renovated more place office building, expected to accommodate approximately 1,000 staff members.

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Co-Working Office Spaces Market based on the below-mentioned segments:

United Kingdom Co-Working Office Spaces Market, By Type

- Corporate & Professional

- Open & Conventional

United Kingdom Co-Working Office Spaces Market, By Application

- SMEs

- Large Size Enterprise

Need help to buy this report?