United Kingdom Foodservice Market Size, Share, and COVID-19 Impact Analysis, By Type (Full Service, Quick Service, Institutes, and Others), By Service Type (Commercial and Non-Commercial), and United Kingdom Foodservice Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited Kingdom Foodservice Market Insights Forecasts to 2033

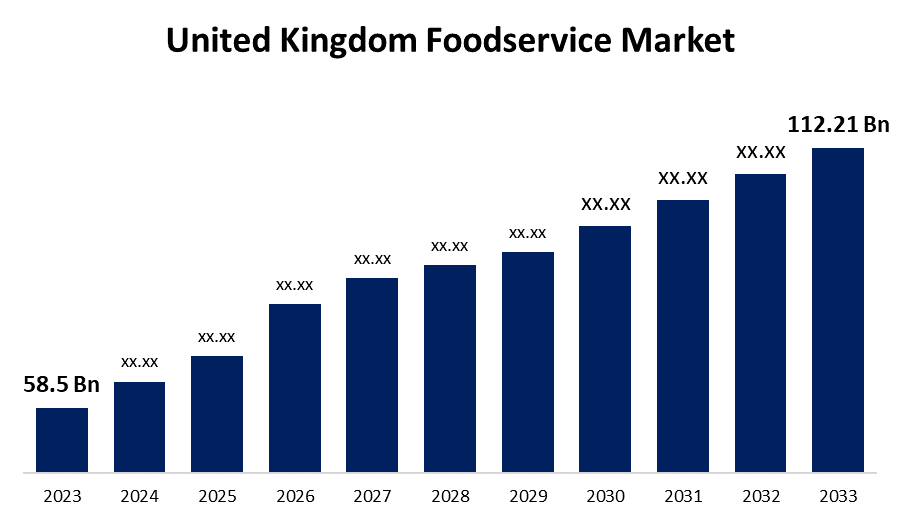

- The UK Foodservice Market Size was valued at USD 58.5 Billion in 2023.

- The Market is growing at a CAGR of 6.73% from 2023 to 2033

- The U.K. Foodservice Market Size is expected to reach USD 112.21 Billion by 2033

Get more details on this report -

The UK Foodservice Market is anticipated to exceed USD 112.21 Billion by 2033, growing at a CAGR of 6.73% from 2023 to 2033.

Market Overview

The preparation, handling, packaging, and distribution of food, beverages, and associated services by a business is referred to as food service. Various industries, including restaurants, cafes, bars, cafeterias, catering services, and institutional food providers, are the key participants in this market. Foodservice is defined by food safety regulators as any establishment that provides meals and snacks for customers to eat right away or take away. Retailers of food are also included in this industry. Food service companies strive to uphold existing rules and codes regarding food safety while providing the community with high-quality meals and services. Simultaneously, evolving consumer lifestyles marked by greater urbanization and hectic schedules drive market expansion.

Report Coverage

This research report categorizes the market for the UK foodservice market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom foodservice market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. foodservice market.

United Kingdom Foodservice Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 58.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.73% |

| 2033 Value Projection: | USD 112.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Service Type |

| Companies covered:: | Compass Group Plc, Creed Foodservice, Greggs Plc, Hannah Food Service, JJ Food Service Ltd., JMP Foodservice, Kitwave Group plc, Mitchells and Butlers plc, MKG Foods, The Restaurant Group PLC, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Food and catering services can be obtained with the use of the balanced scorecard, an additional instrument. It serves as a comprehensive tool for defining technical specifications and assessing offers, going beyond nutrition, resource efficiency, and manufacturing standards. In addition to encouraging investment and innovation, it contains award criteria for commending best practices. The main driver of the market is the emergence of online ordering platforms and meal delivery apps. Another significant trend in the food service industry in the United Kingdom is the increasing integration of technology into food service operations.

Restraining Factors

The food service industry is extremely competitive with businesses ranging from upscale restaurants to street vendors. Food service providers must spend a lot of money to comply with strict health and safety regulations, which lowers profit margins.

Market Segmentation

The United Kingdom foodservice market share is classified into type and service type.

- The full service segment is expected to hold a significant market share through the forecast period.

The United Kingdom foodservice market is segmented by type into full service, quick service, institutes, and others. Among these, the full service segment is expected to hold a significant market share through the forecast period. Due to full-service restaurants appeal to a wider customer base looking for a range of dining experiences by offering a large selection of menu options across different meal kinds, including breakfast, lunch, and supper.

- The commercial segment is anticipated to hold a significant share of the United Kingdom foodservice market during the forecast period.

Based on the service type, the United Kingdom foodservice market is divided into commercial and non-commercial. Among these, the commercial segment is anticipated to hold a significant share of the United Kingdom foodservice market during the forecast period. Commercial food service enterprises catering to a diverse clientele include restaurants, cafes, fast food shops, and similar businesses. Commercial food services are necessary since these establishments serve as important dining locations for individuals, families, and corporate clients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK foodservice market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Compass Group Plc

- Creed Foodservice

- Greggs Plc

- Hannah Food Service

- JJ Food Service Ltd.

- JMP Foodservice

- Kitwave Group plc

- Mitchells and Butlers plc

- MKG Foods

- The Restaurant Group PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, the leading international food service operator Compass Group PLC (LSE: CPG) has agreed to purchase CH&CO, a premium contract and hospitality services provider in the UK and Ireland, for an initial enterprise value of £475 million or $600 million.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Foodservice Market based on the below-mentioned segments

United Kingdom Foodservice Market, By Type

- Full Service

- Quick Service

- Institutes

- Others

United Kingdom Foodservice Market, By Service Type

- Commercial

- Non-Commercial

Need help to buy this report?