United Kingdom Home Appliances Market Size, Share, and COVID-19 Impact Analysis, By Type (Major Appliances, Small Appliances, and Smart Home Appliances), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online/E-commerce, and Others), and United Kingdom Home Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Home Appliances Market Insights Forecasts to 2033

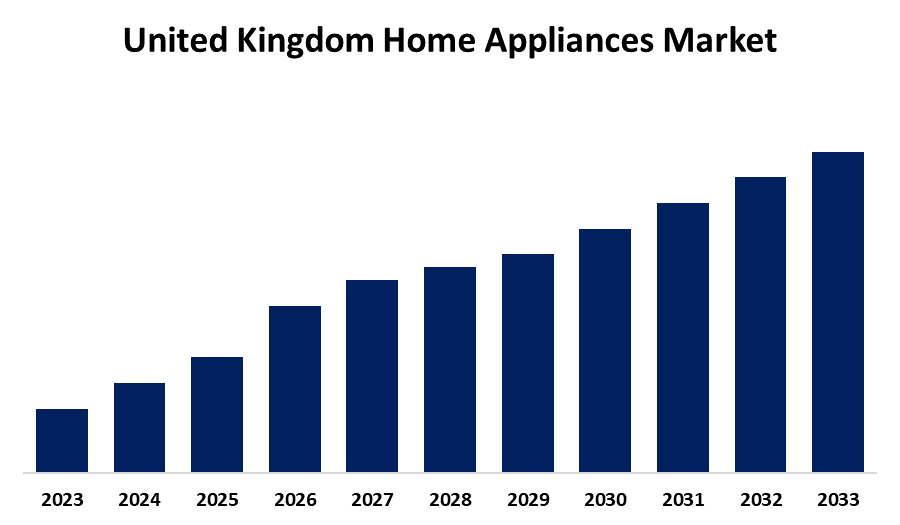

- The U.K. Home Appliances Market Size is Growing at a CAGR of 2.55% from 2023 to 2033

- The U.K. Home Appliances Market Size is Expected to hold a significant share By 2033

Get more details on this report -

The United Kingdom Home Appliances Market Size is Anticipated to hold a significant share By 2033, Growing at a CAGR of 2.55% from 2023 to 2033. The growing consumer spending power and shifting consumer demand toward technology & environment-friendly products are driving the growth of the home appliances market in the UK.

Market Overview

Home appliances market refers to the industry selling devices used in households for cleaning, cooking, refrigeration, and other tasks. The industry includes electrical or mechanical devices used in a household. Home appliances are also known as domestic appliances, electric appliances, or household appliances. The widespread usage allows for nearly any device intended for domestic use to be a home appliance, including consumer electronics as well as stoves, refrigerators, toasters, and air conditioners. With the improved quality of life of individuals, increased consumer spending with increased per capita income, there are shifting consumer demands for home appliances, thereby promoting market growth. Furthermore, the trend of work-from-home culture encourages the use of white goods such as refrigerators and washing machines. The development of smart appliances for energy efficiency and a growing trend towards home automation and internet-connected appliances are boosting market growth opportunities. In addition, the trend of home appliance recycling which involves dismantling and recovering materials is also bolstering the market growth.

Report Coverage

This research report categorizes the market for the UK home appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom home appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK home appliances market.

United Kingdom Home Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.55% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing consumer spending on household appliances which is about 11.2 billion British pounds as per the statista report is propelling the market. The rising working population in the country and demand for enhanced quality and trending designs are propelling the home appliances market growth. The consumer demand for technology such as IoT and AI-enabled appliances that are smarter with energy-efficient features is propelling the market growth for home appliances. The increasing consumer preference for environmentally friendly products is also responsible for market growth. For instance, as per the study by Amazon-commissioned, 2,000 British shoppers, two in three (66%) people prefer to buy products that have a more positive environmental and social impact.

Restraining Factors

The rising cases of hazards and accidents due to household appliances are challenging the home appliances market. Further, the supply chain issues, increased maintenance costs, and regulatory challenges are responsible for restraining the market.

Market Segmentation

The United Kingdom home appliances market share is classified into type and distribution channel.

- The major appliances segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom home appliances market is segmented by type into major appliances, small appliances, and smart home appliances. Among these, the major appliances segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. The introduction of smart devices in residential settings and consumer interest towards user-friendly and interconnected appliances are propelling the market.

- The online/e-commerce segment dominates the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom home appliances market is segmented by distribution channel into supermarkets & hypermarkets, specialty stores, online/e-commerce, and others. Among these, the online/e-commerce segment dominates the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the projected period. The increasing popularity of internet shopping due to its convenience and better price offerings are responsible for propelling the market in the online/e-commerce segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. home appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool Corporation

- Electrolux AB

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Haier Electronics Group Co. Ltd

- BSH Hausgeräte GmbH

- Arcelik AS

- Gorenje Group

- Mitsubishi Electric Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Electrolux Group has launched its CIH Partner Program; a simple, effective and rewarding structure which invites independent retailers, that are members of Euronics, to partner with the brand for innovation, sustainability and growth.

- In March 2023, Samsung Electronics UK Ltd. has announced the launch of its new single door Built-In Fridges and Built-In Freezers – offering households a smarter way to keep their food fresh, whilst giving a streamlined look to the kitchen to compliment Samsung’s new line of built-in ovens.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Home Appliances Market based on the below-mentioned segments

UK Home Appliances Market, By Type

- Major Appliances

- Small Appliances

- Smart Home Appliances

UK Home Appliances Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online/E-commerce

- Others

Need help to buy this report?