United Kingdom Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerated Warehouses and Refrigerated Transportation), By Application (Fruits & Vegetables, Fish, Meat, & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, Processed Food, Pharmaceuticals, and Others), and United Kingdom Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Cold Chain Logistics Market Insights Forecasts to 2033

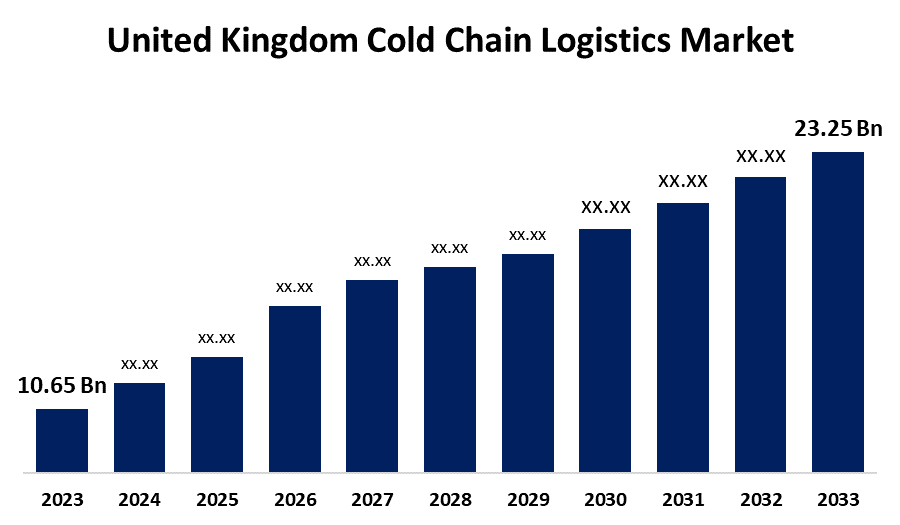

- The U.K. Cold Chain Logistics Market Size was valued at USD 10.65 Billion in 2023.

- The U.K. Cold Chain Logistics Market Size is Growing at a CAGR of 8.12% from 2023 to 2033

- The U.K. Cold Chain Logistics Market Size is Expected to reach USD 23.25 Billion by 2033

Get more details on this report -

The United Kingdom Cold Chain Logistics Market Size is anticipated to Exceed USD 23.25 Billion by 2033, Growing at a CAGR of 8.12% from 2023 to 2033. The growing number of refrigerated warehouses and the development of the pharmaceutical sector are driving the growth of the cold chain logistics market in the UK.

Market Overview

Cold chain logistics market refers to the industry encompassing transportation and storage of temperature-sensitive products, such as food and pharmaceuticals, under controlled conditions to maintain quality and integrity. Cold chain logistics ensures that the products are maintained at the desired temperature throughout the supply chain, extending shelf life and enhancing public safety. The upsurging need for fresh and frozen products, as well as advancements in refrigeration technology and the expansion of pharmaceutical and healthcare sectors, are driving the market expansion of cold chain logistics. The upsurging trend of online buying of perishable products is driving the need for the cold chain for maintaining quality and shelf life. The emergence of intermodal transport as a pivotal solution is escalating the market growth opportunities.

Report Coverage

This research report categorizes the market for the UK cold chain logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK cold chain logistics market.

United Kingdom Cold Chain Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 10.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.12% |

| 2033 Value Projection: | USD 23.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Lineage Logistics, Culina Group, Reed Boardall, Gist Ltd, Gro-continental Ltd (Americold), NewCold, McCulla Refrigerated Transport, FreshLinc Group, Turners (Soham) Ltd, ACS&T Logistics, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The adoption of refrigerated warehouses with transparent and continuous monitoring of stored goods and processes is propelling the market growth of cold chain logistics. The growing need for temperature-sensitive products, including biologics, vaccines, and certain drug formulations, is propelling the market demand. The expansion of e-commerce and online grocery retailing are also responsible for driving market demand for cold chain logistics. The country’s strict food safety regulations, surging the need for adopting advanced refrigeration technologies with real-time monitoring systems are propelling the market.

Restraining Factors

The increased operation cost of cold chain logistics infrastructure is challenging the market. Further, the lack of standardization, which results in compromised product integrity, may hamper the market demand.

Market Segmentation

The United Kingdom Cold Chain Logistics Market share is classified into type and application.

- The refrigerated warehouses segment dominated the market with the largest market share and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cold chain logistics market is segmented by type into refrigerated warehouses and refrigerated transportation. Among these, the refrigerated warehouses segment dominated the market with the largest market share and is expected to grow at a significant CAGR during the projected period. Refrigerated warehouses store perishable goods, including food and pharmaceutical products, in temperature-controlled facilities, ensuring the safety and quality of stored products. The inclination towards packaged food products with the changing consumer lifestyles and dietary patterns contributing to drive the market.

- The dairy & frozen desserts segment dominates the market with a major market share and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom cold chain logistics market is segmented by application into fruits & vegetables, fish, meat, & seafood, dairy & frozen desserts, bakery & confectionery, processed food, pharmaceuticals, and others. Among these, the dairy & frozen desserts segment dominates the market with a major market share and is anticipated to grow at a significant CAGR during the projected period. It was estimated that the average daily consumption of animal protein per person is 39.6 g, with 25.9 g coming from meat and meat products and 9.9 g from milk and milk products. The growing demand for animal-sourced protein products, including cheese, milk, and meat, is propelling the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lineage Logistics

- Culina Group

- Reed Boardall

- Gist Ltd

- Gro-continental Ltd (Americold)

- NewCold

- McCulla Refrigerated Transport

- FreshLinc Group

- Turners (Soham) Ltd

- ACS&T Logistics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Sunswap, a UK-based clean-tech startup dedicated to revolutionizing cold chain logistics, successfully raised over €20 million in a funding round led by BGF. This significant investment would accelerate the deployment of Sunswap’s zero-emission transport refrigeration technology across the UK and Europe, marking a major step forward in the decarbonisation of the logistics industry.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cold Chain Logistics Market based on the below-mentioned segments:

UK Cold Chain Logistics Market, By Type

- Refrigerated Warehouses

- Refrigerated Transportation

UK Cold Chain Logistics Market, By Application

- Fruits & Vegetables

- Fish, Meat, & Seafood

- Dairy & Frozen Desserts

- Bakery & Confectionery

- Processed Food

- Pharmaceuticals

- Others

Need help to buy this report?