United Kingdom Funeral and Cremation Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Burial, Cremation, Memorial, and Others), By Arrangement (Immediate-Need and Pre-Planned), and United Kingdom Funeral and Cremation Services Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Funeral and Cremation Services Market Insights Forecasts to 2033

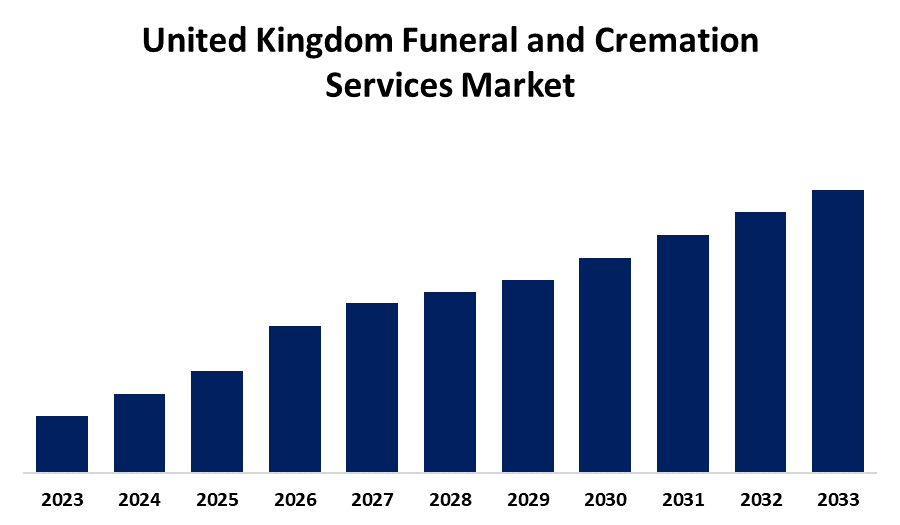

- The Market Size is Growing at a CAGR of 3.1% from 2023 to 2033

- The UK Funeral and Cremation Services Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Funeral and Cremation Services Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 3.1% from 2023 to 2033.

Market Overview

A temporary structure known as funeral and cremation services, staging, or funeral and cremation services is utilized for holding the workers and supplies during all phases of construction, maintenance, and rehabilitation of buildings, suspension bridges, and all other building projects. By offering a safe working platform, funeral, and cremation services lower the possibility of mishaps and falls. It helps shield employees from potential risks at high altitudes by incorporating safety elements like guardrails, toe boards, and safety nets. Funeral and cremation services encourage a safer working environment by establishing a stable and controlled atmosphere. The UK is experiencing a noticeable rise in construction activity, particularly within industrial areas, alongside increased projects for bridges and various infrastructure developments, with the public sector playing a significant role in driving this growth; this includes new industrial buildings, road expansions, railway upgrades, and major bridge construction projects. This increase in construction projects drives the market for funeral and cremation services in the UK.

Report Coverage

This research report categorizes the market for the UK funeral and cremation services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom funeral and cremation services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. funeral and cremation services market.

United Kingdom Funeral and Cremation Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Arrangement |

| Companies covered:: | Dignity Funerals, Co-Op Funeralcare, Simplicity Cremations, Distinct Cremations, Avalon Funeral Plans, Golden Charter, Pure Cremation, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The UK's funeral and cremation services market is expected to expand during the forecast period due to the country's elderly population, the growing preference for cremation over conventional burial, the adaptation of many crematoriums and funeral directors to meet this demand, and shifting societal perceptions of death. Additionally, the UK's population is expected to exceed 70 million people by 2026, mostly due to migration. Additionally, 19% of the population in the UK will be 65 or older in 2022. By 2072, it is anticipated that this percentage would rise to 27%. Funeral and cremation services are becoming more and more popular in the UK due to the country's aging population. Furthermore, according to a BBC survey, nearly half of England's cemeteries may run out of room in the next 20 years. Additionally, 25% of the 358 local authorities who responded to the BBC stated that they will run out of space for graves in ten years. Funeral and cremation services are becoming more and more popular in the UK due to a lack of room for these ceremonies, growing urbanization, and the lack of space in urban areas.

Restraining Factors

Potential clients are turned off by traditional funeral services' growing expenses. Many families have limited resources, which makes them select more affordable solutions.

Market Segmentation

The UK funeral and cremation services market share is classified into type and arrangement.

- The cremation segment is expected to hold the greatest market share through the forecast period.

The U.K. funeral and cremation services market is segmented by type into burial, cremation, memorial, and others. Among these, the cremation segment is expected to hold the greatest market share through the forecast period. Compared to traditional funerals, which entail greater costs for caskets, burial grounds, and continuing upkeep fees, cremation is frequently seen as a more affordable choice. Cremation is a desirable option for families trying to control funeral expenses while maintaining a respectable service because of its affordability.

- The pre-planned segment is anticipated to hold a significant share of the United Kingdom funeral and cremation services market during the forecast period.

Based on the arrangement, the UK funeral and cremation services market is divided into immediate-need and pre-planned. Among these, the pre-planned segment is anticipated to hold a significant share of the United Kingdom funeral and cremation services market during the forecast period. Consumers' growing awareness of the advantages of pre-planning funerals is another factor driving this growth. These advantages include lowering expenses, relieving family strain, and guaranteeing that individual preferences are honoured.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. funeral and cremation services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dignity Funerals

- Co-Op Funeralcare

- Simplicity Cremations

- Distinct Cremations

- Avalon Funeral Plans

- Golden Charter

- Pure Cremation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, the FSE Group, the designated fund manager, has helped Aura Life, a company that offers funeral services and funeral plans, obtain a £350,000 equity stake from the Coast to Capital Growth Fund. In addition to funding from the Oxford Innovation Fund and the FSE Angel Investor Network, the £2+million capital round will help businesses expand and create 16 new employments.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Funeral and Cremation Services Market based on the below-mentioned segments:

United Kingdom Funeral and Cremation Services Market, By Type

- Burial

- Cremation

- Memorial

- Others

United Kingdom Funeral and Cremation Services Market, By Arrangement

- Immediate-Need

- Pre-Planned

Need help to buy this report?