United Kingdom Home Equity Lending Market Size, Share, and COVID-19 Impact Analysis, By Types, (Fixed Rate Loans, and Home Equity Line of Credit (HELOC)), By Service Provider, (Banks, Building Societies, Online, Credit Unions and Others), and United Kingdom Home Equity Lending Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Home Equity Lending Market Insights Forecasts to 2033

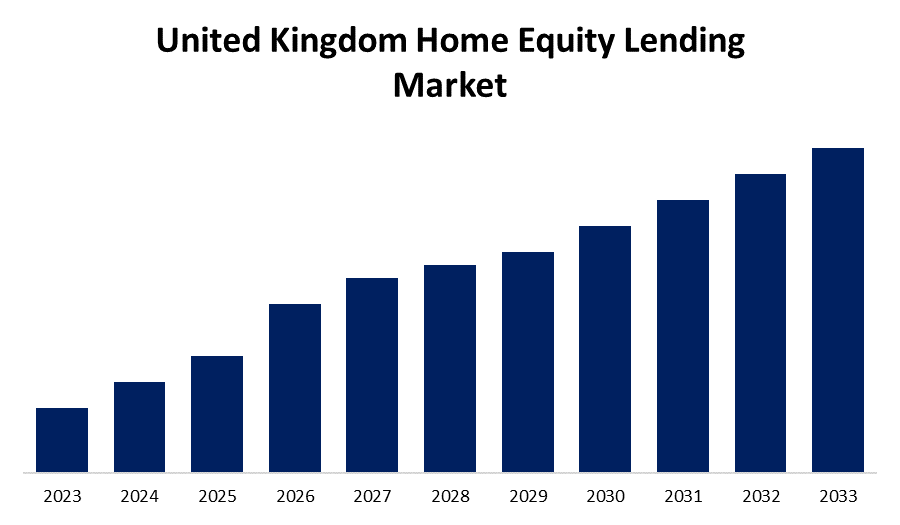

- The Market is growing at a CAGR of 4.5% from 2023 to 2033

- The U.K. Home Equity Lending Market Size is expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Home Equity Lending Market is anticipated to hold a significant share by 2033, growing at a CAGR of 4.5% from 2023 to 2033. The growing homeownership rate, property market, growing interest for home equity releases, rising awareness, regulatory support, and flexibility and use of funds are driving the growth of the home equity lending market in the United Kingdom.

Market Overview

Home equity lending services are offered by high-street banks, online banks, credit unions, building societies, and other institutions. In UK, home equity loans are provided by numerous banks, however, home equity lines of credit (HELOCs) are more prevalent than home equity loans. The home equity loan market is inherently fragmented due to the variety of organizations that provide these products. Over the past year, a significant increase has been observed in the number of UK citizens investing in “buy to let property”. Due to its ability to generate both rental income and capital development, real estate has grown in popularity as an alternative to conventional investments and pensions. Due to the lengthy application process and requirement for a cash reserve equal to 20-30% of the entire investment, investors are using home equity loans and lines of credit for real estate investments. Further, the growing consumer awareness through educational campaigns regarding home equity lending is boosting popularity. The evolving technology and consumer demands to create innovative home equity lending products with added benefits and features are leveraging the market opportunity for the home equity lending market. Furthermore, the flexible use of home equity funds, from consolidation to home improvements, appeals to a wide range of borrowers.

Report Coverage

This research report categorizes the market for the UK home equity lending market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the home equity lending market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the home equity lending market.

United Kingdom Home Equity Lending Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Types, By Service Provider |

| Companies covered:: | Bank of England, Barclays Bank, Selina Advance, Aviva UK, Royal Bank of Scotland, Legal and General, Coventry Building Society, LV Friendly Society, Onefamily, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Home equity lending provides homeowners loans based on their properties. The rise in sales of residential real estate in the UK is indicative of a growing inclination among UK residents to invest in real estate. Thus, the growing homeownership is driving the market demand. In addition, the continuous growth of the UK property market and growing awareness about home equity lending as a financial tool are contributing to driving the market. Because of the nation's record-breaking increases in home prices, 22% of workers today plan to utilize the value of their property to support their retirement, according to a survey of homeowners in the United Kingdom. Thus, growing interest in home equity releases is driving the UK home equity lending market.

Restraining Factors

The increased downturn in the housing market reduces the availability of equity negatively affects the market demand. Further, economic factors, such as inflation, unemployment, and changes in interest rates, impact the borrower confidence and demand for home equity loans, and shifts in regulatory policies are restraining the UK home equity market.

Market Segmentation

The United Kingdom Home Equity Lending Market share is classified into types and service provider.

- The fixed rate loans segment dominates the market with the largest market share during the forecast period.

The United Kingdom home equity lending market is segmented by types into fixed rate loans and home equity line of credit (HELOC). Among these, the fixed rate loans segment dominates the market with the largest market share during the forecast period. Fixed-rate loans assure borrowers of a consistent interest rate for the entire duration of the loan. The increasing priority for long-term financial planning and avoiding the risk with variable-rate loans are driving the market demand.

- The banks segment dominates the United Kingdom home equity lending market during the forecast period.

Based on the service provider, the United Kingdom home equity lending market is divided into banks, building societies, online, credit unions, and others. Among these, the banks segment dominates the United Kingdom home equity lending market during the forecast period. The established reputation, ample resources, and capacity to offer competitive interest rates and conditions are driving the market in the bank services providers segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK home equity lending market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of England

- Barclays Bank

- Selina Advance

- Aviva UK

- Royal Bank of Scotland

- Legal and General

- Coventry Building Society

- LV Friendly Society

- Onefamily

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Selina Advance, a London-based fintech business, raised USD150 million in investment to expand its home equity lending solutions to customers across the UK. The round of fundraising, coordinated by global private equity platform Lightrock, included USD 35 million in equity and USD 115 million in loans from Goldman Sachs and GGC to help the company expand across the UK.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Home Equity Lending Market based on the below-mentioned segments

United Kingdom Home Equity Lending Market, By Types

- Fixed Rate Loans

- Home Equity Line of Credit (HELOC)

United Kingdom Home Equity Lending Market, By Service Provider

- Banks

- Building Societies

- Online

- Credit Unions

- Others

Need help to buy this report?