United Kingdom Cocoa Powder Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Natural Cocoa Powder, Dutch-Processed Cocoa Powder, Blended Cocoa Powder, Cocoa Rouge), By End-Use Industry (Food and Beverage, Cosmetics and Personal Care, Pharmaceutical, Nutraceuticals, Others), and United Kingdom Cocoa Powder Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Cocoa Powder Market Insights Forecasts to 2033

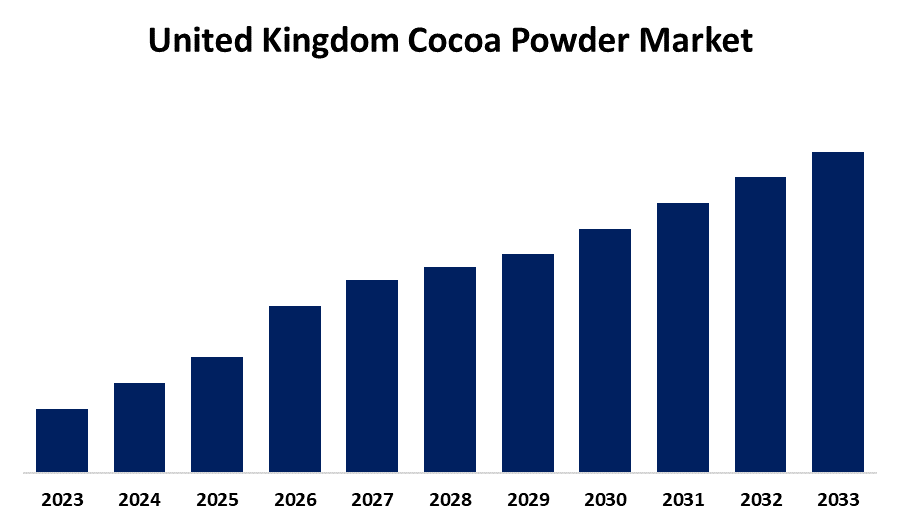

- The Market is Growing at a CAGR of 2.48% from 2023 to 2033

- The UK Cocoa Powder Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Cocoa Powder Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 2.48% from 2023 to 2033.

Market Overview

Cocoa powder is produced when the fat, known as cocoa butter, is eliminated from cacao beans during grinding. The remaining dried particles are processed into a product known as cocoa powder. Flavonoids are secondary metabolites found in plants and fungi that are present in high concentrations in cocoa powder. They are speculated to have positive impacts on human health. Because of the various physiological consequences that cocoa powder has, including its antioxidant and anti-inflammatory qualities as well as its ability to boost endothelial cell processes, which in turn enhance cardiovascular functions, there are many health benefits associated with it. Additionally, the UK's rising cocoa demand is partly due to the introduction of new cocoa-based goods including lower-sugar chocolates and beverages with cocoa extract. The market for products containing cocoa is expanding in the UK as a result of these advancements, as customers look for more varied and healthier options.

Report Coverage

This research report categorizes the market for the UK cocoa powder market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cocoa powder market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. cocoa powder market.

United Kingdom Cocoa Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.48% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type, By End-Use Industry and COVID-19 Impact Analysis. |

| Companies covered:: | Cocoa Processing Company Ltd, Divine Chocolate, Montezuma’s Chocolate, Hotel Chocolat, Green & Black’s, The Grenada Chocolate Company, Willie’s Cacao, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The confectionery and food product industry in the UK is renowned for its creative approach, which includes creating novel ingredients and formulations based on chocolate. In the UK, new products like chocolates with less sugar, drinks with cocoa, and health-conscious items are becoming more and more popular. As producers look for a variety of premium kinds to suit changing customer tastes and dietary trends, this ongoing product development opens up new markets for cocoa beans in the UK. Additionally, the UK is the country in Europe with the fourth-highest chocolate consumption and the seventh-highest globally. The annual average consumption per person is approximately 8.1 kilogram. About 56% of British citizens, eat chocolate more than once a week. Due to customer desire for a wider range of chocolate-based products, the UK's cocoa powder market is expanding as a result of rising chocolate product consumption.

Restraining Factors

Supply chain interruptions are a major impediment to the growth of the cocoa powder market in the United Kingdom.

Market Segmentation

The UK cocoa powder market share is classified into product type and end-use industry

- The natural cocoa powder segment is expected to hold the greatest market share through the forecast period.

The U.K. cocoa powder market is segmented by product type into natural cocoa powder, dutch-processed cocoa powder, blended cocoa powder, and cocoa rouge. Among these, the natural cocoa powder segment is expected to hold the greatest market share through the forecast period. A number of related elements that represent customers' broader goals for sustainability, health, and culinary flexibility show the need for natural cocoa powder. It is becoming more and more well-liked among health-conscious shoppers searching for organic and less processed food options.

- The food and beverage segment is anticipated to hold a significant share of the United Kingdom cocoa powder market during the forecast period.

Based on the end-use industry, the UK cocoa powder market is divided into food and beverage, cosmetics and personal care, pharmaceutical, nutraceuticals, and others. Among these, the food and beverage segment is anticipated to hold a significant share of the United Kingdom cocoa powder market during the forecast period. Due to its broad range of applications and versatility, cocoa powder is essential to the food and beverage sector. It adds a rich, chocolatey flavour and is an essential component of cakes, cookies, brownies, and many other baked products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cocoa powder market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cocoa Processing Company Ltd

- Divine Chocolate

- Montezuma's Chocolate

- Hotel Chocolat

- Green & Black's

- The Grenada Chocolate Company

- Willie's Cacao

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Divine Chocolate, a luxury confectionery brand with an ethical foundation, recently selected RH Amar as its authorized UK distributor for the retailing and restaurant markets.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cocoa Powder Market based on the below-mentioned segments:

United Kingdom Cocoa Powder Market, By Product Type

- Natural Cocoa Powder

- Dutch-Processed Cocoa Powder

- Blended Cocoa Powder

- Cocoa Rouge

United Kingdom Cocoa Powder Market, By End-Use Industry

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceutical

- Nutraceuticals

- Others

Need help to buy this report?