United Kingdom Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product Type (Non-dairy Milk, Butter, Cheeses, Yoghurts, Ice Cream, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), and United Kingdom Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Dairy Alternatives Market Insights Forecasts to 2033

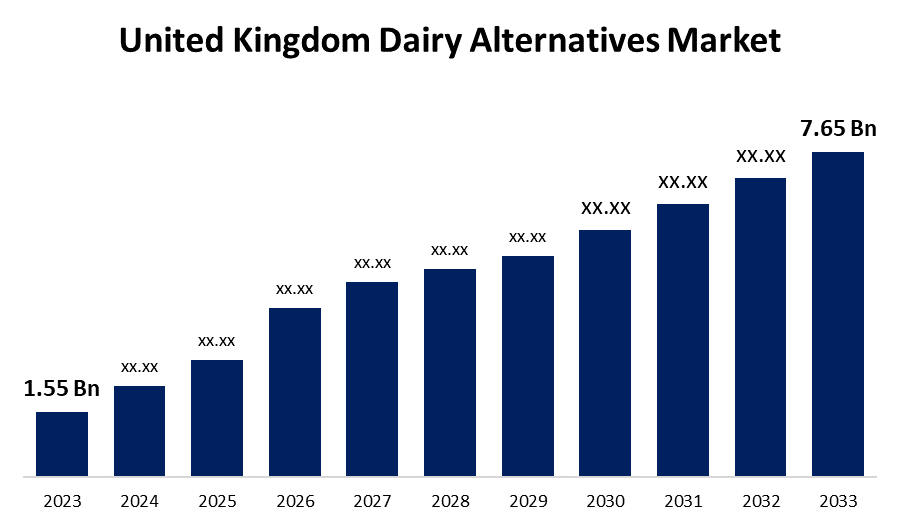

- The U.K. Dairy Alternatives Market Size was valued at USD 1.55 Billion in 2023.

- The U.K. Dairy Alternatives Market is growing at a CAGR of 17.31% from 2023 to 2033

- The U.K. Dairy Alternatives Market Size is expected to reach USD 7.65 Billion by 2033

Get more details on this report -

The United Kingdom Dairy Alternatives Market is anticipated to exceed USD 7.65 Billion by 2033, growing at a CAGR of 17.31% from 2023 to 2033. The growing consumer health consciousness and dietary preferences seeking milk alternatives are driving the growth of the dairy alternatives market in the UK.

Market Overview

Dairy alternatives market refers to the industry selling products made from plant-based ingredients instead of dairy-based products. Dairy alternatives are non-dairy foods and drinks that can replace milk, cheese, butter, and more and are made from plants such as nuts, seeds, grains, and legumes. Consumer preference and demand for dairy alternatives have led to the changing consumer attitude towards health, sustainability, and ethical considerations. Further, the rising emphasis on health and wellness and growing health consciousness among consumers leads to the adoption of dairy alternatives like almond milk, soy milk, and oat milk which are perceived as a healthier choice. The simplicity of dairy alternative manufacturing process technology is offering market growth opportunities for dairy alternatives.

Report Coverage

This research report categorizes the market for the UK dairy alternatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK dairy alternatives market.

United Kingdom Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.55 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 17.31% |

| 023 – 2033 Value Projection: | USD 7.65 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Source, By Product Type, By Distribution Channel |

| Companies covered:: | Arla Foods Blue Diamond Growers Britvic PLC Coconut Collaborative Ltd Danone SA Oatly Group AB Plamil Foods Ltd The Hain Celestial Group Inc. Upfield Holdings BV VBites Foods Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing consumer health consciousness is driving the market for dairy alternatives as they are generally perceived as healthier options, typically containing lower saturated fats and cholesterol while being fortified with essential vitamins and minerals. Further, consumer dietary preferences seeking milk alternatives due to dietary restrictions, environmental concerns, and health conditions are contributing to propel the dairy alternatives market demand. In addition, increasing cases of dairy allergies lead to the growing adoption of plant-based milk and dairy substitutes, thereby promoting the dairy alternatives market.

Restraining Factors

The limited awareness about the product and sub-optimal market penetration are hampering the UK dairy alternatives market growth.

Market Segmentation

The United Kingdom Dairy Alternatives Market share is classified into source, product type, and distribution channel.

- The soy segment dominated the market with a major market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom dairy alternatives market is segmented by source into soy, almond, coconut, rice, oats, and others. Among these, the soy segment dominated the market with a major market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Soy is cholesterol-free and has less saturated fat than cow’s milk and lowers the LDL in the body. The widespread accessibility of soy products as a dairy alternative is responsible for driving the market in the soy segment.

- The non-dairy milk segment dominated the market with a significant revenue share in 2023 and is expected to grow at the fastest CAGR during the forecast period.

The United Kingdom dairy alternatives market is segmented by product type into non-dairy milk, butter, cheeses, yoghurts, ice cream, and others. Among these, the non-dairy milk segment dominated the market with a significant revenue share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Almond milk, coconut milk, rice milk, and soy milk are some of the common non-dairy milk derived from plants. The growing interest in the development of milk alternatives by the key market players is driving the market.

- The supermarkets/hypermarkets segment is expected to dominate the UK dairy alternative market and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom dairy alternatives market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and others. Among these, the supermarkets/hypermarkets segment is expected to dominate the UK dairy alternative market and is anticipated to grow at a significant CAGR during the forecast period. Dairy alternatives such as plant-based milk, yoghurt, cheese, and other dairy substitutes are available in supermarkets/hypermarkets owing to their extensive product selection and convenience factor.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods

- Blue Diamond Growers

- Britvic PLC

- Coconut Collaborative Ltd

- Danone SA

- Oatly Group AB

- Plamil Foods Ltd

- The Hain Celestial Group Inc.

- Upfield Holdings BV

- VBites Foods Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Plenish unveils the UK’s only clean-label fortified oat m*lk with no oils and additives, and rolls out a new creamy recipe. Plenish, the UK’s fastest-growing dairy alternatives brand1, is expanding its range with the launch of Plenish Enriched Oat M*lk - a fortified oat drink that delivers essential vitamins and minerals without compromising on ingredient transparency.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Dairy Alternatives Market based on the below-mentioned segments:

UK Dairy Alternatives Market, By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

UK Dairy Alternatives Market, By Product Type

- Non-dairy Milk

- Butter

- Cheeses

- Yoghurts

- Ice Cream

- Others

UK Dairy Alternatives Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Need help to buy this report?