United Kingdom Heat Pumps Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Air-Source Heat Pump and Ground/Water-Source Heat Pump), By End-User Vertical (Commercial, Residential, and Industrial), and United Kingdom Heat Pumps Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Heat Pumps Market Insights Forecasts to 2033

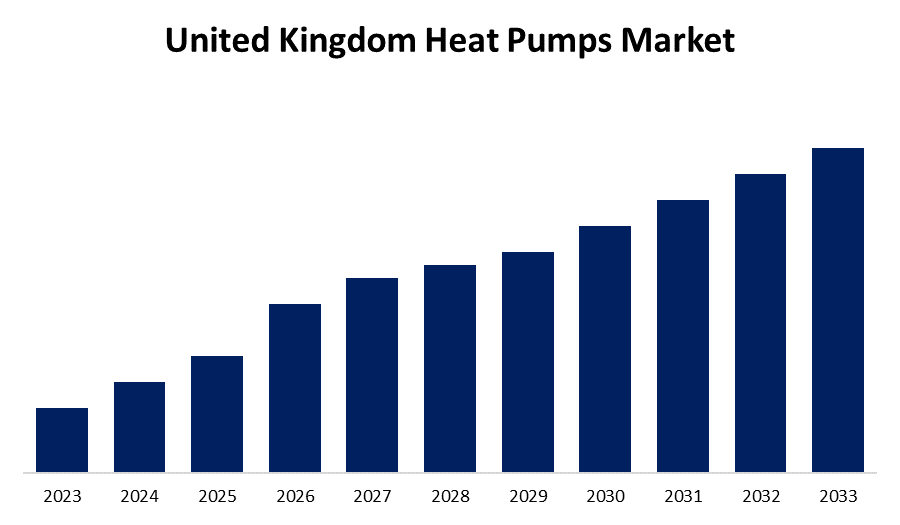

- The Market Size is growing at a CAGR of 11.05% from 2023 to 2033

- The U.K. Heat Pumps Market Size is expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Heat Pumps Market is anticipated to hold a significant share by 2033, growing at a CAGR of 11.05% from 2023 to 2033. The growing recovering office space demand & HVAC retrofits and government regulations & initiatives are driving the growth of the heat pumps market in the UK.

Market Overview

Heat pumps are devices that transfer heat by absorbing heat from a cold space and releasing it into a warmer space. Heat pumps use refrigerant, a material with a low boiling point, to help transfer heat. This material absorbs heat from the environment in its evaporator coil and releases it in its condenser coil by undergoing phase shifts from liquid to vapour and back again. Heat pumps possess high heat efficiency, delivering more heating and cooling capacity per unit of energy input than traditional systems as they transfer heat rather than creating it, resulting in low energy costs and low carbon emissions. In both residential and commercial structures, they are extensively utilised for heating and cooling purposes. Heat pumps are recognised for their economic and environmental benefits since they harness pre-existing heat sources instead of using fuel to produce heat. As the price of conventional energy sources, like oil and gas, climbs, people are looking into more energy-efficient choices, like heat pumps. The growing need for energy-efficient solutions and technological improvements across the country leverages market opportunity.

Report Coverage

This research report categorizes the market for the UK heat pumps market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom heat pumps market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK heat pumps market.

United Kingdom Heat Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.05% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By End-User |

| Companies covered:: | IMS Heat pumps, Vaillant Group, Worcestor Bosch Group, Baxi Heating UK, Ideal Boilers, Zehnder Group, Daikin Airconditioning UK Ltd., Viessmann Group, Danfoss, Kensa Heat Pumps, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

A number of government programmes and legislations, along with the growing need for energy-efficient solution, are driving the market. Further, the increasing demand for upgradation of existing HVAC systems with heat pumps in buildings is driving the market. The high demand for recovering office space is also contributing to driving the UK heat pumps market.

Restraining Factors

The presence of cheaper legacy technologies and semiconductor industry shortages are restraining the market for heat pumps.

Market Segmentation

The United Kingdom Heat Pumps Market share is classified into product type and end-user vertical.

- The air-source heat pumps segment dominates the market with a significant market share during the forecast period.

The United Kingdom heat pumps market is segmented by product type into air-source heat pump and ground/water-source heat pump. Among these, the air-source heat pumps segment dominates the market with a significant market share during the forecast period. An air-source heat pump is one that transfers heat from the exterior to the interior of a building envelope or vice versa. Approximately 25% of households in the UK have heat pumps, and because of programmes like the Boiler Upgrade Scheme, heat pumps are becoming more affordable for the populace. The growing focus on using renewable energy systems for both heating and cooling is driving market demand.

- The residential segment dominates the US heat pumps market during the forecast period.

Based on the end-user vertical, the U.K. heat pumps market is divided into commercial, residential, and industrial. Among these, the residential segment dominates the US heat pumps market during the forecast period. In a survey conducted in 2022, the UK Department for Business, Energy and Industrial Strategy discovered that 78% of participants heated their homes with gas (central heating) in the winter. The growing preference for energy-efficient HVAC systems and the government’s supportive policies encouraging the installation of HVAC systems in homes are driving the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. heat pumps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IMS Heat pumps

- Vaillant Group

- Worcestor Bosch Group

- Baxi Heating UK

- Ideal Boilers

- Zehnder Group

- Daikin Airconditioning UK Ltd.

- Viessmann Group

- Danfoss

- Kensa Heat Pumps

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, British Gas launched the UK’s lowest heat pump rate, to make low carbon technology more affordable and encourage heat pump uptake.

- In March 2024, Heat Geek, a sustainable energy startup, announced a €4.3 million seed funding round, bringing the total raised in 2023 to €4.9 million to power its mission to decarbonise homes via heat pump technology on a national scale.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Heat Pumps Market based on the below-mentioned segments:

UK Heat Pumps Market, By Product Type

- Air-Source Heat Pump

- Ground/Water-Source Heat Pump

UK Heat Pumps Market, By End-User Vertical

- Commercial

- Residential

- Industrial

Need help to buy this report?