United Kingdom E-Brokerage Market Size, Share, and COVID-19 Impact Analysis, By Service Provider (Full Time Broker and Discounted Broker), By Type (Commissions and Transaction Fees), and United Kingdom E-Brokerage Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited Kingdom E-Brokerage Market Insights Forecasts to 2033

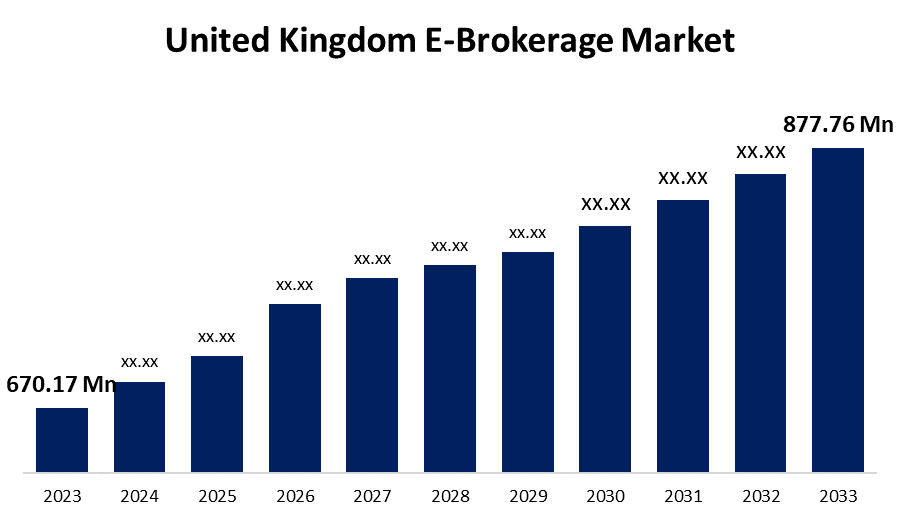

- The U.K. E-Brokerage Market Size was valued at USD 670.17 Million in 2023.

- The Market is Growing at a CAGR of 2.74% from 2023 to 2033

- The UK E-Brokerage Market Size is Expected to Reach USD 877.76 Million by 2033

Get more details on this report -

The U.K. E-Brokerage Market is Anticipated to Reach USD 877.76 Million by 2033, growing at a CAGR of 2.74% from 2023 to 2033.

Market Overview

The internet platform or service that makes it easier to purchase, sell, or trade financial securities including equities, bonds, and commodities is known as electronic brokerage, or e-brokerage. It eliminates the need for a traditional human stockbroker by enabling clients to manage their investments and complete transactions. Faster execution, fewer fees, and the ease of accessing financial markets via internet-enabled devices are the usual benefits of this digital strategy. The majority of e-brokerage companies offer easy registration and let consumers designate them as their financial managers. E-brokerage has grown significantly since the introduction of smart gadgets and broad Internet connectivity. Users may manage their transactions and portfolios with greater control and flexibility. Even after trading hours, one can always access their brokerage account. The primary benefit of e-brokerage is its much cheaper commission costs as compared to using a professional broker's services.

Report Coverage

This research report categorizes the market for the UK e-brokerage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom e-brokerage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. e-brokerage market.

United Kingdom E-Brokerage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 670.17 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.74% |

| 2033 Value Projection: | USD 877.76 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Service Provider, By Type |

| Companies covered:: | eToro, IG Group, Plus500, Capital.com, City Index, Robinhood, AvaTrad, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the services provided by E-brokerage platforms, including robo advising, algo trading, predictive stock trading, etc., has been largely attributed to technological advancement. Retail investors can now engage in the financial markets to a greater extent due to these instruments. By boosting trading frequency, the growing number of foreign companies listed on the nation's stock exchange is also helping to expand E-brokerage services. The UK economy is rapidly digitizing, which has greatly aided in the expansion of e-brokerage platforms. The need for easy-to-use and readily available investment platforms has increased as customers adopt digital solutions and online transactions at an increasing rate.

Restraining Factors

The growing cybersecurity threats in e-brokerage platforms provide a serious obstacle to the market's expansion.

Market Segmentation

The UK e-brokerage market share is classified into service provider and type.

- The full time broker segment is expected to hold the greatest market share through the forecast period.

The U.K. e-brokerage market is segmented by service provider into full time broker and discounted broker. Among these, the full time broker segment is expected to hold the greatest market share through the forecast period. Brokers working full-time have unmatched access to the stock market because to e-brokerage platforms. They can use mobile apps and internet platforms to trade and manage their investments at any time and from any location.

- The transaction fees segment is anticipated to hold a significant share of the United Kingdom e-brokerage market during the forecast period.

Based on the type, the UK e-brokerage market is divided into commissions and transaction fees. Among these, the transaction fees segment is anticipated to hold a significant share of the United Kingdom e-brokerage market during the forecast period. Every transaction completed on the platform, including the purchase and sale of securities, is subject to transaction fees. The growing use of subscription-based business models and the growth of digital assets are the driving forces behind these strategies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. e-brokerage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- eToro

- IG Group

- Plus500

- Capital.com

- City Index

- Robinhood

- AvaTrad

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, the news that UK brokerage firms Cenkos and FinnCap had decided to join in an all-share deal valued at around £42 million caught the market off guard.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom E-Brokerage Market based on the below-mentioned segments:

United Kingdom E-Brokerage Market, By Service Provider

- Full Time Broker

- Discounted Broker

United Kingdom E-Brokerage Market, By Type

- Commissions

- Transaction Fees

Need help to buy this report?