United Kingdom Commercial Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (Rental and Sales), By End Use (Offices, Retail, Leisure, and Others), and United Kingdom Commercial Real Estate Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Commercial Real Estate Market Insights Forecasts to 2033

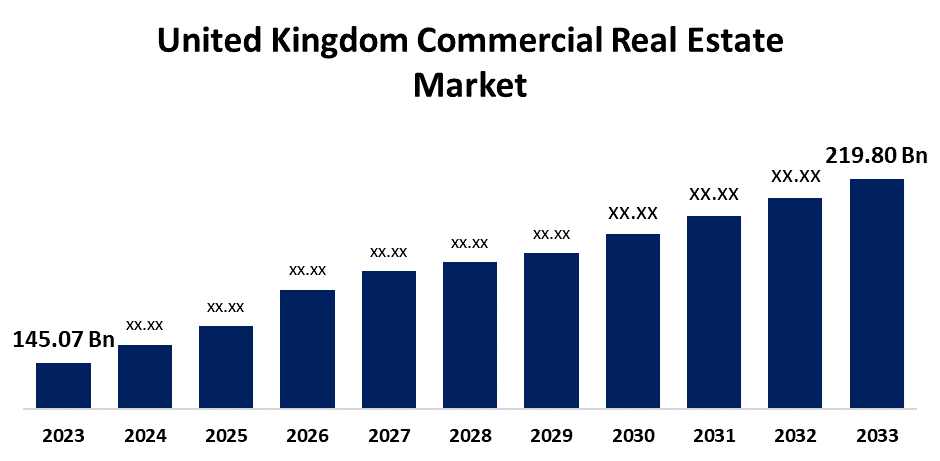

- The U.K. Commercial Real Estate Market Size was valued at USD 145.07 Billion in 2023.

- The Market is Growing at a CAGR of 4.24% from 2023 to 2033

- The UK Commercial Real Estate Market Size is Expected to Reach USD 219.80 Billion by 2033

Get more details on this report -

The U.K. Commercial Real Estate Market is Anticipated to Reach USD 219.80 Billion by 2033, growing at a CAGR of 4.24% from 2023 to 2033.

Market Overview

Property utilized for business-related activities or as a workspace as opposed to residential use is referred to as commercial real estate (CRE). Additionally, an immovable piece of non-residential land utilized for business or land with the potential to make money is called commercial real estate. Tenants usually rent commercial real estate to carry out revenue-generating activities. This wide range of real estate might comprise everything from a big factory or warehouse to a single storefront. Commercial real estate encompasses the development, advertising, administration, and rental of real estate for commercial purposes. Commercial real estate comes in a variety of forms, including shopping malls, restaurants, medical facilities, resorts and hotels, and retail and office space. Furthermore, the move to hybrid work styles has raised the need for flexible office spaces in the UK. Companies in the UK are looking for adaptable work environments that support both on-site and remote work.

Report Coverage

This research report categorizes the market for the UK commercial real estate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom commercial real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. commercial real estate market.

United Kingdom Commercial Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 145.07 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.24% |

| 2033 Value Projection: | USD 219.80 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Type, By End-User, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Land Securities Group PLC, Segro PLC, British Land, Derwent London, Hammerson, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK's steady economy and rising demand for commercial real estate have made it a very attractive place to invest in commercial real estate in recent years. The UK's robust and resilient economy is one of the main reasons fueling the demand for commercial real estate there. International investors find the United Kingdom to be appealing due to its open regulatory structure and well-established legal system. Moreover, a lot of companies are trying to set up shop in this international hub since London is one of the major financial hubs in the globe. Due to this, there is a significant need for commercial office space.

Restraining Factors

Real estate transactions may become more complicated and expensive as a result of stricter laws and compliance requirements.

Market Segmentation

The UK commercial real estate market share is classified into type and end-use.

- The rental segment is expected to hold the greatest market share through the forecast period.

The U.K. commercial real estate market is segmented by type into rental and sales. Among these, the rental segment is expected to hold the greatest market share through the forecast period. The market is growing as a result of the shifting business environment and the rise in industry diversity. To run their businesses efficiently, the top corporations need office spaces, retail locations, and industrial facilities.

- The offices segment is anticipated to hold a significant share of the United Kingdom commercial real estate market during the forecast period.

Based on the end use, the UK commercial real estate market is divided into offices, retail, leisure, and others. Among these, the offices segment is anticipated to hold a significant share of the United Kingdom commercial real estate market during the forecast period. Businesses rent office space to be utilized for professional services, office duties, and operational activities. The location, facility quality, infrastructure, and market demand are some of the elements that usually determine the rental rates of office space.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. commercial real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Land Securities Group PLC

- Segro PLC

- British Land

- Derwent London

- Hammerson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Landsec announces that it has successfully paid £120 million to GIC for an extra 17.5% share in Bluewater, bringing its total ownership position in one of the top shopping locations in the UK to 66.25%.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Commercial Real Estate Market based on the below-mentioned segments:

United Kingdom Commercial Real Estate Market, By Type

- Rental

- Sales

United Kingdom Commercial Real Estate Market, By End Use

- Offices

- Retail

- Leisure

- Others

Need help to buy this report?