United Kingdom Facility Management Market Size, Share, and COVID-19 Impact Analysis, By Offering (In-House and Outsourced), By Industry (Healthcare, Business & Corporate, Manufacturing, and Government), and United Kingdom Facility Management Market Insights, Industry Trend, Forecasts to 2033.

Industry: Electronics, ICT & MediaUnited Kingdom Facility Management Market Insights Forecasts to 2033

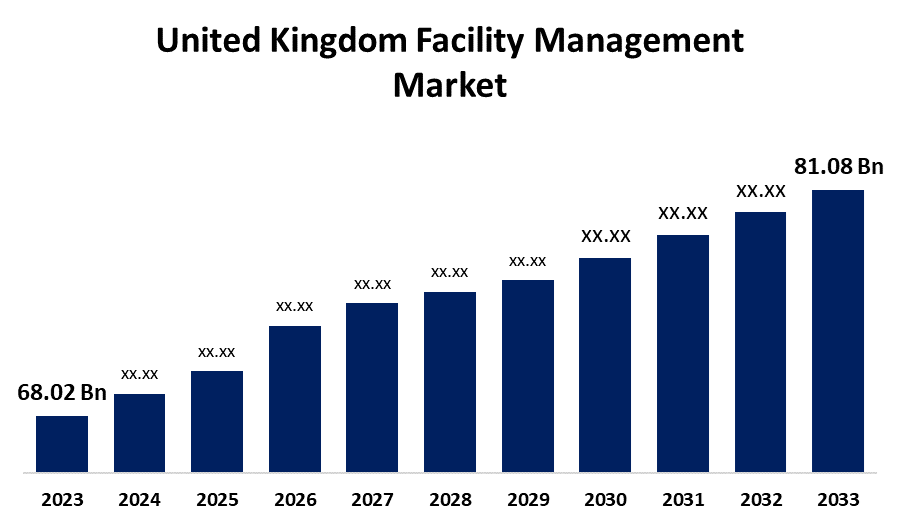

- The U.K. Facility Management Market Size was valued at USD 68.02 Billion in 2023.

- The Market is Growing at a CAGR of 1.77% from 2023 to 2033

- The U.K. Facility Management Market Size is Expected to Reach USD 81.08 Billion by 2033

Get more details on this report -

The UK Facility Management Market is Anticipated to Reach USD 81.08 Billion by 2033, growing at a CAGR of 1.77% from 2023 to 2033.

Market Overview

Facility management is an organizational function that aims to increase people's quality of life and the efficiency of the main business by integrating individuals, locations, and processes within the physical environment. More than £65 billion is contributed to the UK economy by the facilities management industry, of which over £13 billion is directly derived from public sector procurement. This indicates that the UK Government controls nearly 20% of the market, which presents ample opportunity to optimize the efficacy and efficiency of public sector facilities and workplaces. One driving aspect is the significant role that the government plays in facilities management, which emphasizes how crucial it is to maximize these services to guarantee that the facilities management vision is realized. The UK facilities management business is expanding due to strong government investment and support, which spurs innovation and better service delivery. Additionally, the demand for sustainability and energy efficiency is driving the facilities management business in the UK. Key factors include the use of sophisticated HVAC systems, efficient lighting, and renewable energy sources. Energy management systems are used by facility managers to monitor consumption and cut expenses. The market is also pushed forward by the government's pledge to achieve net-zero emissions by 2050, which encourages investment in environmentally friendly solutions.

Report Coverage

This research report categorizes the market for United Kingdom facility management market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.K. facility management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK facility management market.

United Kingdom Facility Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 68.02 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.77% |

| 2033 Value Projection: | USD 81.08 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Offering, By Industry, and COVID-19 Impact Analysis |

| Companies covered:: | CBRE Group, Inc., Mitie Group PLC, EMCOR Facilities Services Inc., Interserve Limited, G4S Facilities Management UK Limited, ISS UK, JLL Limited, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK's expanding emphasis on operational effectiveness, cost reduction, environmentally friendly procedures, integrating cutting-edge technology, and proactive maintenance methods to ensure seamless company operations and satisfaction for workers within places of employment, particularly in rapidly expanding urban environments, are the main factors driving the growing demand for facility management services. Additionally, innovations fueled by technology are revolutionizing the FM sector in the United Kingdom. The FM market is expanding as a result of facility managers using IoT, BIM, AI, and other cutting-edge technologies more frequently to improve operational effectiveness, cut expenses, and deliver higher-quality services.

Restraining Factors

A major issue facing the facility management (FM) industry in the UK is the growing skills gap and scarcity of qualified personnel.

Market Segmentation

The UK facility management market share is classified into offering and industry.

- The in-house segment is anticipated to hold a significant share of the U.K. facility management market during the forecast period.

Based on the offering, the United Kingdom facility management market is divided into in-house and outsourced. Among these, the in-house segment is anticipated to hold a significant share of the U.K. facility management market during the forecast period. Large companies that need a lot of facility management are choosing internal solutions more and more in order to maintain direct control over operations and ensure that they are in line with corporate goals.

- The healthcare segment is anticipated to hold a significant share of the United Kingdom facility management market during the forecast period.

Based on the industry, the UK facility management market is divided into healthcare, business & corporate, manufacturing, and government. Among these, the healthcare segment is anticipated to hold a significant share of the United Kingdom facility management market during the forecast period. Facility management plays a crucial role in the healthcare industry by guaranteeing the cleanliness, safety, and effectiveness of clinics, hospitals, and other medical facilities. This method also includes managing healthcare waste, maintaining compliance with health and safety regulations, managing heating, ventilation, and air conditioning systems, and maximizing space use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK facility management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CBRE Group, Inc.

- Mitie Group PLC

- EMCOR Facilities Services Inc.

- Interserve Limited

- G4S Facilities Management UK Limited

- ISS UK

- JLL Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, CBRE Group, Inc. revealed that it intends to merge its project administration division with Turner & Townsend, a majority-owned division that provides program administration, budget consultancy, and project management services worldwide.

Market Segment

This study forecasts revenue at the U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Facility Management Market based on the below-mentioned segments:

United Kingdom Facility Management Market, By Offering

- In-House

- Outsourced

United Kingdom Facility Management Market, By Industry

- Healthcare

- Business & Corporate

- Manufacturing

- Government

Need help to buy this report?