United Kingdom Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Device (Insulin Pumps, Insulin Pens, Insulin Syringes, and Insulin Jet Injectors), By Application (Hospitals, Clinics, Homecare Settings, and Other), and United Kingdom Insulin Drugs & Delivery Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Insulin Drugs & Delivery Devices Market Insights Forecasts to 2033

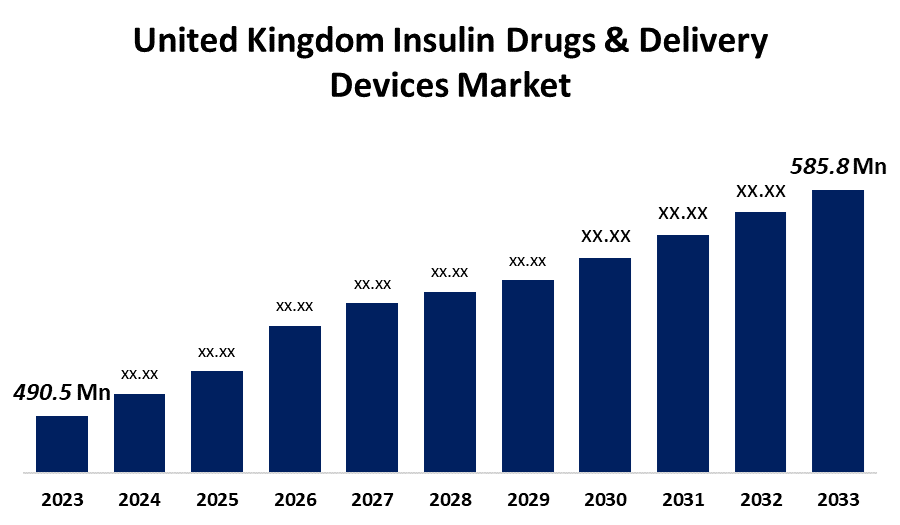

- The U.K. Insulin Drugs & Delivery Devices Market Size was valued at USD 490.5 Million in 2023.

- The Market is growing at a CAGR of 1.79% from 2023 to 2033

- The U.K. Insulin Drugs & Delivery Devices Market Size is expected to reach USD 585.8 Million by 2033

Get more details on this report -

The United Kingdom Insulin Drugs & Delivery Devices Market is anticipated to exceed USD 585.8 Million by 2033, growing at a CAGR of 1.79% from 2023 to 2033. The growing prevalence of diabetes and the development of innovation products are driving the growth of the insulin drugs & delivery devices market in the UK.

Market Overview

Insulin drugs & delivery devices are revolutionizing glucose management. Diabetes care providers successfully assist patients by utilizing insulin pump therapy, which has been shown to enhance clinical results and quality of life. According to the most recent data, more than a million diabetics are receiving insulin pump therapy. An insulin infusion pump can be used instead of using insulin pens or a daily injection schedule. These pumps are more accurate than injections, cause less pain, and minimize the huge swings in blood glucose levels. It is easier to use infusion pumps as it does not require meal-timing scheduling. Insulin therapy is continuous subcutaneous insulin infusion (CSII) which is an efficient and flexible method of insulin delivery. Over time, technological advancements in insulin delivery devices have made it possible to administer insulin more precisely and safely. Many technological advances have been made in CSII technology, including as the pump's incorporation of continuous glucose monitoring.

Report Coverage

This research report categorizes the market for the UK insulin drugs & delivery devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom insulin drugs & delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK insulin drugs & delivery devices market.

United Kingdom Insulin Drugs and Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 490.5 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 1.79% |

| 2033 Value Projection: | USD 585.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Device, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk, Biocon, Eli Lilly, Sanofi, Medtronic, Julphar, Ypsomed, Becton Dickinson, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the data on Diabetes UK, the number of persons living with diabetes in the United Kingdom is over 4.3 million. Obesity, unhealthy diet, and sedentary lifestyle are the main reasons of the increasing rate of newly diagnosed type 1 and type 2 diabetes patients. Healthcare spending and the fast-rising incidence and prevalence of diabetes patients are driving the market growth. Top producers are concentrating on technological advancements and creating cutting-edge products, from insulin injections to insulin pumps which is significantly driving the market.

Restraining Factors

The high cost of insulin analogs in the treatment of diabetes and the strict regulatory procedures governing the approval of insulin delivery devices are majorly restraining the market growth. Further, inadequate reimbursement procedures are anticipated to limit market expansion.

Market Segmentation

The United Kingdom Insulin Drugs & Delivery Devices Market share is classified into device and application.

- The insulin pumps segment is anticipated to witness the fastest CAGR growth during the forecast period.

The United Kingdom insulin drugs & delivery devices market is segmented by device into insulin pumps, insulin pens, insulin syringes, and insulin jet injectors. Among these, the insulin pumps segment is anticipated to witness the fastest CAGR growth during the forecast period. An insulin pump is a gadget that continually or as needed distributes insulin automatically. The pump imitates the pancreas in humans. The growing technological advancement and rising preference due to continuous insulin administration are driving the market growth.

- The hospitals segment dominates the UK insulin drugs & delivery devices market during the forecast period.

Based on the application, the U.K. insulin drugs & delivery devices market is divided into hospitals, clinics, homecare settings, and other. Among these, the hospitals segment dominates the UK insulin drugs & delivery devices market during the forecast period. Insulin delivery devices are used in hospitals for inpatient treatment and monitoring, as well as for acute care and management of problems associated with diabetes. The rising incidence of type 1 and type 2 diabetes owing to unhealthy lifestyles and the increasing geriatric population are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. insulin drugs & delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Biocon

- Eli Lilly

- Sanofi

- Medtronic

- Julphar

- Ypsomed

- Becton Dickinson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, The Medicines and Healthcare Products Regulatory Agency (MHRA) issued a safety warning about the NovoRapid PumpCart prefilled insulin cartridge and the Roche Accu-Chek Insight Insulin pump.

- In April 2022, NHS runs world-first test into ‘sci-fi like’ artificial pancreases. Almost 1,000 adults and children with type 1 diabetes have been given a potentially life-altering ‘artificial pancreas’ by the NHS in England as part of the first nationwide test into the effectiveness of this technology in the world.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Insulin Drugs & Delivery Devices Market based on the below-mentioned segments:

UK Insulin Drugs & Delivery Devices Market, By Device

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

- Insulin Jet Injectors

UK Insulin Drugs & Delivery Devices Market, By Application

- Hospitals

- Clinics

- Homecare Settings

- Other

Need help to buy this report?