United Kingdom Cosmetics Products Market Size, Share, and COVID-19 Impact Analysis, By Category (Haircare, Skincare, Makeup, and Others), By Gender (Men and Women), By Distribution Channel (Specialty Stores, Hypermarket/Supermarket, Online Channels, and Others), and United Kingdom Cosmetics Products Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Cosmetics Products Market Insights Forecasts to 2033

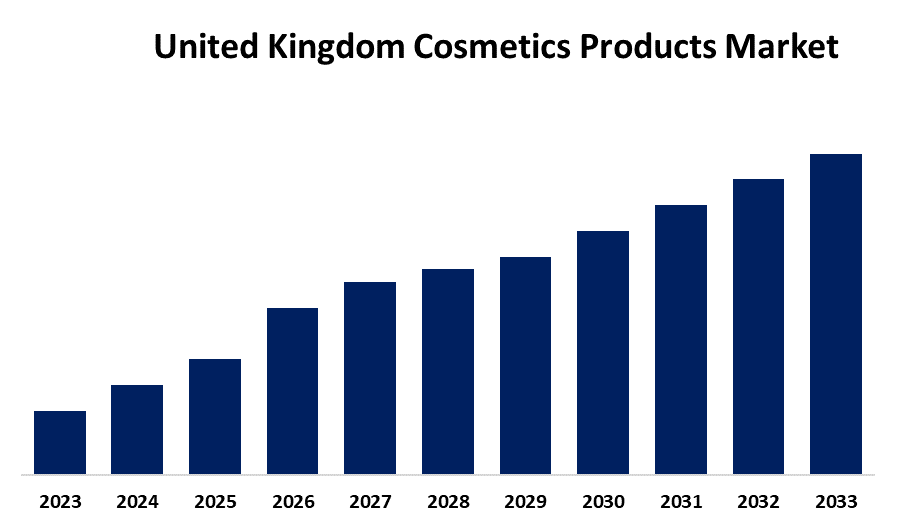

- The U.K. Cosmetics Products Market Size is Growing at a CAGR of 4.05% from 2023 to 2033

- The U.K. Cosmetics Products Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The United Kingdom Cosmetics Products Market Size is Anticipated to hold a significant share by 2033, Growing at a CAGR of 4.05% from 2023 to 2033. The growing consumer awareness about personal grooming & beauty enhancement, the influence of social media, and growing disposable income are driving the growth of the cosmetics products market in the UK.

Market Overview

The cosmetics products market is the manufacturing and distributing of products designed for enhancing or altering appearance, improving hygiene, or providing skincare benefits, such as makeup, skin & hair care, fragrances, and toiletries. Cosmetics products are the products applied to the human body for cleansing, beautifying, promoting attractiveness, or altering appearance. These include a wide range of items from makeup and skincare to hair products & fragrances. The awareness about the enhancement of personal appearance, especially among consumers, leads to drive the demand for cosmetics products as an essential component for daily grooming routines. Consumer trends and preferences about skincare and haircare products, which are further influenced by environmental awareness and sustainability concerns are contributing to drive the cosmetics products market growth. Further, the incorporation of organic, natural ingredients and promotion of wellness benefits are being popularly used especially among eco-conscious consumers. The growing popularity of hyper-personalization within the beauty sector in order to drive customer relationships is accelerating the market growth opportunities for cosmetics products.

Report Coverage

This research report categorizes the market for the UK cosmetics products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cosmetics products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK cosmetics products market.

United Kingdom Cosmetics Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.05% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Category, By Gender, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | L’Oreal SA, Estee Lauder Inc., Kose Corporation, Shiseido Company Limited, Kao Corporation, Oriflame Cosmetics Global SA, LVMH, Coty Inc., Revlon Inc., Unilever PLC, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing awareness about personal hygiene and grooming with the evolving lifestyles and emphasis on appearance and self-care is contributing to driving the cosmetics products market. Social media influence is responsible for driving trends in the UK by shaping consumer perceptions through influencers, and product recommendations that propel the cosmetics products market. It was estimated that one in five high-income earners (earning over 200% of the median income) have spent over £100 on makeup (20%), compared to 9% of middle-income earners. Thus, the increasing disposable income of the country is significantly contributing to driving the market for cosmetics products.

Restraining Factors

The prevalence of counterfeit products may hamper the cosmetics products market due to the health risks associated with these products and lack of proper testing. Further, the increased price of sustainable ethical production is challenging the market growth.

Market Segmentation

The United Kingdom cosmetics products market share is classified into category, gender, and distribution channel.

- The skincare segment dominated the United Kingdom cosmetics products market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cosmetics products market is segmented by category into haircare, skincare, makeup, and others. Among these, the skincare segment dominated the United Kingdom cosmetics products market in 2023 and is expected to grow at a significant CAGR during the projected period. There is an increasing need for natural and organic skincare products due to consumers' awareness of environmental sustainability and clean beauty. The growing demand for face creams, sunscreens, and body lotions, as well as the trend of organic skin care, are contributing to the growth of the market in the skincare segment.

- The women segment dominated the United Kingdom cosmetics products market in 2023 and is expected to grow at a significant CAGR growth during the projected period.

The United Kingdom cosmetics products market is segmented by gender into men and women. Among these, the women segment dominated the United Kingdom cosmetics products market in 2023 and is expected to grow at a significant CAGR growth during the projected period. Cosmetic products that are handy and easy to use are preferred by women especially during traveling or attending social meetings. The increasing number of working women in the urbanized region where pollution level is high, driving the market demand in the women segment.

- The hypermarket/supermarket segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom cosmetics products market is segmented by distribution channel into specialty stores, hypermarket/supermarket, online channels, and others. Among these, the hypermarket/supermarket segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. The extensive range of product availability from various brands as per the consumer choices in the supermarket and hypermarket stores are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. cosmetics products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L'Oreal SA

- Estee Lauder Inc.

- Kose Corporation

- Shiseido Company Limited

- Kao Corporation

- Oriflame Cosmetics Global SA

- LVMH

- Coty Inc.

- Revlon Inc.

- Unilever PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Ariana Grande's r.e.m. beauty was announced its launch at Sephora, bringing its range of skincare-infused makeup to consumers in Europe.

- In November 2022, Indian luxury ayurvedic beauty brand Forest Essentials strengthened its presence in the United Kingdom with the launch of its first standalone store in London.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Cosmetics Products Market based on the below-mentioned segments:

UK Cosmetics Products Market, By Category

- Haircare

- Skincare

- Makeup

- Others

UK Cosmetics Products Market, By Gender

- Men

- Women

UK Cosmetics Products Market, By Distribution Channel

- Specialty Stores

- Hypermarket/Supermarket

- Online Channels

- Others

Need help to buy this report?