United Kingdom Fermentation Chemical Market Size, Share, and COVID-19 Impact Analysis, By Product (Alcohols, Enzymes, Organic Acids, and Others), By Application (Industrial, Food & Beverages, and Plastic & Fibers), and United Kingdom Fermentation Chemical Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited Kingdom Fermentation Chemical Market Insights Forecasts to 2033

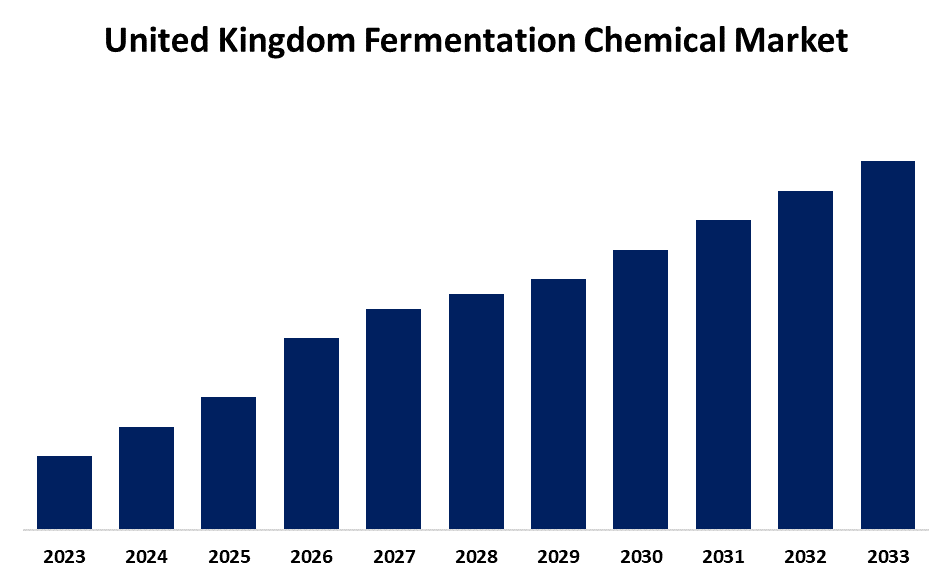

- The Market Size is Growing at a CAGR of 6.2% from 2023 to 2033

- The UK Fermentation Chemical Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Fermentation Chemical Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 6.2% from 2023 to 2033.

Market Overview

The process of fermentation, a metabolic reaction in which microorganisms like bacteria, yeast, or fungi transform organic substrates into chemical compounds, is initiated or accelerated by fermentation chemicals. These substances, which include alcohols, acids, and enzymes, are crucial to the food and beverage, biofuel, and pharmaceutical industries. Antibiotics, alcoholic drinks, and organic acids are just a few of the molecules that are produced during the fermentation process and are therefore crucial for supporting ecologically friendly and sustainable industrial practices. Additionally, the strong demand for methanol and ethanol, as well as the requirement to meet demands from various chemicals and industrial end-use applications, are predicted to further boost the UK's need for fermentation chemicals. Additionally, a comparable, presumably higher demand for different organic acids from UK fiber and plastic manufacturing companies will have a major impact on the increase over the foreseeable future.

Report Coverage

This research report categorizes the market for the UK fermentation chemical market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom fermentation chemical market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. fermentation chemical market.

United Kingdom Fermentation Chemical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Croda International plc, Johnson Matthey plc, Univar Solutions, BASF SE, INEOS, Honeywell International Inc., Dow Chemical Company, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

In the UK, 2.59 million people drink yogurt drinks once a day, while 4.71 million people eat yogurt every day. With a market value of more than one billion euros in 2021, the UK has one of the biggest probiotic yogurt markets in Europe. The market for fermentation chemicals in the UK is being driven further by the rising popularity and consumption of yogurt and fermented foods. One of the main factors propelling the UK market for fermentation chemicals is the growing demand for products based on fermentation. Additionally, the typical adult in the UK drinks roughly 9.7 liters of pure alcohol per year, or roughly 18 units every week. The UK market for fermentation chemicals is growing as a result of rising alcohol consumption. Fermentation chemicals are extremely necessary for the production of alcohol, which fuels the UK market's expansion.

Restraining Factors

Lactic acid fermentation is expensive, which limits its application in the dairy sector. Throughout the course of the forecast period, this factor is anticipated to restrain the market expansion for fermentation chemicals.

Market Segmentation

The UK fermentation chemical market share is classified into product and application.

- The alcohols segment is expected to hold the greatest market share through the forecast period.

The U.K. fermentation chemical market is segmented by product into alcohols, enzymes, organic acids, and others. Among these, the alcohols segment is expected to hold the greatest market share through the forecast period. The use of alcohol in pharmaceutical applications for the creation of antiseptics, anesthetics, liniments, lotions, and medications has increased dramatically.

- The industrial segment is anticipated to hold a significant share of the United Kingdom fermentation chemical market during the forecast period.

Based on the application, the UK fermentation chemical market is divided into industrial, food & beverages, and plastic & fibers. Among these, the industrial segment is anticipated to hold a significant share of the United Kingdom fermentation chemical market during the forecast period. Industrial fermentation uses microorganisms such as bacteria, fungus, and eukaryotic cells to produce products including ethanol, citric acid, and acetic acid. Growing investments in biotechnology, R&D, and manufacture from renewable raw materials are responsible for its significant share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. fermentation chemical market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Croda International plc

- Johnson Matthey plc

- Univar Solutions

- BASF SE

- INEOS

- Honeywell International Inc.

- Dow Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, the contract development and manufacturing organization (CDMO) Fujifilm Diosynth Biotechnologies has established a microbial fermentation production plant in Billingham.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Fermentation Chemical Market based on the below-mentioned segments:

United Kingdom Fermentation Chemical Market, By Product

- Alcohols

- Enzymes

- Organic Acids

- Others

United Kingdom Fermentation Chemical Market, By Application

- Industrial

- Food & Beverages

- Plastic & Fibers

Need help to buy this report?