United Kingdom Home Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Building/Property Insurance, Content Insurance, Building and Content Insurance, Renter’s or Tenant’s Insurance, Landlord’s Insurance, and Strata/holiday Home Insurance), By Distribution Channel (Direct, Independent Advisers, Banks/building Societies, Utilities/Retailers/Affinity Groups, Company Agents, and Online Channels), and United Kingdom Home Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Home Insurance Market Insights Forecasts to 2033

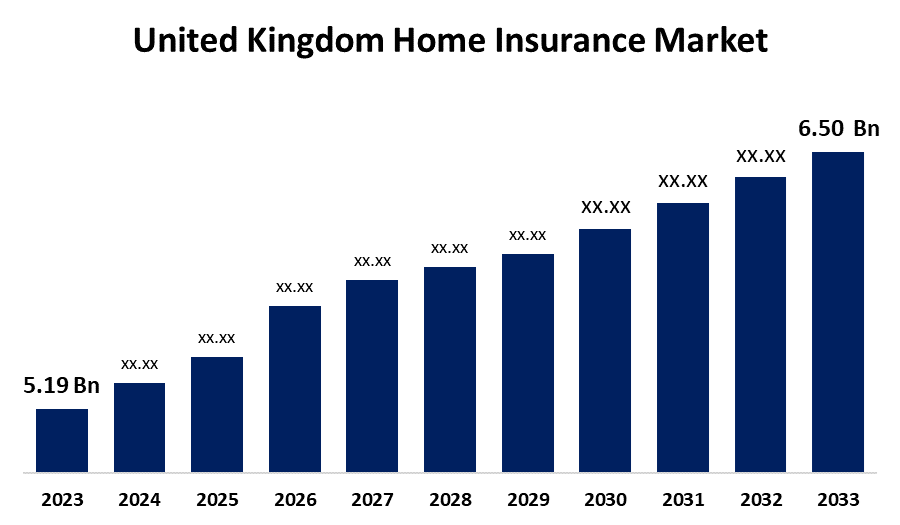

- The United Kingdom Home Insurance Market Size was valued at USD 5.19 Billion in 2023.

- The Market is growing at a CAGR of 2.28% from 2023 to 2033

- The U.K. Home Insurance Market Size is expected to reach USD 6.50 Billion by 2033

Get more details on this report -

The United Kingdom Home Insurance Market is anticipated to exceed USD 6.50 billion by 2033, growing at a CAGR of 2.28% from 2023 to 2033. The growing awareness about protecting home properties as well as the threats to the property and the trend of customized coverage schemes for specific needs of homeowners are driving the growth of the home insurance market in the United Kingdom.

Market Overview

Home insurance is a contract in which an individual receives financial security or compensation from an insurance company in the form of a policy. It covers losses and damage to an owner's residence, furnishings, and other possessions and provides liability protection. Due to the high rate of property ownership in the UK and the growth in property values, homeowners seek comprehensive insurance coverage for their homes. Further, digital transformation is revolutionizing customer experiences by integrating advanced technologies, with a notable tendency towards online insurance management and purchases. The new technological developments and digital transformation are creating lucrative market growth. Cutting-edge technologies are creating customer experiences tailored to individual preferences by incorporating predictive analytics and introducing personalized recommendations. This convenient policy management and customer engagement are responsible for driving market opportunities for home insurance.

Report Coverage

This research report categorizes the market for the UK home insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the home insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the home insurance market.

United Kingdom Home Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.19 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.28% |

| 2033 Value Projection: | USD 6.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Aviva, Direct Line Group, Admiral Group, Axa Insurance UK, Ageas, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The satisfaction of financial security against property damage has been made possible by home insurance. Thus, homeowners are increasingly seeking home insurance. The rising number of households and growing property values are also driving the market demand. The increasing awareness about protecting home properties as well as the threats to the property are driving the market growth. The growing application of technological advancements for enhancing customer experience, convenient purchasing options, and management are significantly driving the UK home insurance market. In addition, the trend of customized coverage schemes for the specific needs of homeowners and the availability of a wide range of offers provided by insurers is driving the market growth for home insurance.

Restraining Factors

The growing claims costs impacting insurer’s profitability are hampering the market growth. Damage from a wide range of events such as tsunamis, sewage and drain backups, seeping groundwater, standing water, and several other water sources is typically not covered by property insurance plans. Policies excluding coverage for natural disasters are restraining the market demand.

Market Segmentation

The United Kingdom Home Insurance Market share is classified into type and distribution channel.

- The building/property insurance segment dominates the market with the largest market share during the forecast period.

The United Kingdom home insurance market is segmented by type into building/property insurance, content insurance, building and content insurance, renter's or tenant's insurance, landlord's insurance, and strata/holiday home insurance. Among these, the building/property insurance segment dominates the market with the largest market share during the forecast period. Policies that protect a home’s tangible assets and equipment – whether owned by a business or a private individual from theft, fire, and other risks are included in property insurance coverage. The increasing demand for finance for house insurance and the integration of digital transformation as well as penetration of the internet and mobile devices are boosting the market growth.

- The online channels segment dominates the United Kingdom home insurance market during the forecast period.

Based on the distribution channel, the United Kingdom home insurance market is divided into direct, independent advisers, banks/building societies, utilities/retailers/affinity groups, company agents, and online channels. Among these, the online channels segment dominates the United Kingdom home insurance market during the forecast period. Digital transformation has allowed policyholders to conveniently manage their policies, make payments, and submit claims electronically. The increasing popularity of online home insurance in the United Kingdom among policy seekers is responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK home insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aviva

- Direct Line Group

- Admiral Group

- Axa Insurance UK

- Ageas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Aviva, the leading home insurer in the UK, signed a contract with Barclays UK to purchase its home insurance portfolio, which comprises 350,000 customers.

- In May 2023, Amazon, the international e-commerce giant, forged a partnership with prominent UK insurance providers, Ageas, Co-op, LV, and Policy Expert to streamline the home insurance purchase process.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Home Insurance Market based on the below-mentioned segments:

United Kingdom Home Insurance Market, By Type

- Building/Property Insurance

- Content Insurance

- Building and Content Insurance

- Renter's or Tenant's Insurance

- Landlord's Insurance

- Strata/Holiday Home Insurance

United Kingdom Home Insurance Market, By Distribution Channel

- Direct

- Independent Advisers

- Banks/Building Societies

- Utilities/Retailers/Affinity Groups

- Company Agents

- Online Channels

Need help to buy this report?