United Kingdom Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Type (Chocolate, Sugar, and Gums), By Distribution Channel (Hypermarket/Supermarket, Convenience Stores, Departmental Stores, and Online Retail), and United Kingdom Confectionery Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited Kingdom Confectionery Market Insights Forecasts to 2033

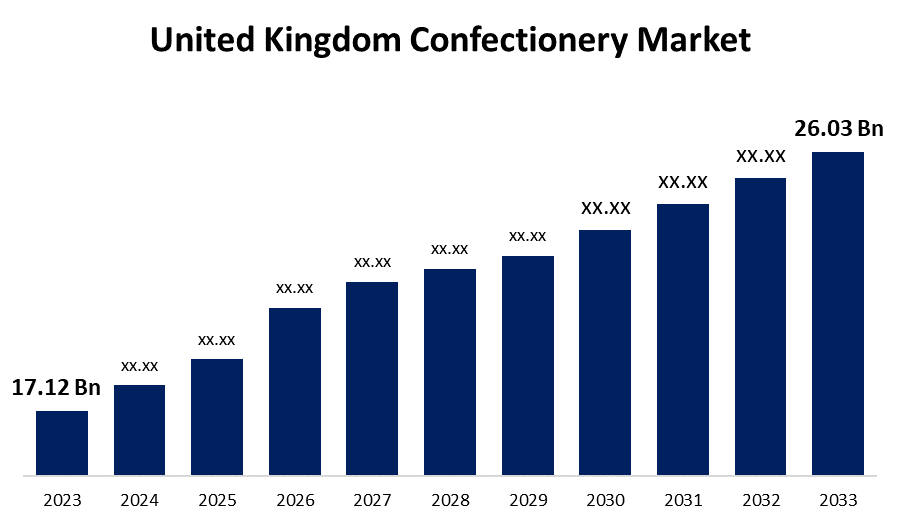

- The U.K. Confectionery Market Size was valued at USD 17.12 Billion in 2023.

- The Market is Growing at a CAGR of 4.28% from 2023 to 2033

- The UK Confectionery Market Size is Expected to Reach USD 26.03 Billion by 2033

Get more details on this report -

The U.K. Confectionery Market is Anticipated to Exceed USD 26.03 Billion by 2033, growing at a CAGR of 4.28% from 2023 to 2033.

Market Overview

Confectionery is the practice of creating confections, or sweet meals. Confections are products high in sugar and carbs. The confectionery sector comprises huge global corporations that manufacture a wide range of chocolate, chewing gum, candies, and other items derived from cocoa. This line of work requires technical expertise in producing a variety of confectionery products, such as chocolates, candies, and candies, and an artistic flare in their presentation and decorating. A confectionery store is a business that sells confectionery, with children and adolescents as its target market. It is also known as a sweet shop in the United Kingdom. Different scents can be found in the candy that is adored and eaten by people of all ages. Confectionery is enhanced by these flavors, which also provide a delicious aroma. As a result, when candy is ingested, they aid in leaving a pleasing flavor and aroma on the palette.

Report Coverage

This research report categorizes the market for the UK confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. confectionery market.

United Kingdom Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.12 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.28% |

| 2033 Value Projection: | USD 26.03 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Mondelez International Inc., Mars Incorporated, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Ferrero International SA, HARIBO Holding GmbH & Co. KG, Barry Callebaut AG, August Storck KG, Swizzels Matlow Ltd, The Hershey Company, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Confectionery is more than just a type of food; it is a sign of celebration, an expression of affection, and a source of comfort and delight for many people. It has an important role in cultural customs, holiday occasions, and ordinary moments of indulgence, particularly in the UK. Luxurious chocolate is becoming more popular, and new food product innovations in the United Kingdom have increased the number of new items introduced worldwide by 72%. One of the main factors propelling market growth in the confectionery sector in the UK is the country's high chocolate consumption, which is considered to be the seventh highest in the world and the fourth highest in Europe, with an average yearly per capita consumption of about 8.1 kg.

Restraining Factors

Since their supply and demand in the UK market fluctuate so quickly, sugar and cocoa prices have fluctuated during the past few years. The whole confectionery market in the UK is anticipated to be hampered by changes in raw material prices.

Market Segmentation

The UK confectionery market share is classified into type and distribution channel.

- The chocolate segment is expected to hold the greatest market share through the forecast period.

The U.K. confectionery market is segmented by type into chocolate, sugar, and gums. Among these, the chocolate segment is expected to hold the greatest market share through the forecast period. The UK's chocolate manufacturers now have an abundance of chances due to consumers' daily routines and increased acceptance of Westernized food.

- The hypermarket/supermarket segment is anticipated to hold a significant share of the United Kingdom confectionery market during the forecast period.

Based on the distribution channel, the UK confectionery market is divided into hypermarket/supermarket, convenience stores, departmental stores, and online retails. Among these, the hypermarket/supermarket segment is anticipated to hold a significant share of the United Kingdom's confectionery market during the forecast period. 87% of UK consumers typically shopped at supermarkets in 2021 for food and other needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mondelez International Inc.

- Mars Incorporated

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero International SA

- HARIBO Holding GmbH & Co. KG

- Barry Callebaut AG

- August Storck KG

- Swizzels Matlow Ltd

- The Hershey Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Nestlé and Advent International have announced a deal for Nestlé to buy the bulk of Grupo CRM, a Brazilian luxury chocolate company. With more than 1,000 chocolate boutiques operating under the Kopenhagen and Brasil Cacau brands, as well as a robust and expanding internet presence, Grupo CRM successfully operates a direct-to-consumer business model.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Confectionery Market based on the below-mentioned segments:

United Kingdom Confectionery Market, By Type

- Chocolate

- Sugar

- Gums

United Kingdom Confectionery Market, By Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Departmental Stores

- Online Retails

Need help to buy this report?