United Kingdom Dental Service Organization Market Size, Share, and COVID-19 Impact Analysis, By Service (Human Resources, Marketing & Branding, Accounting, Medical Supplies Procurement, and Others), By End-Use (Dental Surgeons, Endodontists, General Dentists, and Others), and United Kingdom Dental Service Organization Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Dental Service Organization Market Insights Forecasts to 2033

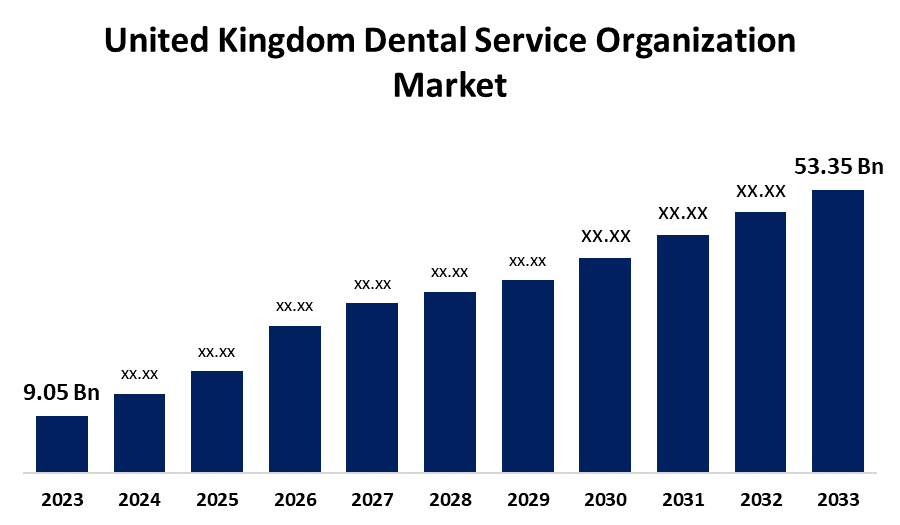

- The U.K. Dental Service Organization Market Size was valued at USD 9.05 Billion in 2023.

- The Market is growing at a CAGR of 19.41% from 2023 to 2033

- The U.K. Dental Service Organization Market Size is expected to reach USD 53.35 Billion by 2033

Get more details on this report -

The United Kingdom Dental Service Organization Market is anticipated to exceed USD 53.35 Billion by 2033, growing at a CAGR of 19.41% from 2023 to 2033. The growing spending on dental care and improvement in nonclinical business management by the organizations, and emphasis on telehealth solutions are driving the growth of the dental service organization market in the UK.

Market Overview

Dental service organizations are the independent business support centers that contract with dental practices to provide critical business management and support including non-clinical operations. Dental practice owners contract with this organization to manage administrative, marketing, and/or business sides. This allows dentists to focus on delivering patient care, thus enhancing the dental service to patients. Furthermore, dental manufacturers have been collaborating and partnering with DSOs which enables the company to save a significant amount of time and money by implementing new dental equipment, diagnostic software, and products on a larger scale with the assistance of a DSO. The increasing adoption of technologically innovative solutions such as dental practice management software, digital inventory management platforms, and patient communication tools for the efficient management of patient care and operating businesses are enhancing market growth. IN addition, the increased focus on value-based care and the use of social media for effective medical recruitment is on trends in the market.

Report Coverage

This research report categorizes the market for the UK dental service organization market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom dental service organization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK dental service organization market.

United Kingdom Dental Service Organization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.05 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.41% |

| 2033 Value Projection: | USD 53.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | European Dental Group (EDG), Integrated Dental Holdings Group, Colosseum Dental Group, Bupa, Dental Group, Abbey Dental Care, Dental Beauty Group Ltd., Clyde Munro Dental Group, Bhandal Dental Practice, Mydentist, Dentex Health, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The amount that British consumers spent on dental treatments in 2022 was over 3.1 billion pounds, which was more than the year before. The amount that households spent on dental care almost tripled between 2005 and 2019. Further, the complexity of healthcare laws as well as the growing emphasis on patient care service and operational efficiency in the dental sector surges the need for business support services. The growing adoption of telehealth in the dentistry fields for providing patient-centered and value-based care is significantly propelling the market growth. The growing use of digital dental technologies due to growing awareness of the need to maintain good oral health is further driving the market growth.

Restraining Factors

The lack of accessibility to dental care for those without adequate insurance coverage is hindering the market growth. Further, the high costs of certain dental treatments are restricting the market growth.

Market Segmentation

The United Kingdom Dental Service Organization Market share is classified into service and end-use.

- The medical supplies procurement segment is expected to grow at the fastest CAGR during the forecast period.

The United Kingdom dental service organization market is segmented by service into human resources, marketing & branding, accounting, medical supplies procurement, and others. Among these, the medical supplies procurement segment is expected to grow at the fastest CAGR during the forecast period. Medical supplies procurement refers to the supply of essential tools and materials for a dental practice for efficient operation. It includes bargaining contracts, and organizing supplies along with effective procurement that facilitates workflows, improves staff productivity, and lowers costs. The collaborative arrangement between DSOs and dental device manufacturers for obtaining medical supplies at a cost-effective rate enhances the market demand.

- The general dentists segment dominates the UK dental service organization market with the largest market share in 2023.

The United Kingdom dental service organization market is segmented by end-use type into dental surgeons, endodontists, general dentists, and others. Among these, the general dentists segment dominates the UK dental service organization market with the largest market share in 2023. A better work-life balance, less financial risk, and access to the latest dental tools and technology are the factors that the DSO often provides to general dentists. In the UK, general dentists make up around 90% of dentists, according to the General Dental Council. The services offered by general dentists to a large patient base are contributing to driving the market demand in the general dentists segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. dental service organization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- European Dental Group (EDG)

- Integrated Dental Holdings Group

- Colosseum Dental Group

- Bupa

- Dental Group

- Abbey Dental Care

- Dental Beauty Group Ltd.

- Clyde Munro Dental Group

- Bhandal Dental Practice

- Mydentist

- Dentex Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, mydentist, the UK’s largest dentist provider, invested a combined £9.5m into four new practices across Bridgwater, Bath, Eastleigh, and Lancaster.

- In March 2022, Dental Beauty Partners (“DBP”) partnered with Kiss Dental, a Leading UK Dental Group Based in Manchester, to support its rapid growth plans.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Dental Service Organization Market based on the below-mentioned segments:

UK Dental Service Organization Market, By Service

- Human Resources

- Marketing & Branding

- Accounting

- Medical Supplies Procurement

- Others

UK Dental Service Organization Market, By End-Use

- Dental Surgeons

- Endodontists

- General Dentists

- Others

Need help to buy this report?