United Kingdom Diagnostic Imaging Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (CT Scanners, Ultrasound systems, X-ray Imaging Systems, Nuclear Imaging Systems, MRI Systems, and Mammography Systems), By Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, and Others), By End User (Hospitals, Diagnostic Imaging Centers, and Others), and United Kingdom Diagnostic Imaging Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Diagnostic Imaging Equipment Market Insights Forecasts to 2033

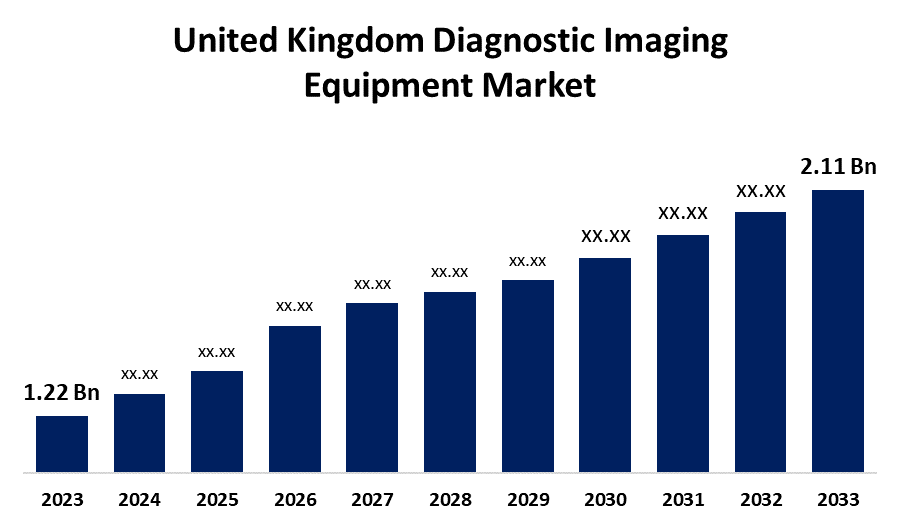

- The U.K. Diagnostic Imaging Equipment Market Size was valued at USD 1.22 Billion in 2023.

- The U.K. Diagnostic Imaging Equipment Market Size is growing at a CAGR of 5.63% from 2023 to 2033

- The U.K. Diagnostic Imaging Equipment Market Size is expected to exceed USD 2.11 Billion by 2033

Get more details on this report -

The United Kingdom Diagnostic Imaging Equipment Market Size is anticipated to exceed USD 2.11 Billion by 2033, growing at a CAGR of 5.63% from 2023 to 2033. The growing prevalence of chronic diseases and adoption of advanced technologies in medical imaging are driving the growth of the diagnostic imaging equipment market in the UK.

Market Overview

Diagnostic imaging equipment market refers to the production and sale of devices used for creating visual representations of the human body’s internal structures and functions, aiding in diagnosis and treatment planning. Diagnostic medical imaging equipment includes magnetic resonance imaging units, computed tomography units, positron emission tomography units, and gamma camera. There is a surging demand for diagnostic medical imaging equipment due to the prevalence of chronic diseases including cardiovascular diseases, musculoskeletal diseases, cancer, and neurological disorders. Further, brain abnormalities that are linked to moderate cognitive impairment (MCI) are diagnosed by the use of imaging tools such as MRI and other advanced imaging systems. The development of automated diagnostic imaging scanners, cutting-edge technology, and expanding corporate activities in the R&D of diagnostic imaging equipment are escalating the market growth of diagnostic imaging equipment. Demand for minimally invasive procedures is escalating the market demand as diagnostic imaging equipment such as laparoscopic cameras, ultrasound, and CT scans are required for guiding minimally invasive procedures.

Report Coverage

This research report categorizes the market for the UK diagnostic imaging equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom diagnostic imaging equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK diagnostic imaging equipment market.

United Kingdom Diagnostic Imaging Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.63% |

| 2033 Value Projection: | USD 2.11 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, By End User |

| Companies covered:: | Carestream Health Inc., Esaote SpA, Fujifilm Holdings Corporation (Hitachi, Ltd.), GE Healthcare, MR Solutions Ltd., Hologic Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers, Canon Medical Systems Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of chronic diseases surges the need for diagnostic imaging equipment for tracking disease progression or remission, helping guide treatment plans, thereby propelling the market. As per the survey by the Office for National Statistics, almost half the population of the UK reported having long-standing health problems. The adoption of advanced technology in medical imaging including AI, machine learning, and 3D/4D imaging for improved diagnostic accuracy, streamlining workflows, and enabling personalized healthcare are propelling the market growth.

Restraining Factors

The expensive procedures and equipment are restraining the market growth. Further, the concerns regarding workforce shortages are challenging the diagnostic imaging equipment market.

Market Segmentation

The United Kingdom diagnostic imaging equipment market share is classified into product, application, and end user.

- The CT scanners segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom diagnostic imaging equipment market is segmented by product into CT scanners, ultrasound systems, X-ray imaging systems, nuclear imaging systems, MRI systems, and mammography systems. Among these, the CT scanners segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. CT scanners are widely used in healthcare for the early diagnosis and treatment of diseases. There is increasing installation of this system for precise disease prognosis across healthcare settings. The increasing use of advanced forms of CT scanners for accurate diagnosis is propelling the market growth.

- The cardiology segment held the largest market share of the diagnostic imaging equipment market in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom diagnostic imaging equipment market is segmented by application into cardiology, oncology, neurology, orthopedics, gastroenterology, gynecology, and others. Among these, the cardiology segment held the largest market share of the diagnostic imaging equipment market in 2023 and is anticipated to grow at a significant CAGR during the projected period. Equipment like echocardiography is used for cardiology applications for the diagnosis of information in suspected cases of cardiac failure. It is also used in the diagnosis of valvular heart diseases. The increasing use of novel equipment for precise targeting of internal organs via real-time imaging is driving the market demand.

- The hospitals segment held the largest market share of the diagnostic imaging equipment market in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom diagnostic imaging equipment market is segmented by end user into hospitals, diagnostic imaging centers, and others. Among these, the hospitals segment held the largest market share of the diagnostic imaging equipment market in 2023 and is anticipated to grow at a significant CAGR during the projected period. In hospitals, techniques like X-rays, CT scans, MRI, and ultrasound, are crucial for visualizing internal structures and organs for diagnosis, treatment planning, and monitoring patient conditions. The increasing use of automated systems for disease diagnosis at hospitals is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. diagnostic imaging equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carestream Health Inc.

- Esaote SpA

- Fujifilm Holdings Corporation (Hitachi, Ltd.)

- GE Healthcare

- MR Solutions Ltd.

- Hologic Inc.

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Siemens Healthineers

- Canon Medical Systems Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, GE Healthcare signed an agreement with Alliance Medical to create a digital solution with the aim to enhance productivity within hospital radiology departments in the UK.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Diagnostic Imaging Equipment Market based on the below-mentioned segments:

UK Diagnostic Imaging Equipment Market, By Product

- CT Scanners

- Ultrasound systems

- X-ray Imaging Systems

- Nuclear Imaging Systems

- MRI Systems

- Mammography Systems

UK Diagnostic Imaging Equipment Market, By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

UK Diagnostic Imaging Equipment Market, By End User

- Hospitals

- Diagnostic Imaging Centers

- Others

Need help to buy this report?