United Kingdom Pig Feed Market Size, Share, and COVID-19 Impact Analysis, By Type (Starter Feed, Sow Feed, and Grower Feed), By Form (Pellets, Mash, and Crumbles), and United Kingdom Pig Feed Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Pig Feed Market Insights Forecasts to 2033

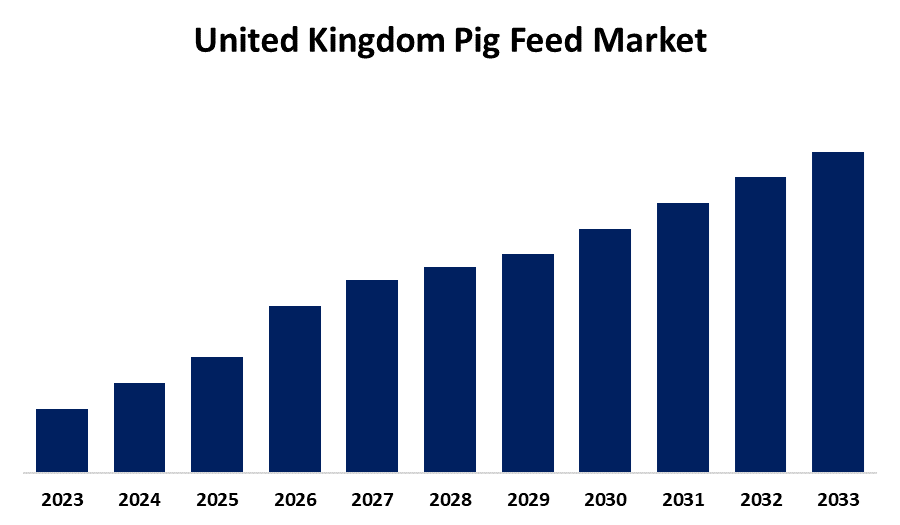

- The Market is Growing at a CAGR of 4.15% from 2023 to 2033

- The UK Pig Feed Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Pig Feed Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 4.15% from 2023 to 2033.

Market Overview

Swine feed, often known as pig feed, is made from a combination of nutrients derived from both vegetative or animal sources. The main ingredients are maize, soy meal, grain such as barley sorghum, wheat, vitamin and mineral supplements, other micronutrients, and vaccines. Pig feed comes in a variety of forms on the market, including granules mash, and crumbles. The market for swine feed includes the supply of specialty feed items made to meet the urgent nutritional needs of swine populations. The availability or quality of traditional swine feed may be jeopardized by unanticipated events like disease outbreaks, natural catastrophes, or supply chain interruptions; these feeds are designed to lessen these effects. High concentrations of vital nutrients, vitamins, and minerals are often present in emergency swine feed to maintain swine health and productivity in trying circumstances. Additionally, the need to meet the rising demand for pork is one of the main factors propelling the UK's pig feed market, together with the expanding swine producing industry. To fund this expansion, the UK's output and consumption of pork feed must increase correspondingly.

Report Coverage

This research report categorizes the market for the UK pig feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom pig feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. pig feed market.

United Kingdom Pig Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.15% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Form and COVID-19 Impact Analysis. |

| Companies covered:: | Wynnstay, Alltech Inc., ABN (Associated British Foods plc), Midland Feeds, ForFarmers, Archer Daniels Midland Company (ADM), Harpers Feeds, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK's growing pig population and consumers' inclination for pork meat have made it possible for pig feed producers to meet the growing demand. The United Kingdom offers a vast array of prospects for suppliers to optimize their supply chain and achieve substantial income development. Additionally, in the UK, one of the primary meat protein sources is pork. After poultry, pork accounts for 516.1 tonnes of total consumption. As manufacturers strive to satisfy the growing demand for premium pork products, the UK pig feed business has expanded in response to the growing demand for pork. Furthermore, pork demand in the UK is being boosted by a strong middle-class population, rising disposable income, and shifting customer preferences. The consumption of pork in the UK has a relative impact on the production of high-quality pig feed, enabling a promising growth outlook during the forecast period. Additionally, UK consumption patterns also have an impact on the amount of pork sold. Due to the British tradition of eating the well-known "English breakfast," which consists of bacon and sausages two of the most popular pig items among the British morning is the time of day when people consume the most pork (38%). The UK pig feed business is growing as a result of the cultural preference for pork for breakfast, which increases demand for pig feed.

Restraining Factors

Increased awareness of the environmental impacts of intensive cattle husbandry practices, especially water pollution and greenhouse gas emissions, may lead to stricter regulations and higher production costs.

Market Segmentation

The UK pig feed market share is classified into type and form.

- The starter feed segment is expected to hold the greatest market share through the forecast period.

The U.K. pig feed market is segmented by type into starter feed, sow feed, and grower feed. Among these, the starter feed segment is expected to hold the greatest market share through the forecast period. Starter feed helps piglets make the switch from sow's milk to solid diet by supplying vital nutrients that are necessary for their development. Additionally, sow feed, which is made especially for pregnant and nursing sows, continues to have a sizable market share. This kind of feed is designed to promote sows' reproductive health and guarantee that piglets develop normally throughout the gestation and lactation phases.

- The pellets segment is anticipated to hold a significant share of the United Kingdom pig feed market during the forecast period.

Based on the form, the UK pig feed market is divided into pellets, mash, and crumbles. Among these, the pellets segment is anticipated to hold a significant share of the United Kingdom pig feed market during the forecast period. Pig farmers frequently choose pellets because of their easy handling and feeding due to their uniformly compressed structure. By providing exact control over feed intake and nutrient consumption, they encourage effective feed usage and reduce wastage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. pig feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wynnstay

- Alltech Inc.

- ABN (Associated British Foods plc)

- Midland Feeds

- ForFarmers

- Archer Daniels Midland Company (ADM)

- Harpers Feeds

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2021, in the UK, Cargill has established a new reference farm for grower and finisher pig research.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Pig Feed Market based on the below-mentioned segments:

United Kingdom Pig Feed Market, By Type

- Starter feed

- Sow feed

- Grower feed

United Kingdom Pig Feed Market, By Form

- Pellets

- Mash

- Crumbles

Need help to buy this report?