United Kingdom Mobility Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Wheelchairs, Mobility Scooters, Walking Aids, Patient Lifts & Hoists, and Others), By End User (Healthcare Facilities and Homecare Settings), and United Kingdom Mobility Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited Kingdom Mobility Devices Market Insights Forecasts to 2033

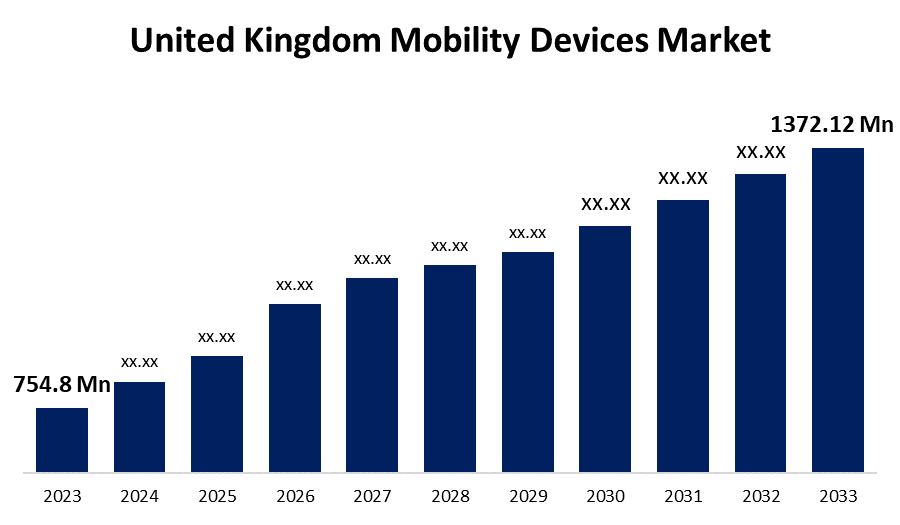

- The U.K. Mobility Devices Market Size was valued at USD 745.8 Million in 2023.

- The U.K. Mobility Device Market is Growing at a CAGR of 6.29% from 2023 to 2033

- The Worldwide UK Mobility Devices Market Size is Expected to Reach USD 1372.12 Million by 2033

Get more details on this report -

The U.K. Mobility Devices Market is Anticipated to Reach USD 1372.12 Million by 2033, Growing at a CAGR of 6.29% from 2023 to 2033.

Market Overview

Mobility aid devices are cutting-edge, ergonomically built tools that help old, crippled, or recovering children and adults have more mobility independence. Depending on their range of motion, people with mobility impairments might select different mobile devices. Individuals with physical disabilities are becoming more and more dependent on health care, and their unmet requirements are also growing rapidly. In the upcoming years, there will probably be a greater demand for mobility aid devices due to the growing population of people with physical disabilities. Additionally, healthcare facilities are seeing an increase in the number of inpatient and outpatient admissions due to accidents that result in disabilities.

Report Coverage

This research report categorizes the market for the UK mobility devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom mobility devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. mobility devices market.

United Kingdom Mobility Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 745.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.29% |

| 2033 Value Projection: | USD 1372.12 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End User |

| Companies covered:: | Pride Mobility, Invacare, Roma Medical, Van Os Medical, Kymco Healthcare, Drive Medical, TGA Mobility, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK has a population of over 4.3 million people who use mobility aids. As the population ages, there is a growing need for mobility devices, which is contributing to the growth of the mobility market in the country. Furthermore, the growing elderly population is encouraging leading companies in the industry to concentrate on introducing cutting-edge products such as walking devices, mobility motorcycles, wheelchairs, and other items to meet the demands of the patient group. The growing number of sports-related injuries that result in total or partial incapacity is another reason driving this device acceptance. Product demand is anticipated to be fueled by an increase in domestic and regional competitors in the market as well as a rise in research and development efforts for these items.

Restraining Factors

The absence of service centers and a lack of knowledge about modern personal mobility devices are the main challenges impeding the growth of the UK market for these devices.

Market Segmentation

The UK mobility devices market share is classified into product type and end user.

- The wheelchairs segment is expected to hold the greatest market share through the forecast period.

The U.K. mobility devices market is segmented by product type into wheelchairs, mobility scooters, walking aids, patient lifts & hoists, and others. Among these, the wheelchairs segment is expected to hold the greatest market share through the forecast period. The high demand for wheelchairs was caused by the growing number of people with disabilities as a consequence of an increase in road incidents and harm.

- The homecare settings segment is anticipated to hold a significant share of the United Kingdom mobility devices market during the forecast period.

Based on the end user, the UK mobility devices market is divided into healthcare facilities and homecare settings. Among these, the homecare settings segment is anticipated to hold a significant share of the United Kingdom mobility devices market during the forecast period. This is mostly because children with developmental impairments and arthritis are becoming more common. The use of mobile devices by older persons has significantly aided in their rapid recovery from significant disabilities and enabled them continue their physical activities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. mobility devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pride Mobility

- Invacare

- Roma Medical

- Van Os Medical

- Kymco Healthcare

- Drive Medical

- TGA Mobility

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Progeo Noir 2.0 carbon fiber active manual wheelchair that is configurable was introduced by Permobil in the United Kingdom as part of its product line expansion. To give the user the best possible ride, the wheelchair blends the advantages of carbon with the comforts of a wheelchair.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Mobility Devices Market based on the below-mentioned segments:

United Kingdom Mobility Devices Market, By Product Type

- Wheelchairs

- Mobility Scooters

- Walking Aids

- Patient Lifts & Hoists

- Others

United Kingdom Mobility Devices Market, By End User

- Healthcare Facilities

- Homecare Settings

Need help to buy this report?