United Kingdom Online Gambling Market Size, Share, and COVID-19 Impact Analysis, By Game Type (Casinos, Sports Betting, and Others), By Device (Mobile, Desktop, and Others), and United Kingdom Online Gambling Market Insights Forecasts 2023 - 2033.

Industry: Electronics, ICT & MediaUnited Kingdom Online Gambling Market Insights Forecasts to 2033

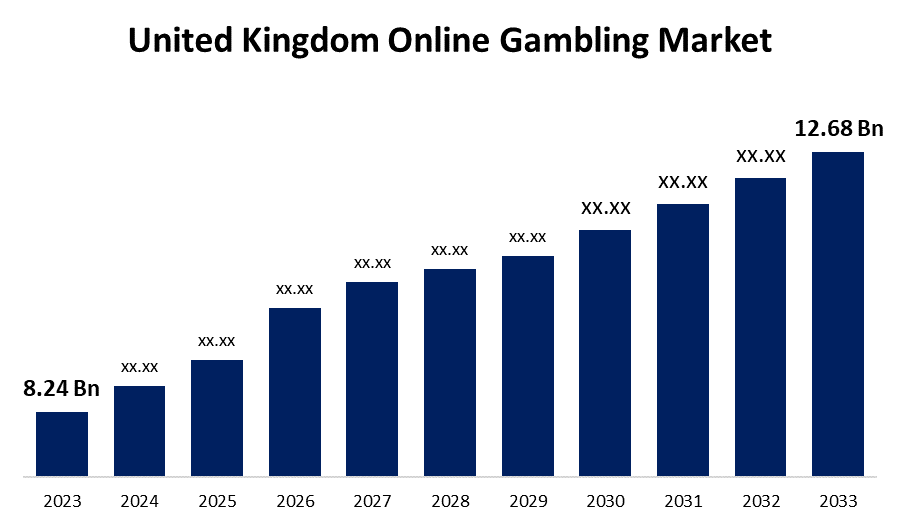

- The United Kingdom Online Gambling Market Size was valued at USD 8.24 Billion in 2023

- The Market Size is Growing at a CAGR of 4.4% from 2023 to 2033.

- The United Kingdom Online Gambling Market Size is Expected to Reach USD 12.68 Billion by 2033.

Get more details on this report -

The United Kingdom Online Gambling Market size is expected to reach USD 12.68 Billion by 2033, at a CAGR of 4.4% during the forecast period 2023 to 2033.

Market Overview

Online gambling is the action of placing bets on casinos using the internet. It does not require physical interaction between the players because the session can be moderated by computer programs. Sports betting, blackjack, poker, roulette, and slot machines are among the many games offered by online casinos. Online gambling has grown in popularity in the United Kingdom due to the conveniences it provides, such as cashless transactions, accessibility via electronic devices, customized budgets, and real-time gambling experiences. In addition, the Gambling Commission of Great Britain is the major regulatory body for the UK gambling industry. Furthermore, the UK has particular restrictions for remote gambling providers. To lawfully offer their services to UK residents, these operators must first get a Gambling Commission license. The UK is continuously striving to make the gambling sector safer. In December 2023, the Gambling Commission announced a new 'Tell us something in confidence' facility to allow for the reporting of unlawful and suspicious activities in the gambling business.

Report Coverage

This research report categorizes the market for the United Kingdom online gambling market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom online gambling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom online gambling market.

United Kingdom Online Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.4% |

| 2033 Value Projection: | USD 12.68 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Game Type, By Device |

| Companies covered:: | Allwyn UK Holding Ltd, Evolution AB, Casino Del Sol, Ballys Corp, 888 Holdings Plc, Betfred Group, Fantasy Springs Resort Casino, Buzz Group Ltd, Caesars Entertainment Inc, Bet365 Group Ltd, Delta Corp. Ltd, Entain Plc, Betsson AB, NetBet Enterprises Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Online casino companies focus on solutions that help and encourage gamblers, ensure the integrity of gambling activities, and combat fraud. To entice new customers, several online gambling sites offer free-play versions of their games. Revenue in free-to-play versions comes from in-app or website adverts. The adoption of blockchain technology has had a tremendous impact on the United Kingdom online gambling market. Furthermore, the United Kingdom's online gambling market is primarily driven by the widespread usage of cell phones and internet services. Online gambling provides an immersive gaming experience to participants and is typically accessed via mobile and desktop-based programs and software. Private firms are collaborating with third-party software suppliers to provide user-friendly gaming interfaces for users, which is driving market growth. Furthermore, the advent of low-cost mobile applications has made it easy for customers to access casino gaming sites.

Restraining Factors

The UK online gaming market is facing a number of serious issues. Dealing with various regulatory frameworks, as well as addressing challenges such as gambling addiction and cybersecurity, will impede the expansion of the United Kingdom online gambling market.

Market Segment

- In 2023, the sports betting segment accounted for the largest revenue share over the forecast period.

Based on game type, the United Kingdom online gambling market is segmented into casinos, sports betting, and others. Among these, the sports betting segment has the largest revenue share over the forecast period. The surge in popularity of sports betting wagering on games such as rugby and soccer, coupled with strong internet penetration, has pushed the industry growth. The cooperation between gambling software developers and private enterprises to produce user-friendly UI gaming solutions has grown the sports betting segment in the United Kingdom online gambling market.

- In 2023, the mobile segment is witnessing significant growth over the forecast period.

Based on device, the United Kingdom online gambling market is segmented into mobile, desktop, and others. Among these, the mobile segment is witnessing significant growth over the forecast period. This expansion is being driven by the increased use of smartphones and tablets, as well as advancements in mobile technology. Mobile gambling apps and mobile-optimized websites provide the convenience of playing whenever and wherever which appeals to younger demographics and casual gamblers. The mobile market focuses on user-friendly interfaces, short loading times, and optimal gaming for smaller screens. The integration of mobile payment systems, as well as push alerts for promotions and updates, add to the segment's appeal and growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom online gambling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allwyn UK Holding Ltd

- Evolution AB

- Casino Del Sol

- Ballys Corp

- 888 Holdings Plc

- Betfred Group

- Fantasy Springs Resort Casino

- Buzz Group Ltd

- Caesars Entertainment Inc

- Bet365 Group Ltd

- Delta Corp. Ltd

- Entain Plc

- Betsson AB

- NetBet Enterprises Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, BetMGM became the first American online gaming company to enter into Europe with the introduction of BetMGM UK. MGM Resorts International, based in Las Vegas, has announced the site's debut in the United Kingdom.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United Kingdom Online Gambling Market based on the below-mentioned segments:

United Kingdom Online Gambling Market, By Game Type

- Casinos

- Sports Betting

- Others

United Kingdom Online Gambling Market, By Device

- Mobile

- Desktop

- Others

Need help to buy this report?