United Kingdom Cosmetic Dentistry Market Size, Share, and COVID-19 Impact Analysis, By Type (Equipment and Consumables), By End-user (Solo Practices, DSO/Group Practices, and Others), and United Kingdom Cosmetic Dentistry Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Cosmetic Dentistry Market Insights Forecasts to 2033

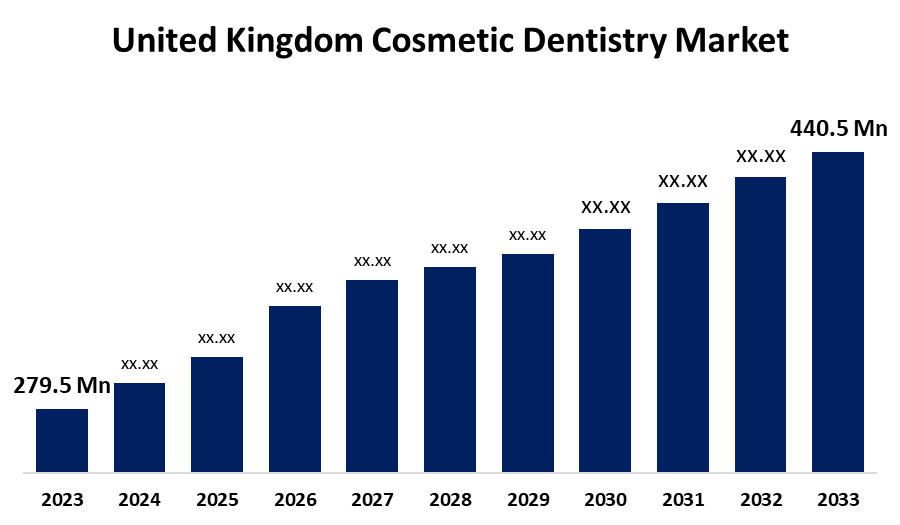

- The U.K. Cosmetic Dentistry Market Size was valued at USD 279.5 Million in 2023.

- The U.K. Cosmetic Dentistry Market is growing at a CAGR of 4.65% from 2023 to 2033

- The U.K. Cosmetic Dentistry Market Size is expected to reach USD 440.5 Million by 2033

Get more details on this report -

The United Kingdom Cosmetic Dentistry Market is anticipated to exceed USD 440.5 Million by 2033, growing at a CAGR of 4.65% from 2023 to 2033. The increasing prevalence of dental abnormalities, technologically advanced solutions, awareness for cosmetic dentistry, and rising demand for aesthetic enhancements are driving the growth of the cosmetic dentistry market in the UK.

Market Overview

The cosmetic dentistry market refers to the industry and services emphasizing the improvement of the aesthetic appearance of teeth, gums, and overall smile. Cosmetic dentistry is the branch of dentistry that aims to enhance aesthetics, such as color, shape, size, alignment, and bite. There is increasing popularity of cosmetic dentistry owing to the growing consumption of products such as sugary food & drinks and tobacco & alcohol that may cause oral health issues and other non-communicable diseases. The rising focus on aesthetics, the prevalence of oral health disorders, and dental tourism are the factors propelling the cosmetic dentistry market. The technological advancements and investment in CAD/CAM technologies by dental laboratories are augmenting the market growth. The development of technologically advanced solutions and dental materials for superior results are offering lucrative opportunities in the cosmetic dentistry market.

Report Coverage

This research report categorizes the market for the UK cosmetic dentistry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cosmetic dentistry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK cosmetic dentistry market.

United Kingdom Cosmetic Dentistry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 279.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.65% |

| 2033 Value Projection: | USD 440.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Macopharma UK Ltd., Phillips & Co Cosmetic Dentistry, Harley Street Dental Clinic, Forward Dental Care, Rodericks Dental Partners, Abbey Dental Care, Kings Dental Clinic, The London Centre for Cosmetic Dentistry Limited, Bespoke Smile London, The London Smile Clinic, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of dental abnormalities or cosmetic dental problems, such as crooked teeth, chipped teeth, cracked teeth, discoloured or stained teeth, and other problems, are driving the need for cosmetic dentistry, thereby propelling the market. The advancement in technology that gas transformed modern cosmetic dentistry by making it more efficient, effective, and accessible leads to drive the market growth. The increasing awareness about cosmetic dentistry via social media, media coverage, and celebrity endorsements are contributing to propelling the market demand. Furthermore, the growing demand for aesthetic enhancements for improving the appearance of teeth and smiles, including correction of various imperfections like discoloration, misalignment, gaps, and teeth damage, is augmenting the market growth.

Restraining Factors

The heightened cost of cosmetic dental procedures is hindering market growth. Further, the restricted adoption of dental bridges and orthodontic treatments due to their risks and complications is challenging market growth.

Market Segmentation

The United Kingdom Cosmetic Dentistry Market share is classified into type and end-user.

- The consumables segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cosmetic dentistry market is segmented by type into equipment and consumables. Among these, the consumables segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. The segment includes teeth whitening agents and composite resins for bonding, veneers, crowns, and materials that are used for creating inlays and onlays. The emergence of innovations like dental lasers, CAD/CAM technology, and advanced dental implants are propelling the market in the consumables segment.

- The solo practices segment dominated the United Kingdom cosmetic dentistry market and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cosmetic dentistry market is segmented by end-user into solo practices, DSO/group practices, and others. Among these, the solo practices segment dominated the United Kingdom cosmetic dentistry market and is expected to grow at a significant CAGR during the projected period. Solo practices involve a healthcare setup where a single dentist operates and manages the entire dental workflow. The presence of numerous dental clinics and solo practitioners, with the increasing demand for cosmetic dental treatments, are propelling the market in the solo practices segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cosmetic dentistry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Macopharma UK Ltd.

- Phillips & Co Cosmetic Dentistry

- Harley Street Dental Clinic

- Forward Dental Care

- Rodericks Dental Partners

- Abbey Dental Care

- Kings Dental Clinic

- The London Centre for Cosmetic Dentistry Limited

- Bespoke Smile London

- The London Smile Clinic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, The Birmingham Dental and Biomaterials Testing Service (BiMaTs) was launched by the University of Birmingham Enterprise, UK.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cosmetic Dentistry Market based on the below-mentioned segments:

UK Cosmetic Dentistry Market, By Type

- Equipment

- Consumables

UK Cosmetic Dentistry Market, By End-user

- Solo Practices

- DSO/Group Practices

- Others

Need help to buy this report?