United Kingdom Energy Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product (Energy Drinks and Energy Shots), By Type (Organic and Conventional), By Packaging (Bottles, Cans, and Others), By Distribution Channel (On-Trade and Off-Trade), and United Kingdom Energy Drinks Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Energy Drinks Market Insights Forecasts to 2033

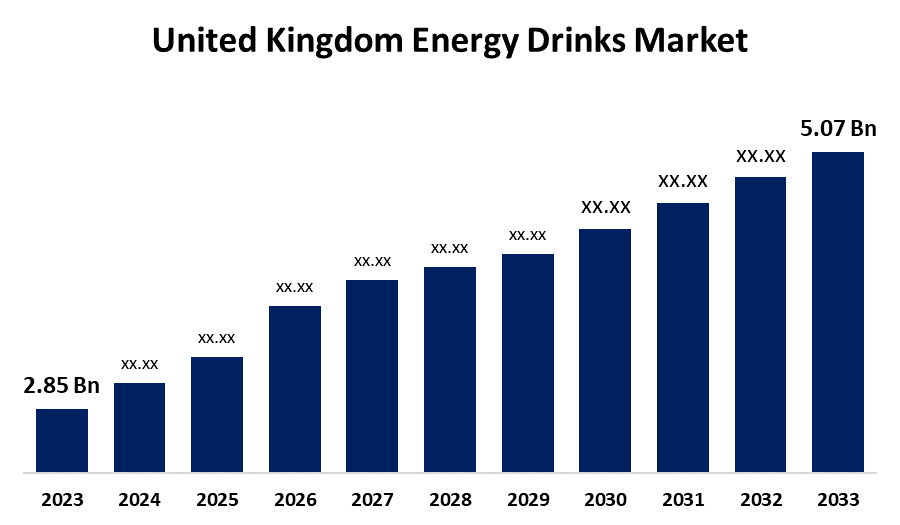

- The U.K. Energy Drinks Market Size was valued at USD 2.85 Billion in 2023.

- The U.K. Energy Drinks Market Size is Growing at a CAGR of 5.93% from 2023 to 2033

- The U.K. Energy Drinks Market Size is Expected to reach USD 5.07 Billion by 2033

Get more details on this report -

The United Kingdom Energy Drinks Market Size is Anticipated to exceed USD 5.07 Billion by 2033, Growing at a CAGR of 5.93% from 2023 to 2033. The growing advancements in manufacturing methods, innovations in product offerings, and a growing number of traditional & non-traditional outlets are driving the growth of the energy drinks market in the UK.

Market Overview

Energy drinks market refers to the industry of beverages containing stimulant compounds, typically caffeine that provide mental and physical stimulation. Energy drink is a type of functional beverage composed of high levels of caffeine, and sugar, along with other stimulants like taurine and herbal extracts that enhance energy and alertness. They are popularly used among fitness enthusiasts and athletes due to their quick energy-boosting capacity. These drinks provide quick and convenient ways to maintain alertness and performance levels among gamers during marathon sessions and professional tournaments. Promotion of beverages as functional drinks and brand introduction of energy drinks which cater to the demand for healthier alternatives. Further, there is a growing trend towards minimally processed and free from artificial additives drinks among consumers as this provides a cleaner and more natural alternative to conventional counterparts. The surging preference for organic and sugar-free energy drinks along with the growing e-commerce sector promoting the product market, thereby creating lucrative market opportunities for energy drinks.

Report Coverage

This research report categorizes the market for the UK energy drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom energy drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK energy drinks market.

United Kingdom Energy Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.93% |

| 2033 Value Projection: | USD 5.07 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product, By Type, By Packaging, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Suntory Holdings Limited, Red Bull GmbH, Monster Energy Company, The Coca-Cola Company, GlaxoSmithKline PLC, Global Trade Holdings Co., Ltd., PepsiCo Inc., Max Muscle Nutrition, TSI Consumer Goods GmbH, Nestle SA, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market trend and consumer inclination towards sustainable practices, health-focused formulations, and innovative delivery methods leads to the advancement in energy drink manufacturing, thereby propelling the market growth. Innovations in product offerings that involve flavor profiles, functional ingredients, and health-conscious options responsible for propelling the energy drinks market. The availability of energy drinks in traditional outlets including supermarkets and convenience stores as well as non-traditional ones including gyms, health food stores, online platforms, and vending machines are promoting the market growth.

Restraining Factors

The increasing concerns regarding the potential health risks associated with excess consumption of drinks are challenging the market growth. The massive competition with well-known brands as well as significant advertising budgets hampering the market growth.

Market Segmentation

The United Kingdom energy drinks market share is classified into product, type, packaging, and distribution channel.

- The energy drinks segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom energy drinks market is segmented by product into energy drinks and energy shots. Among these, the energy drinks segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Energy drinks have potentially reduced chances of health risks due to the lower content of caffeine as compared to energy shots.

- The conventional segment held the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom energy drinks market is segmented by type into organic and conventional. Among these, the conventional segment held the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period. Conventional energy drinks appeal to consumers looking for an immediate energy kick without emphasizing natural or organic ingredients. The ease of accessibility of conventional energy drinks drives market growth.

- The cans segment accounted for the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom energy drinks market is segmented by packaging into bottles, cans, and others. Among these, the cans segment accounted for the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period. The need for convenient packaging as well as its ease of transportation and recyclability of cans propel the market demand.

- The off-trade segment accounted for the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom energy drinks market is segmented by distribution channel into on-trade and off-trade. Among these, the off-trade segment accounted for the largest share of the UK energy drinks market in 2023 and is expected to grow at a significant CAGR during the projected period. Off-trade segment includes supermarkets, convenience stores, and online retailers where energy drinks are purchased and consumed outside the premises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. energy drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suntory Holdings Limited

- Red Bull GmbH

- Monster Energy Company

- The Coca-Cola Company

- GlaxoSmithKline PLC

- Global Trade Holdings Co., Ltd.

- PepsiCo Inc.

- Max Muscle Nutrition

- TSI Consumer Goods GmbH

- Nestle SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Acti+ introduced a refreshing clean and natural alternative to the energy drink market, promising positive energy only. The brand-new Strawberry & Dragon Fruit, Peach & Apricot, and Pineapple & Yuzu flavoured energy drinks are packed with nootropics, 8 essential vitamins and minerals, and contain zero sugar, designed to only offer natural, clean energy, along with a whole host of health benefits.

- In July 2024, UK-based functional energy drinks maker Tenzing launched the “world’s strongest natural energy drink”. The new Super Natural Energy drink would contain 200mg of “natural caffeine” sourced from green coffee and green tea. It is available in a Fiery Mango flavour in the UK on Tenzing’s website, Amazon and Holland and Barrett stores.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom energy drinks market based on the below-mentioned segments

UK Energy Drinks Market, By Product

- Energy Drinks

- Energy Shots

UK Energy Drinks Market, By Type

- Organic

- Conventional

UK Energy Drinks Market, By Packaging

- Bottles

- Cans

- Others

UK Energy Drinks Market, By Distribution Channel

- On-Trade

- Off-Trade

Need help to buy this report?