United Kingdom E-fuel Market Size, Share, and COVID-19 Impact Analysis, By State (Liquid and Gas), By Application (Automotive, Aviation, Industrial, Marine, and Others), and United Kingdom E-fuel Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom E-fuel Market Insights Forecasts to 2033

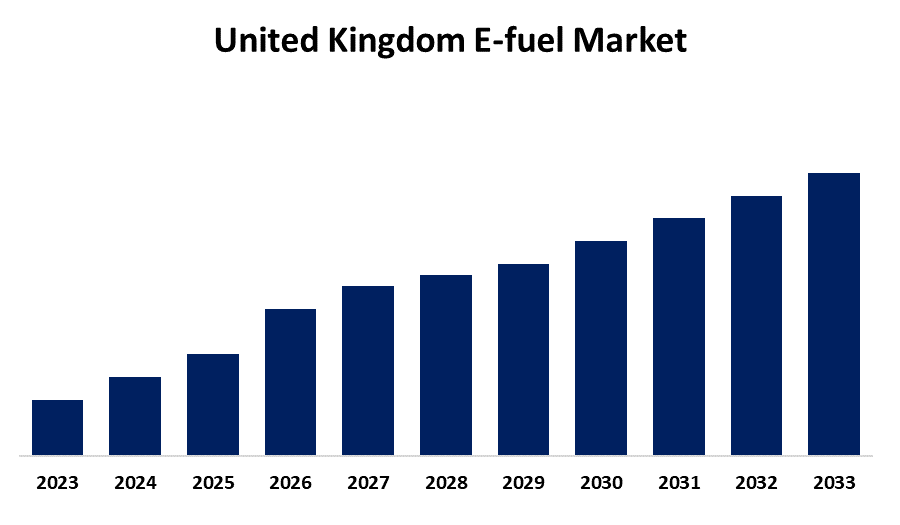

- The Market Size is Growing at a CAGR of 23.65% from 2023 to 2033

- The UK E-fuel Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. E-fuel Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 23.65% from 2023 to 2033.

Market Overview

E-fuel is made up of carbon and hydrogen atoms, just like ordinary gasoline and diesel. It is a significant advancement in replacing traditional fossil fuels. Nevertheless, it is known as synthetic fuel, which is made by converting carbon dioxide and water into hydrocarbon fuels like methane or artificial gas utilizing electricity, usually from renewable energies like solar or wind electricity. Through the carbon dioxide recycling process, synthetic fuels obtain their carbon through the atmosphere and their hydrogen comes from water. These fuels are thought to be a viable way to lower carbon emissions in the transportation industry since they can be recycled in current internal combustion engines with little change. Additionally, alternative fuels research and development has increased since the UK government pledged in 2022 to phase out gasoline and diesel vehicles by 2030. This important change in legislation is a key driver of the UK e-fuel business since it speeds up the need for ecologically acceptable and sustainable fuel substitutes, opening the door to a more sustainable future.

Report Coverage

This research report categorizes the market for the UK e-fuel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom e-fuel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. e-fuel market.

United Kingdom E-fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 23.65% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By State, By Application |

| Companies covered:: | INFINIUM, Liquid Wind, INERATEC, Siemens Energy, HIF Global, Zero Petroleum, Norsk e-Fuel, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The UK's net-zero emissions standards are driving the e-fuel market's expansion into new industries, including power generation, transportation, and industry. In the UK, transportation—especially shipping and aviation—is the most prevalent use of e-fuels. With synthetic fuels, aviation, one of the hardest industries to decarbonize, has advanced significantly. More commercial airlines are investigating the possibility of e-fuels after the Royal Air Force used them for its first carbon-neutral trip in 2021. In the UK, governments are encouraging the development of e-fuels and making more investments in renewable energy. As a result, e-fuels are becoming more affordable and competitive with fossil fuels. The development and marketing of e-fuels in the UK depend heavily on government backing, which propels the industry and aids in the accomplishment of sustainability objectives. Additionally, the UK aviation industry has made e-kerosene, also known as sustainable aviation fuel or SAF, a major focus of government initiatives like the Jet Zero Council. The goal is to drastically reduce the sector's carbon footprint by using this alternative fuel source in order to reach net-zero emissions by 2050. E-fuel sales in the UK are being driven by the government's growing emphasis on lowering carbon emissions.

Restraining Factors

The issues impeding the e-fuel market's development include restricted production capacity and technological constraints.

Market Segmentation

The UK e-fuel market share is classified into state and application.

- The liquid segment is expected to hold the greatest market share through the forecast period.

The U.K. e-fuel market is segmented by state into liquid and gas. Among these, the liquid segment is expected to hold the greatest market share through the forecast period. The segment is growing since liquid electronic fuels are widely used and do not require major adjustments to existing settings to increase the efficiency of automobiles, generators, and industrial processes.

- The automotive segment is anticipated to hold a significant share of the United Kingdom e-fuel market during the forecast period.

Based on the application, the UK e-fuel market is divided into automotive, aviation, industrial, marine, and others. Among these, the automotive segment is anticipated to hold a significant share of the United Kingdom e-fuel market during the forecast period. The product and other low-emission fuels must be quickly deployed if transportation decarbonization is to be accelerated. While the aviation and marine industries continue to rely more on fuel-based technologies for carbon removal, the road transport industry presents substantial electrification prospects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. e-fuel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INFINIUM

- Liquid Wind

- INERATEC

- Siemens Energy

- HIF Global

- Zero Petroleum

- Norsk e-Fuel

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 202, a £20 million grant was launched by the UK government to aid in the development of e-fuels and other sustainable fuel alternatives. The fund's objective is to hasten e-fuels commercialization and assist the UK in reaching its net-zero emissions goal.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom E-fuel Market based on the below-mentioned segments:

United Kingdom E-fuel Market, By State

- Liquid

- Gas

United Kingdom E-fuel Market, By Application

- Automotive

- Aviation

- Industrial

- Marine

- Others

Need help to buy this report?