United Kingdom Fintech Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-premises and Cloud-based), By Application (Payment and Fund Transfer, Loans, Insurance, Personal Finance, and Wealth Management), and United Kingdom Fintech Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited Kingdom Fintech Market Insights Forecasts to 2033

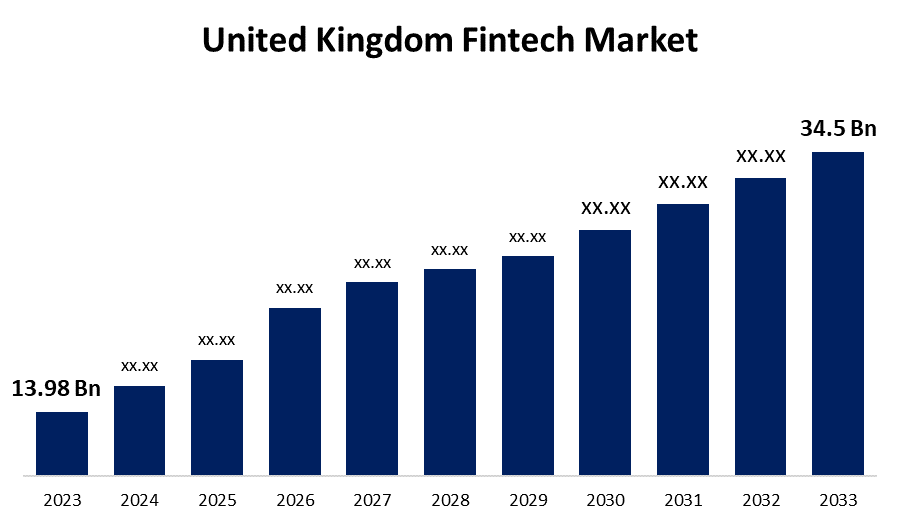

- The United Kingdom Fintech Market Size was valued at USD 13.98 Billion in 2023.

- The Market is Growing at a CAGR of 9.45% from 2023 to 2033

- The United Kingdom Fintech Market Size is Expected to Reach USD 34.5 Billion by 2033

Get more details on this report -

The United Kingdom Fintech Market is Anticipated to Exceed USD 34.5 Billion by 2033, growing at a CAGR of 9.45% from 2023 to 2033. The market is expanding as a result of the growing use of digital banking and payment systems.

Market Overview

Fintech, often known as financial technology, is a technology that improves or automates financial services and operations. It uses sophisticated software and algorithms to assist business owners, enterprises, and individuals in managing their money via a computer or smartphone. It is commonly used to automate insurance, investments, trading, risk management, and banking services, among others, and can give financial information. Digital payments, peer-to-peer lending, crowdfunding, robo-advisory services, mobile banking, insurance technology (insurtech), regtech (regulatory technology), and many more applications are included in the broad category of fintech. By reaching underprivileged people, these technologies seek to improve financial transactions' efficiency, accessibility, ease, and transparency while also promoting financial inclusion. To offer alternatives to established financial institutions including banks and upend their business models, fintech businesses frequently work together or compete with them. The fintech industry is moving quickly due to developments in regulations, shifting customer expectations, and technology breakthroughs. It has drawn a lot of interest from regulators, incumbents, investors, and entrepreneurs, and it is expected to influence the financial services industry going forward.

Report Coverage

This research report categorizes the market for the United Kingdom fintech market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom fintech market.

United Kingdom Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.98 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.45% |

| 2033 Value Projection: | USD 34.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Mode, By Application |

| Companies covered:: | MoneyBox, Monzo, Transfer Wise, Payment Sense, Starling Bank, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The UK fintech market is undergoing dynamic transitions, due to important drivers and developing trends. The increasing adoption of digital banking and payment solutions is driving market growth. Furthermore, fintech companies utilize mobile technology and artificial intelligence to offer new and user-friendly banking services, resulting in another important growth driver. Aside from that, the growing popularity of open banking, aided by governmental initiatives, has prompted various strategic collaborations between traditional financial institutions and fintech startups, resulting in improved product offerings and customer service. Furthermore, with a boom in interest in digital assets, fintech companies are looking into blockchain applications for secure and transparent transactions. The growing need for secure and convenient fintech services is expected to drive market expansion during the forecast period.

Restraining Factors

Regulatory problems are projected to be a major impediment in the fintech business, as fintech companies frequently face complex and time-consuming regulatory procedures. Fintech companies operate in a dynamic and changing regulatory environment, with varied levels of regulation and compliance requirements across jurisdictions. Navigating complicated and frequently fragmented regulations may be time-consuming and costly, particularly for startups and smaller businesses.

Market Segmentation

The United Kingdom fintech market share is classified into deployment mode and application.

- The on-premises segment is expected to hold the largest market share through the forecast period.

The United Kingdom fintech market is segmented by deployment mode into on-premises and cloud-based. Among these, the on-premises segment is expected to hold the largest market share through the forecast period. In an on-premise deployment, financial services are hosted and controlled on the company's hardware and servers, which are located within its premises. This mode assures that the organization maintains complete control over its data and systems. They usually require considerable upfront costs for infrastructure and software acquisitions, as well as ongoing maintenance and update fees.

- The payment and fund transfer segment is expected to hold a significant market share through the forecast period.

The United Kingdom fintech market is segmented by application into payment and fund transfer, loans, insurance, personal finance, and wealth management. Among these, the payment and fund transfer segment is expected to hold a significant market share through the forecast period. Fintech has significantly increased the speed and convenience of payments and fund transfers. Mobile payment apps enable rapid, contactless payments, and peer-to-peer networks simplify sending and receiving money between individuals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MoneyBox

- Monzo

- Transfer Wise

- Payment Sense

- Starling Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Moneybox, the award-winning savings and investing platform, has launched an entirely new market-leading Cash ISA with a variable AER of 4.65% on deposits of GBP 500 (USD 629.99) or more. Developed to encourage people to build their savings tax-free over a medium-long period, this new Cash ISA permits up to three withdrawals within 12 months of account establishment without sacrificing the appealing interest rate.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Fintech Market based on the below-mentioned segments:

United Kingdom Fintech Market, By Deployment Mode

- On-premises

- Cloud-based

United Kingdom Fintech Market, By Application

- Payment and Fund Transfer

- Loans

- Insurance

- Personal Finance

- Wealth Management

Need help to buy this report?