United Kingdom Forage Seeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Alfalfa, Clover, and Ryegrass), By Livestock (Poultry, Cattle, and Swine), By Species (Legumes and Grasses), By Origin (Organic and Inorganic), and United Kingdom Forage Seeds Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureUnited Kingdom Forage Seeds Market Insights Forecasts to 2033

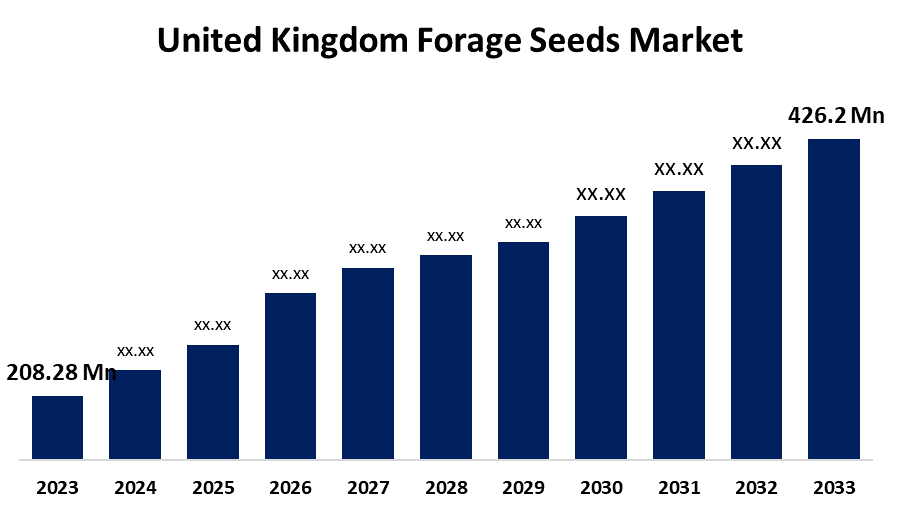

- The United Kingdom Forage Seeds Market Size was valued at USD 208.28 Million in 2023.

- The Market is Growing at a CAGR of 7.42% from 2023 to 2033

- The United Kingdom Forage Seeds Market Size is Expected to reach USD 426.2 Million by 2033

Get more details on this report -

The United Kingdom Forage Seeds Market is Anticipated to Exceed USD 426.2 Million by 2033, growing at a CAGR of 7.42% from 2023 to 2033.

Market Overview

Plants or plant parts used as forages are consumed by herbivorous animals. Plants are used as forage by grazing animals such as cows, horses, sheep, goats, llamas, and others. Specifically, the leaves and stems of these plants are devoured. The main purpose of forage crops is to feed livestock or to be stored as hay or silage. Compared to other feeds like oilseed and wheat bran, forage seeds are less expensive. Pesticides and artificial fertilizers are not necessary for forage seeds to develop properly. Forage seeds help to improve and preserve soil richness and quality. Forage seed helps to lower the cost of nitrogen fertilizer as well as the energy required to apply fertilizers. Forage seeds are plants or plant parts other than grains that are fed to livestock such as cattle, poultry, aquaculture, and swine. The product has various benefits, including reduced weed population, enhanced yield, less disease in subsequent crops, greater and deeper carbon retention for greenhouse gas reduction, improved internal drainage, and water filtration. The product is classified as organic or inorganic, with two forms: green and dry. There are four types: chicory, ryegrass, alfalfa, and clover. One of the main drivers of growth in the forage seeds market in the United Kingdom is the growing demand for animal feeds that are high in nutrients and organic.

Report Coverage

This research report categorizes the market for the United Kingdom forage seeds market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom forage seeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom forage seeds market.

United Kingdom Forage Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 208.28 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.42% |

| 2033 Value Projection: | 426.2 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 144 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Livestock, By Species, By Origin and COVID-19 Impact Analysis |

| Companies covered:: | A.W. Jenkinson Farming Ltd, Agrii, Barenbrug UK, Breedon Group plc, Bunn Fertiliser Ltd, Cotswold Seeds Ltd, DLF Seeds Ltd, And Others Key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in demand for dairy and meat products, as well as the producers' increasing output of forage seeds for animal feed, are major factors driving market growth. According to the Food and Agriculture Organization, consumers' increased need for proteins is driving greater meat consumption, which is propelling the rise of the United Kingdom Forage Seed Market over the expected period. The growth of the forage seeds market is primarily determined by the increasing demand for animal fodder due to an increase in livestock population, government subsidiaries, and a decrease in animal grazing land. Farmers also favor the production of these seeds due to their financial advantages, which include crop rotation, risk diversification, reduced soil erosion, and enhanced soil structure. Evolving new technologies and advances in seed genetics are anticipated to create unexplored potential for market players. As individuals become more cognizant of their health, the demand for organic foods is increasing. The meat of forage-fed animals is healthier, which helps to prevent obesity, cholesterol, cancer, lipids, and hypertension. This is projected to open up attractive future potential for the Forage Seeds Market.

Restraining Factors

Animals that are exposed to prussic acid suffocate to death as it stops their blood from carrying oxygen. Poor-quality ingredients are the cause of animal ailments associated with forage. Anti-quality components are chemicals that have an impact on an animal's intake of fodder or that make them respond negatively when they eat the forage. Certain dangerous materials are created by nature. Insect infestations are the source of some, and microbiological activity is the result of others.

Market Segmentation

The United Kingdom Forage Seeds Market share is classified into product type, livestock, species, and origin.

- The alfalfa segment is expected to hold the largest market share through the forecast period.

The United Kingdom forage seeds market is segmented by product type into alfalfa, clover, and ryegrass. Among these, the alfalfa segment is expected to hold the largest market share through the forecast period. It is mostly used to feed cattle, goats, horses, and dairy cows. Alfalfa helps animals grow faster by boosting digestibility and intestinal health. It also improves livestock productivity by producing higher-quality livestock.

- The cattle segment dominates the market with the largest market share over the predicted period.

The United Kingdom forage seeds market is segmented by livestock into poultry, cattle, and swine. Among these, the cattle segment dominates the market with the largest market share over the predicted period. The quality of milk and meat products is determined by the feed used to raise cattle. Livestock producers add forage seeds to their cattle feed to ensure maximum production and performance. They aid in increasing milk production and strengthen cattle's immune systems, resulting in higher feed efficiency.

- The legumes segment is expected to hold the largest share of the United Kingdom forage seeds market during the forecast period.

Based on the species, the United Kingdom forage seeds market is divided into legumes and grasses. Among these, the legumes segment is expected to hold the largest share of the United Kingdom forage seeds market during the forecast period. Legumes have nitrogen-fixing nodules on their roots that aid in nitrogen fixation from the atmosphere. Forage legumes boost animal health by delivering critical nutrients such as protein. Legumes improve soil fertility, lowering the cost of crop production and animal feed.

• The organic segment is expected to hold the largest share of the United Kingdom forage seeds market during the forecast period.

Based on the origin, the United Kingdom forage seeds market is divided into organic and inorganic. Among these, the organic segment is expected to hold the largest share of the United Kingdom forage seeds market during the forecast period. Forage seed produced utilizing organic practices is becoming more and more necessary as the number of organic animal farms increases. Forage legumes can help fix atmospheric nitrogen, or animal dung can be used to supply nitrogen to organic systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom forage seeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A.W. Jenkinson Farming Ltd

- Agrii

- Barenbrug UK

- Breedon Group plc

- Bunn Fertiliser Ltd

- Cotswold Seeds Ltd

- DLF Seeds Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2021, Germinal has introduced a brand-new grass seed blend intended exclusively for golf greens.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Forage Seeds Market based on the below-mentioned segments:

United Kingdom Forage Seeds Market, By Type

- Alfalfa

- Clover

- Ryegrass

United Kingdom Forage Seeds Market, By Livestock

- Poultry

- Cattle

- Swine

United Kingdom Forage Seeds Market, By Species

- Legumes

- Grasses

United Kingdom Forage Seeds Market, By Origin

- Organic

- Inorganic

Need help to buy this report?