United Kingdom Colocation Market Size, Share, and COVID-19 Impact Analysis, By Type (Retail, and Wholesale), By Enterprise Size (Small, Medium, and Large), By Industry Vertical (BFSI, Communication Technology, Education, Healthcare, Media & Entertainment, Retail & E-commerce, and Others), and United Kingdom Colocation Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyUnited Kingdom Colocation Market Insights Forecasts to 2033

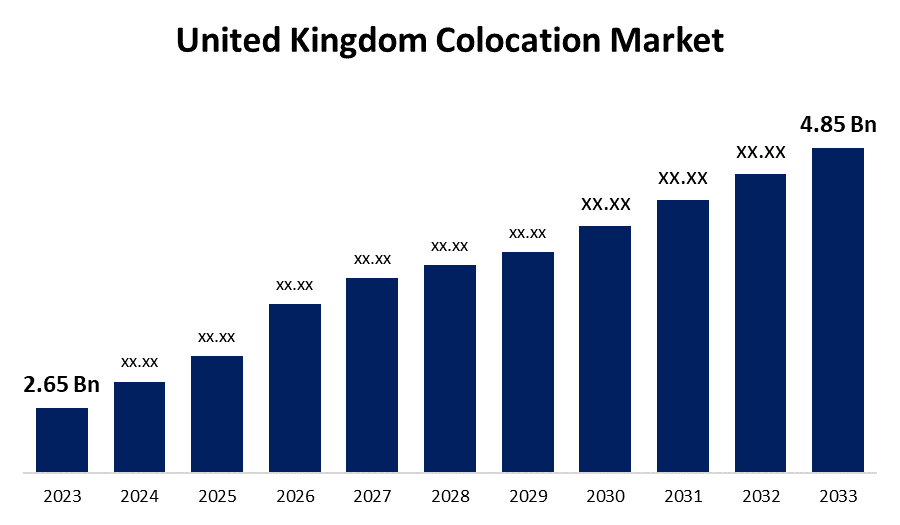

- The U.K. Colocation Market Size was valued at USD 2.65 Billion in 2023.

- The Market is growing at a CAGR of 6.23% from 2023 to 2033

- The U.K. Colocation Market Size is expected to reach USD 4.85 Billion by 2033

Get more details on this report -

The United Kingdom Colocation Market is anticipated to exceed USD 4.85 Billion by 2033, growing at a CAGR of 6.23% from 2023 to 2033. The growing digital transformation & internet users and favorable government initiatives are driving the growth of the colocation market in the UK.

Market Overview

Business organizations can eliminate internal servers or data centers by renting space from colocation data centers for servers and other computing infrastructure. They can utilize cutting-edge data center technology that gives scalability, security, and continuity for a range of data systems and applications. In the UK, colocation has the potential to significantly increase floor space as a result of ongoing MNC establishments, Industry 4.0 initiatives, and investments in digitizing the economy. Residential data center usage has shifted to industrial sites. UK government's new digital and data strategy, which was released in June 2022 and aims to support sector-wide system and service change by 2025. The increasing demand for adaptability and scalable infrastructure solutions due to the growing computing and data needs is expanding the market. Further, the rising application of big data analytics, cloud computing, and Internet of Things have enhanced the need for effective and affordable data processing and storage solutions.

Report Coverage

This research report categorizes the market for the UK colocation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom colocation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK colocation market.

United Kingdom Colocation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.23% |

| 2033 Value Projection: | USD 4.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Enterprise Size, By Industry Vertical |

| Companies covered:: | Scaleup Technologies GmbH & Co. KG, Proximity Data Centers, Redcentric PLC, Datum Datacenters Limited, Safe Hosts Internet LLP, vXtream Limited, Equinix, Inc., Netwise Housing Limited, ServerMania Inc., Kao Data, Digital Realty, Iomart Group PLC, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

UK government is putting plans in place to support technological improvement and acceptance in its industrial verticals after noticing the continuous shift towards technology. The demand for high-speed bandwidth for both residential and commercial businesses has been further reinforced by the growing internet penetration and tech-savvy population, which has also stimulated the total industry expansion. Further, the ongoing trend of the adoption of 5G in the UK with the support of the government is enhancing network access in the country.

Restraining Factors

The restrictions brought on by sustainability concerns, high capital costs, and capacity issues are impeding the market expansion.

Market Segmentation

The United Kingdom Colocation Market share is classified into type, enterprise size, and industry vertical.

- The retail segment dominated the market with the largest market share in 2023.

The United Kingdom colocation market is segmented by type into retail and wholesale. Among these, the retail segment dominated the market with the largest market share in 2023. Retail colocation gives clients dedicated space, power, and connection in multi-tenant data centers so they may customize their IT infrastructure to meet their needs. The increasing popularity of colocation in the industry as it meets demand for data processing and storage capabilities.

- The large segment is anticipated to grow at the fastest CAGR growth during the forecast period.

The United Kingdom colocation market is segmented by enterprise size into small, medium, and large. Among these, the large segment is anticipated to grow at the fastest CAGR growth during the forecast period. As part of its £500 million data center investment strategy to boost the UK's digital and IT industry, NTT Ltd. announced in December 2020 the opening of its London 1 data center in the United Kingdom. There is an increased investment by large businesses in the establishment of data centers.

- The BFSI segment is anticipated to witness the fastest CAGR growth in the UK colocation market during the forecast period.

Based on the industry vertical, the U.K. colocation market is divided into BFSI, communication technology, education, healthcare, media & entertainment, retail & e-commerce, and others. Among these, the BFSI segment is anticipated to witness the fastest CAGR growth in the UK colocation market during the forecast period. The BFSI industry needs data infrastructure that is highly accessible, scalable, and safe. It is subject to strict data security and compliance regulations. These criteria are satisfied by colocation providers since they offer data centers with robust security protocols and compliance certifications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. colocation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Scaleup Technologies GmbH & Co. KG

- Proximity Data Centers

- Redcentric PLC

- Datum Datacenters Limited

- Safe Hosts Internet LLP

- vXtream Limited

- Equinix, Inc.

- Netwise Housing Limited

- ServerMania Inc.

- Kao Data

- Digital Realty

- Iomart Group PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, In a landmark deal for the UK data centre market, specialist operator Asanti Datacentres Limited announced that it has acquired five UK data centres from Daisy Group, one of the country’s largest communications and IT services providers.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Colocation Market based on the below-mentioned segments:

UK Colocation Market, By Type

- Retail

- Wholesale

UK Colocation Market, By Enterprise Size

- Small

- Medium

- Large

UK Colocation Market, By Industry Vertical

- BFSI

- Communication Technology

- Education

- Healthcare

- Media & Entertainment

- Retail & E-commerce

- Others

Need help to buy this report?