United Kingdom Glass Bottles and Containers Market Size, Share, and COVID-19 Impact Analysis, By Color (Amber, Flint, and Green), By End-User (Beverages, Food, Cosmetics, and Others), and United Kingdom Glass Bottles and Containers Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited Kingdom Glass Bottles and Containers Market Insights Forecasts to 2033

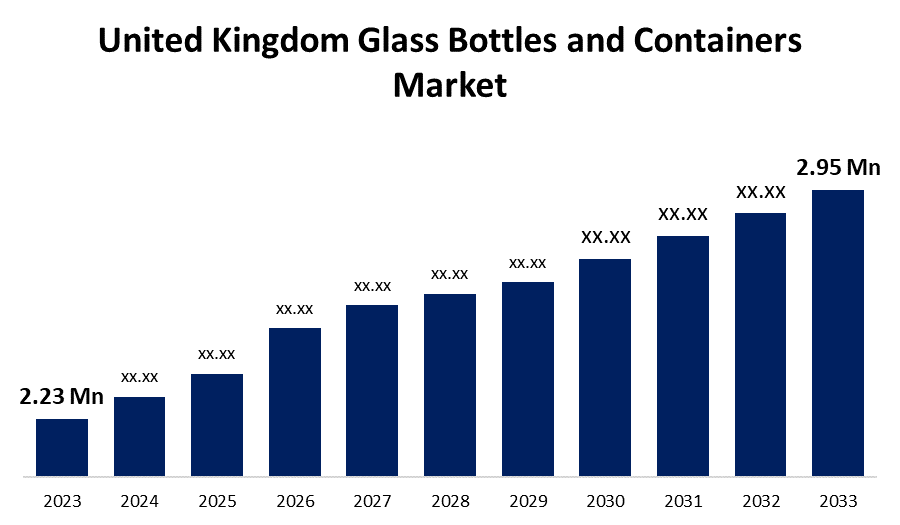

- The U.K. Glass Bottles and Containers Market Size was valued at USD 2.23 Million tonnes in 2023.

- The Market Size is Growing at a CAGR of 2.84% from 2023 to 2033

- The U.K. Glass Bottles and Containers Market Size is expected to reach USD 2.95 Million tonnes by 2033

Get more details on this report -

The United Kingdom Glass Bottles and Containers Market is anticipated to exceed USD 2.95 Million tonnes by 2033, growing at a CAGR of 2.84% from 2023 to 2033. The growing demand for glass packaging in the beverage industry and the sustainability of glass packaging are driving the growth of the glass bottles and containers market in the UK.

Market Overview

Glass bottles and containers are increasingly used in pharmaceutical and biological product packaging because of the strength, chemical endurance, transparency, and hermeticism of glass. Glass is still the most common material used in high-end alcoholic and non-alcoholic beverage containers. One of the most popular packaging materials for alcoholic beverages, including spirits, is glass. The market is expanding because glass packaging is so widely used in so many different industries—most notably, personal care, chemicals, and agriculture. Glass bottles and containers are widely used in the food and beverage industry as a result of the industry's growing emphasis on premium presentation and environmentally friendly packaging. Further, the glass packaging market has a lot of opportunities because glass bottles and containers are widely used in the food and beverage sector.

Report Coverage

This research report categorizes the market for the UK glass bottles and containers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom glass bottles and containers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK glass bottles and containers market.

United Kingdom Glass Bottles and Containers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.23 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2.84% |

| 023 – 2033 Value Projection: | USD 2.95 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Color, By End-User |

| Companies covered:: | Verallia Packaging (Verallia SA), O-I Glass Inc., Ciner Glass Ltd, Glassworks International, Gaasch Packaging, Vidrala SA, Berlin Packaging, Ardagh Group SA, Stoelzle Flaconnage, Beatson Clark, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The need from consumers for packaging that is safer and healthier is driving growth in glass packaging across many sectors. Further, glass packaging has become more attractive to consumers due to cutting-edge technologies that enable glass to be shaped, embossed, and given artistic finishes. Factors including the growing need from the food and beverage industry and the desire for environmentally friendly products are driving the market expansion.

Restraining Factors

The availability of alternative packaging options over glass materials is restraining the market for glass bottles and containers.

Market Segmentation

The United Kingdom Glass Bottles and Containers Market share is classified into color and end-user.

- The flint segment dominates the market with the largest market share during the forecast period.

The United Kingdom glass bottles and containers market is segmented by color into amber, flint, and green. Among these, the flint segment dominates the market with the largest market share during the forecast period. Flint glass is a hard, clear glass made of silicon dioxide mixed with lead or potassium and containing lead oxides that possess a low Abbe number and a high refractive index. Flint glass is increasingly used by manufacturers and the advantages of flint glass are driving the market demand in the flint segment.

- The beverages segment dominates the UK glass bottles and containers market during the forecast period.

Based on the end-user, the U.K. glass bottles and containers market is divided into beverages, food, cosmetics, and others. Among these, the beverages segment dominates the UK glass bottles and containers market during the forecast period. Glass is one of the most popular packaging materials for alcoholic beverages, including spirits due to its chemical sterility and non-permeability. Its ability to withstand both CO2 loss and O2 invasion results in a package with a longer shelf life. The use of this packaging for alcoholic beverages and the rising consumption of alcohol as well as the innovation in design and chemical composition are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. glass bottles and containers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Verallia Packaging (Verallia SA)

- O-I Glass Inc.

- Ciner Glass Ltd

- Glassworks International

- Gaasch Packaging

- Vidrala SA

- Berlin Packaging

- Ardagh Group SA

- Stoelzle Flaconnage

- Beatson Clark

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Estal, a manufacturer of glass packaging, enlarged their Wild Glass Collection, integrated its commercial team, and added new product warehouses for its UK operation.

- In January 2023, Ardagh Glass Packaging in Limmared, a subsidiary of Ardagh Group, has signed an agreement with Absolut Vodka, to use this furnace commencing in the second half of 2023.

- In November 2022, Verallia, signed a binding agreement with an affiliate of Sun European Partners LLP for the acquisition of Allied Glass, a market leader in the UK premium glass packaging segment with a focus on the premium spirits’ end market.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Glass Bottles and Containers Market based on the below-mentioned segments:

UK Glass Bottles and Containers Market, By Color

- Amber

- Flint

- Green

UK Glass Bottles and Containers Market, By End-User

- Beverages

- Food

- Cosmetics

- Others

Need help to buy this report?