United Kingdom Dental Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Dental Health Maintenance Organizations (DHMO), Dental Preferred Provider Organizations (DPPO), Dental Indemnity Plans (DIP), Dental Exclusive Provider Organizations (DEPO), and Dental Point of Service (DPS)), By Type (Major Basic and Preventive Segments), By Demographic (Senior Citizens, Adults, and Minors), and United Kingdom Dental Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Dental Insurance Market Insights Forecasts to 2033

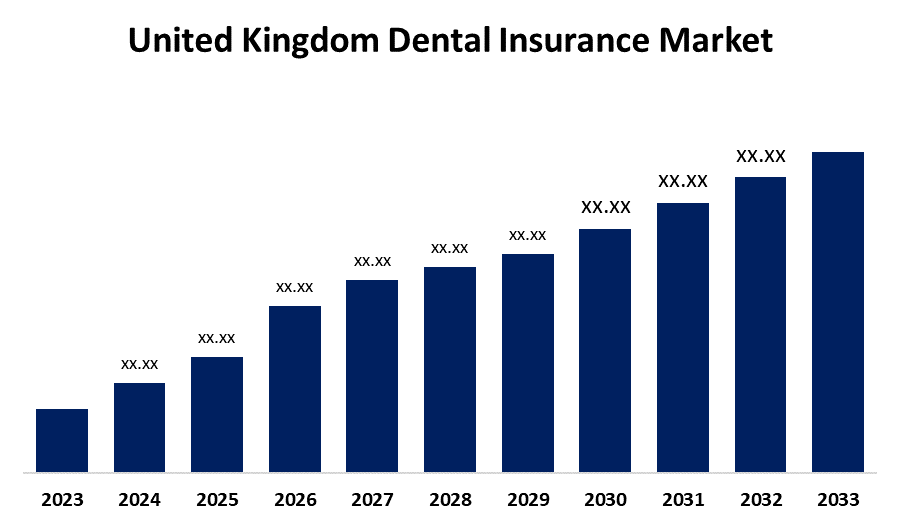

- The Market is growing at a CAGR of 4.9% from 2023 to 2033

- The UK Dental Insurance Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Dental Insurance Market is anticipated to hold a significant share by 2033, growing at a CAGR of 4.9% from 2023 to 2033. The growing consumer price index for dental services and NHS dentistry services in the UK are driving the growth of the dental insurance market in the United Kingdom.

Market Overview

Dental insurance is the discretionary purchase item, referred to as a dental plan. Depending on the plan selected, they are intended to assist in covering a portion of the related dental care expenses. It includes essential services including root canals, crowns, implants, and dentures. It covers routine treatment such as check-ups and dental X-rays, as well as restorative treatment such as fillings to ease the financial concerns of dental treatment. Dental plans are created by dentists as per the patient's need at discounted prices to make dental health easy and affordable. Furthermore, demand from businesses is anticipated to climb as employee morale rises and they start to spend more on dental coverage. The transition from traditional legacy systems to SaaS and cloud-based solutions holds the potential to revolutionize the landscape for health and dental insurance providers. Thus, technological advancement is anticipated to create lucrative market opportunities for dental insurance providing cost savings and improved information accessibility.

Report Coverage

This research report categorizes the market for the UK dental insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Dental insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK dental insurance market.

United Kingdom Dental Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Coverage, By Type, By Demographic and COVID-19 Impact Analysis |

| Companies covered:: | Cigna, Simplyhealth, Bupa, Dencover, Unum, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A fifth of patients in the UK have delayed dental care because of expense, according to the British Dental Association. Prices are rising along with the increasing number of dental services and treatments. In addition, UK people are now subscribing to more dental insurance policies. Further, the high awareness about dental care with the growing dental health issues is encouraging for dental care and treatment that leads to driving the market. The rising consumer inclination towards NHS dentistry services in the UK due to cost-effectiveness over private dentistry is driving market growth.

Restraining Factors

The lack of awareness about oral healthcare in some regions leads to lower prioritization of dental insurance than other types of health insurance. Further, the high cost and complexity of dental procedures are potentially restraining the UK dental insurance market.

Market Segmentation

The United Kingdom Dental Insurance Market share is classified into coverage, type, and demographic.

- The dental preferred provider organizations (DPPO) segment dominates the market with the largest market share during the forecast period.

The United Kingdom dental insurance market is segmented by coverage into dental health maintenance organizations (DHMO), dental preferred provider organizations (DPPO), dental indemnity plans (DIP), dental exclusive provider organizations (DEPO), and dental point of service (DPS). Among these, the dental preferred provider organizations (DPPO) segment dominates the market with the largest market share during the forecast period. DPPOs help to reduce consumers' pocket expenses as they have a network of dentists that provide services to plan members at a discounted rate which helps people to save money on dental care. These better plans for dental expenses are enhancing the market demand.

- The preventive segment dominated the market with the largest market share during the forecast period.

Based on the type, the United Kingdom dental insurance market is divided into major, basic, and preventive. Among these, the preventive segment dominated the market with the largest market share during the forecast period. A preventive segment of dental insurance includes regular checkups, cleanings, and early intervention for dental problems to maintain oral health. The affordability and preventive dental insurance plan premiums are driving up the market growth.

- The senior citizens segment dominated the market with the largest market share in 2023.

Based on the demographic, the United Kingdom dental insurance market is divided into senior citizens, adults, and minors. Among these, the senior citizens segment dominated the market with the largest market share in 2023. The growing aging population in the UK is responsible for driving demand for dental care as these age groups are more likely to experience dental health issues, such as gum disease, tooth decay, and tooth loss. This increases the costs of preventive care and dental treatment subsequently leading to drive the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK dental insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cigna

- Simplyhealth

- Bupa

- Dencover

- Unum

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, The UK’s leading health and dental plan provider Simplyhealth, has announced it has invested in Ampersand, a provider of digital therapies for inflammatory conditions. This collaboration would help accelerate the adoption of digital therapeutics in the UK, reducing outpatient appointments, improving health outcomes, and cutting unplanned hospital visits for patients suffering from a broad range of inflammatory conditions.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Dental Insurance Market based on the below-mentioned segments:

United Kingdom Dental Insurance Market, By Coverage

- Dental Health Maintenance Organizations (DHMO)

- Dental Preferred Provider Organizations (DPPO)

- Dental Indemnity Plans (DIP)

- Dental Exclusive Provider Organizations (DEPO)

- Dental Point of Service (DPS)

United Kingdom Dental Insurance Market, By Type

- Major

- Basic

- Preventive

United Kingdom Dental Insurance Market, By Demographic

- Senior Citizens

- Adults

- Minors

Need help to buy this report?