United Kingdom Oil and Gas Market Size, Share, and COVID-19 Impact Analysis, By Sector (Upstream, Downstream, and Midstream), By Application (Offshore and Onshore), and United Kingdom Oil and Gas Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom Oil and Gas Market Insights Forecasts to 2033

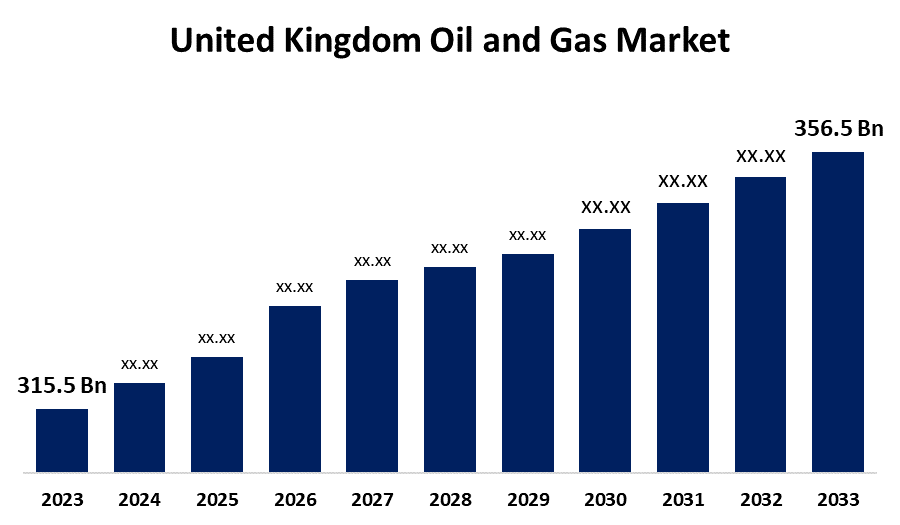

- The United Kingdom Oil and Gas Market Size was valued at USD 315.5 Billion in 2023

- The Market is Growing at a CAGR of 1.23% from 2023 to 2033

- The U.K. Oil and Gas Market Size is Expected to Reach USD 356.5 Billion by 2033

Get more details on this report -

The United Kingdom Oil and Gas Market is Anticipated to Exceed USD 356.5 Billion by 2033, growing at a CAGR of 1.23% from 2023 to 2033. The growing investments in oil & gas infrastructure developments are driving the Growth of the oil and gas market in the United Kingdom.

Market Overview

The oil & gas industry plays a central role in the economy of the United Kingdom, accounting for more than three-quarters of the UK’s total primary energy needs. There is 1.42 million production of BOE oil & gas per day. Oil and natural gas products are even used to make artificial limbs, hearing aids, and flame-retardant clothing to protect firefighters. Paints, dyes, fibers, and just about anything that is manufactured have some connection to oil and natural gas. To overcome the challenges of recovering oil and gas from increasingly difficult reservoirs and deeper waters, the North Sea has developed a position at the forefront of offshore engineering, particularly in subsea technology. The European Union Emission Trading Scheme (EU ETS), which aims to reduce carbon dioxide emissions and mitigate the threat of climate change, is a scheme in which UK oil and gas plants participate. Furthermore, the discovery of new oil and gas fields across the country is anticipated to create lucrative market growth opportunities.

Report Coverage

This research report categorizes the market for the UK oil and gas market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oil and gas market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK oil and gas market.

United Kingdom Oil and Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 315.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.23% |

| 2033 Value Projection: | USD 356.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sector, By Application |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

UK has one of the largest and most liquid gas markets with extensive import infrastructure and a diverse range of gas supply sources such as pipelines from Norway, Belgium, and the Netherlands, domestic production, and the Liquifies Natural gas (LNG) terminals to bring in gas worldwide. There is growing development of significant technical expertise in the exploration and production of oil and gas resources. Thus, owing to the above factors and the growing investments in oil and gas production are anticipated to propel the UK oil & gas market.

Restraining Factors

The increasing technological advancements in renewable energy which can effectively replace fossil fuels, for environmental, economic, and social benefits are anticipated to hamper the oil & gas market. The volatility in oil and gas prices due to geopolitical development is also responsible for restraining the market.

Market Segmentation

The United Kingdom Oil and Gas Market share is classified into sector and application.

- The upstream segment dominates the market with the largest market share in 2023.

The United Kingdom oil and gas market is segmented by sector into upstream, downstream, and midstream. Among these, the upstream segment dominates the market with the largest market share in 2023. Upstreaming activities are the initial phases of oil and gas production that include exploration, drilling, and extraction. The effective upstream process produces high-quality, economical, and lifesaving products. Enhanced technological developments like seismic imaging and improved drilling methods are driving the market in the upstream segment.

- The offshore segment is anticipated to grow at the fastest CAGR over the forecast period.

Based on the application, the United Kingdom oil and gas market is divided into offshore and onshore. Among these, the offshore segment is anticipated to grow at the fastest CAGR over the forecast period. Offshore oil and gas activities are some of the harshest operating environments on the planet. Drilling in waters up to 3,000 meters deep requires equipment that is reliable and safe. It helps to maximize operating productivity and prevent unexpected downtime. The higher costs, advanced technology, and greater logistical complexity propel the market growth in the offshore segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK oil and gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Corporation

- Shell PLC

- TotalEnergies SE

- BP PLC

- Cadent Gas Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, the UK government announced around a hundred new licenses for oil and gas extraction from the UK’s seas. The new licenses, the first of which will be issued later this year, continue a long-running process of the UK government spurring investment in North Sea oil and gas production, although the sector has shrunk significantly in recent times.

- In May 2023, Shell Plc (SHEL.L), opened a new tab that will use AI-based technology from big-data analytics firm SparkCognition in its deep sea exploration and production to boost offshore oil output.

- In February 2023, Delta Energy, a local upstream player in the United Kingdom, announced the discovery of significant oil and gas in the Pensacola region on license P2252. The company claims that the potential natural gas reservoir has more than 300 bcf of natural gas in the reservoir.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Oil and Gas Market based on the below-mentioned segments:

United Kingdom Oil and Gas Market, By Sector

- Upstream

- Downstream

- Midstream

United Kingdom Oil and Gas Market, By Application

- Offshore

- Onshore

Need help to buy this report?