United Kingdom Diabetes Care Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Blood glucose monitoring devices and Insulin delivery devices), By End Use (Hospital, Ambulatory surgical centres, Diagnostic centres, Homecare, and Others), and United Kingdom Diabetes Care Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Diabetes Care Devices Market Insights Forecasts to 2033

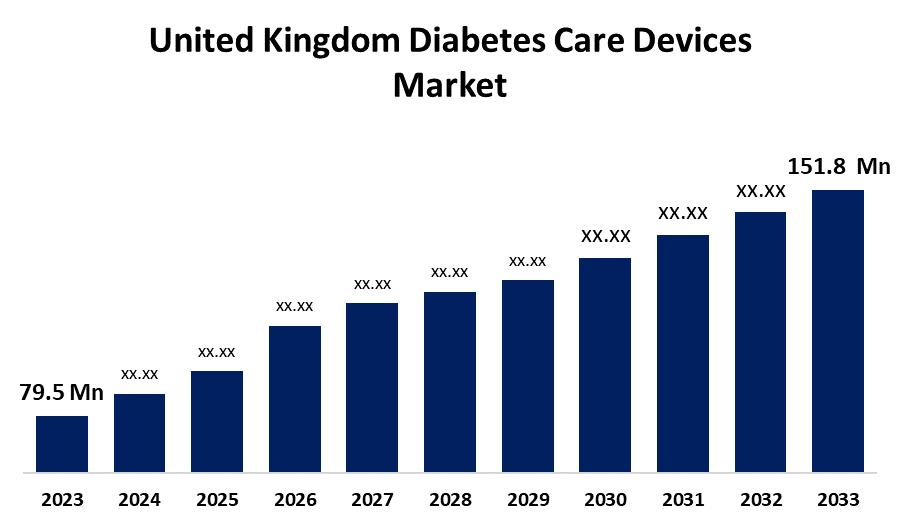

- The U.K. Diabetes Care Devices Market Size was valued at USD 79.5 Million in 2023.

- The U.K. Diabetes Care Devices Market Size is Growing at a CAGR of 6.68% from 2023 to 2033

- The U.K. Diabetes Care Devices Market Size is Expected to reach USD 151.8 Million by 2033

Get more details on this report -

The United Kingdom Diabetes Care Devices Market Size is anticipated to Exceed USD 151.8 Million by 2033, Growing at a CAGR of 6.68% from 2023 to 2033. The growing diabetes prevalence, an aging population, technological advancements, and awareness about diabetes management are driving the growth of the UK diabetes care devices market.

Market Overview

Diabetes care devices market refers to the industry encompassing medical devices used for managing and treating diabetes, such as blood glucose meters, continuous glucose monitors (CGMs), insulin pumps, and related accessories. Diabetes care devices are the tools and technologies that aid in managing conditions including monitoring of blood glucose levels, delivering insulin, and tracking data to improve diabetes management in the diabetic individual. The use of these devices aids in preventing longer hospital stays as it proactively addresses their condition by facilitating continuous monitoring and management of blood sugar levels. There is growing emphasis on the creation of advanced insulin pumps and pens and other technological advancements by the key market players. The introduction of telemedicine and remote monitoring as well as integrated healthcare systems with electronic health records (EHRs) is offering a market growth opportunity.

Report Coverage

This research report categorizes the market for the UK diabetes care devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom diabetes care devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK diabetes care devices market.

United Kingdom Diabetes Care Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 79.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.68% |

| 2033 Value Projection: | USD 151.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Diabetes Care, Roche Diabetes Care, LifeScan (Johnson & Johnson), Sanofi, Medtronic, Novo Nordisk A/S, Terumo, Eli Lilly, Arkray, Becton Dickinson, Dexcom, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing prevalence of diabetes is propelling the diabetes care devices market demand. It was estimated that more than 5.8 million people in the UK are living with diabetes, which is an all-time high. Between 2023 and 2024, of those registered with type 2 diabetes in England, 44.1 percent were aged between 40 and 64 years. Technological advancements including continuous subcutaneous insulin infusion (CSII) and continuous glucose monitoring (CGM) systems are propelling the market growth. The awareness about diabetes management is anticipated to promote market growth. For instance, in November 2024, Sanofi and Breakthrough T1D UK announced a special collaboration with Beano, to mark World Diabetes Day, 14th November 2024, and Diabetes Month (UK).

Restraining Factors

The increased cost of diabetes care devices which includes insulin pumps and continuous glucose monitors are challenging the market. The rigorous regulatory framework associated with the approval of these devices is hampering the market growth.

Market Segmentation

The United Kingdom diabetes care devices market share is classified into product and end use.

- The blood glucose monitoring devices segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom diabetes care devices market is segmented by product into blood glucose monitoring devices and insulin delivery devices. Among these, the blood glucose monitoring devices segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Blood glucose monitoring devices are used in home and health care settings for measuring the amount of sugar (glucose) in the blood. The use of blood glucose monitoring for providing information for managing diet, exercise, and insulin dosing is propelling the market growth.

- The hospital segment dominated the market with a substantial market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom diabetes care devices market is segmented by end use into hospital, ambulatory surgical centres, diagnostic centres, homecare, and others. Among these, the hospital segment dominated the market with a substantial market share in 2023 and is expected to grow at a significant CAGR during the projected period. Devices like CGM (continuous glucose monitoring) and CSII (continuous subcutaneous insulin infusion) systems used in hospitals aid in improving clinical outcomes. The services offered by the hospitals for diabetes management from diagnosis to medication and management are driving the market in the hospital segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. diabetes care devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Diabetes Care

- Roche Diabetes Care

- LifeScan (Johnson & Johnson)

- Sanofi

- Medtronic

- Novo Nordisk A/S

- Terumo

- Eli Lilly

- Arkray

- Becton Dickinson

- Dexcom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, The National Institute of Clinical Excellence announced it was the first to expand access to automated glucose monitors for children with type 2 diabetes. Children living with type 2 diabetes in the United Kingdom can now be prescribed continuous glucose monitors (CGM) to manage their condition.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Diabetes Care Devices Market based on the below-mentioned segments:

UK Diabetes Care Devices Market, By Product

- Blood glucose monitoring devices

- Insulin delivery devices

UK Diabetes Care Devices Market, By End Use

- Hospital

- Ambulatory surgical centres

- Diagnostic centres

- Homecare

- Others

Need help to buy this report?